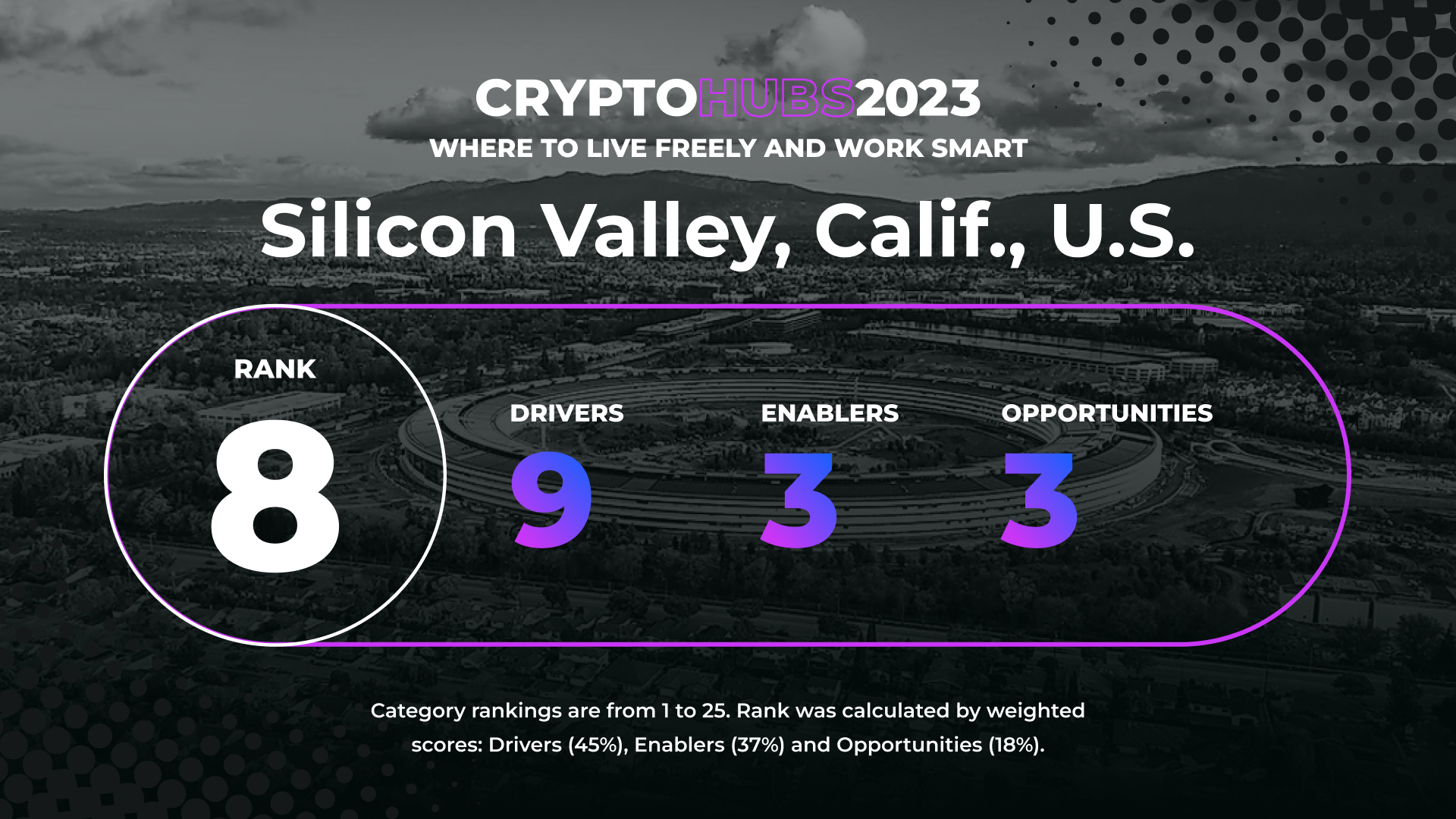

Silicon Valley: The Mecca for Venture Capital May Be Cooling on Crypto

Silicon Valley was the second-highest ranked U.S. hub in CoinDesk’s Crypto Hubs 2023. Several of the eight criteria were measured on a national basis, so all the U.S. hubs were hampered by a middling crypto regulatory score, a drivers criteria, which at 35% was the most heavily weighted overall. This poor performance was partially offset by the U.S.’s high crypto adoption score, another drivers criterion, represented 10% of the overall score. Among the U.S. hubs, Silicon Valley generally trailed Wyoming just a hair in opportunities, which is based on per-capita rate of crypto jobs, companies and events. Due to its high cost of living, Silicon Valley suffered from a lower quality of life score, weighted 15% and a measure within the enabler category. But the coastal Silicon Valley area had the upper hand in other enabler measures including digital infrastructure and ease of doing business.

Silicon Valley does not need advertising as a launchpad for the world’s most successful tech companies, like Google, Apple, Facebook – you name it. And it’s been home for some crypto startups, too, including blockchain analytics company CipherTrace and stablecoin issuer MakerDAO.

The Valley, centered on the city of San Jose about 55 miles southeast of San Francisco, offers an unprecedented concentration of top tech talent, historically supplied by local world-class universities including Stanford. It is also a center of venture capital, with giants like Andreesen Horowitz (a16z), Sequoia Capital and Lightspeed Venture Partners that have been systematically supporting crypto startups.

Read Crypto Hubs 2023: Where to Live Freely and Work Smart

This combination presents a promising environment for any young tech ecosystem, including crypto. However, the still-young blockchain community is facing competition from other emergent tech sectors.

“For those looking for VC funding for crypto, the Valley is almost closed,” says Gene Hoffman, CEO and president of Chia, the company behind the namesake blockchain.

Two years ago, the crypto industry was sucking talent out of the more established, “traditional” tech firms like Google, Amazon or Apple, but now, the industry doesn’t look as hot for the VCs and entrepreneurs here.

The reason? Artificial-intelligence startups are stealing thunder. And the recent SEC offensive against crypto, including investigations of the major global exchanges Binance and Coinbase, doesn’t help. “All but the diehards are now worried about buying coins,” Hoffman said. “We are going nowhere because the SEC is a blocker for us.”

Finding money for a new crypto project is still possible, of course. But the roster of VC funds willing to invest is much smaller these days, and those that do have “definitely retrenched to early stage [funding] mostly,” he said, adding that funds like a16z, Paradigm Capital, Haun ventures and Electric Capital remain active in the space.

Competition from other U.S. tech hubs

And while there is no exodus of crypto companies out of the Valley, new startups appear to be opening shop in newer U.S. tech hubs like Seattle, Austin or Miami, Hoffman said. Expensive housing prices in Silicon Valley might be one of reason why. Some firms are mulling leaving the U.S. altogether for friendlier regulatory regimes.

VCs are also looking elsewhere, if not exactly leaving so far: a16z, one of the key backers of crypto startups since the birth of crypto, in June announced it will open its first non-U.S. office in London, where the government has been more welcoming to crypto.

The demise of Silicon Valley as a crypto hub is still a long way off, however. The South Bay boasts a high concentration of tech ideas, money and workforce, with plenty of events and greenhouses for startups like YCombinator, all of which are crucial for fledgling crypto businesses.

The community of tech professionals, more importantly, is still there, Hoffman said: “For us, the Valley is a fine place where we source good talent.”

Edited by Jeanhee Kim and Bradley Keoun.