Short-Term Signs of Worry for Bitcoin as BTC Miners Balance Turns Negative

Bitcoin’s price has failed to overcome the critical resistance level at $25,000 and has since retraced to where it currently trades at $21,500.

Since August 15th, the cryptocurrency has lost about 15% of its dollar value and has closed only four days in the green. Now, data suggests that there might be more pain to come, at least in the short term.

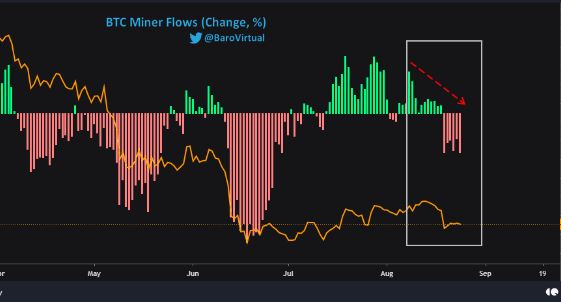

- Data reveals that the miners have moved to reduce their reserves since August 8. An analyst from the popular resource CryptoQuant commented on the matter, saying:

The percentage change (%) in the positions of BTC miners indicates that miners have again moved to reduce their reserves since August 08,2022, and now their net balance is in the negative zone.

- He concluded that “at least in the short term, this alignment is not something good.”

- As evident in the chart, BTC’s price tends to decline or, at best, range to the downside when miners’ reserves hit negative values.

You may notice that in previous times when miners’ balance was reduced, BTC tended to decline to free fall or range decline trading. The current situation requires closer attention to the miner flows.

- On the other hand, any subsequent dip in the price could also constitute a buying opportunity, according to further analysis from CryptoQuant. This is because the ratio of users who hold between one week and one month has dropped below 4%.

- Commenting on the matter was analyst Dan Lim:

When the ratio of this period fell to 4% or below the yellow dotted line (please see chart below), the bottom in the cycle was reached.

2011: 3.2%

2015: 3.2%, 3.4%

2019: 3.7%

2022 (Current): 3.8%

- It’s worth pointing out that the current ratio sits at 3.8%, and there’s evidently more room to go down. Yet, the analyst concluded that if there’s a correction bigger than 4-5%, it might be a good thing to consider accumulating BTC for the longer term.

The post Short-Term Signs of Worry for Bitcoin as BTC Miners Balance Turns Negative appeared first on CryptoPotato.