Singapore Central Bank: No Tokens We’ve Seen Are Securities

The Monetary Authority of Singapore (MAS), the city-state’s de facto central bank, believes currently no tokens it has seen are securities.

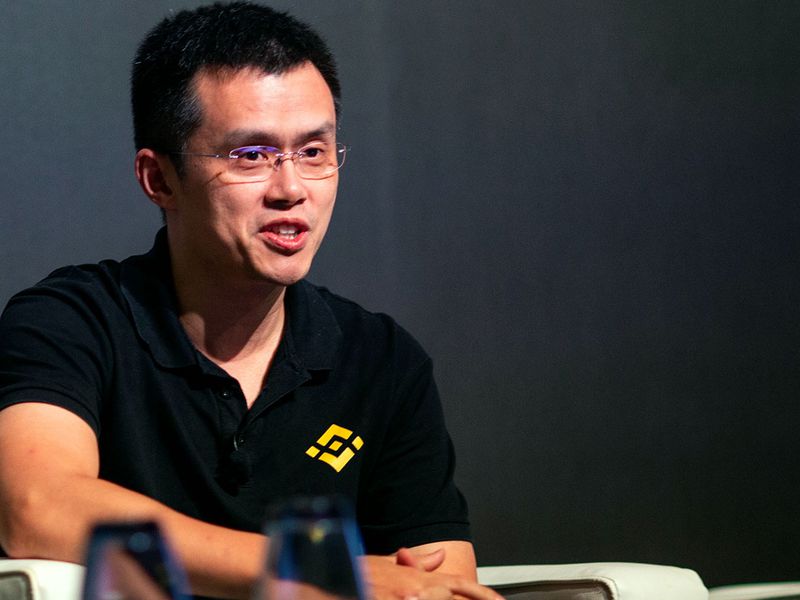

During a fireside chat at CoinDesk’s Consensus Singapore 2018 conference on Wednesday, Damien Pang, the MAS’ head of technology infrastructure told the audience that the regulator has not yet seen tokens that should be deemed as securities in Singapore.

However, he went on to state that the categorization of a digital token, in regardless of its underlying technology, could change over the time, depending their current and future characteristics. He said:

“The MAS takes a close look at the characteristics of the tokens, in the past, at the present and in the future, instead of just the technology built on.”

Pang added that currently the MAS divides digital tokens into three categories: utility tokens, payment tokens, and securities. He went on to explain:

“The MAS does not intend to regulate utility tokens that are used to access certain services. But a payments service bill is expected to be enacted by the end of this year to apply to payment tokens, which have storage and payment values.”

Should the characteristics of any of the utility or payment tokens become more aligned wth features of securities offerings, such as promising future earnings, Pang reiterated that Singapore’s securities and futures act will apply to these assets.

Asked why the authority does not intend to name names on what tokens are securities such as the ongoing debate of ethereum by its U.S. counterparts, Damien Pang said this approach may not help create an encouraging environment for innovation.

He concluded:

“The moment you start naming names, people take it very literally – These are and those are not. But in fact, there are more than 1000 tokens. So regulator should bare in mind that we provide clear guidelines to categorize them.”

Damien Pang image via CoinDesk

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.