Shiba Inu (SHIB) Drops by 15% in 2 Weeks: These Factors Suggest Extended Correction

TL;DR

- Shiba Inu’s price has fallen substantially lately, with declining burn rates and large transaction volumes signaling continued bearish momentum.

- On the other hand, reduced exchange reserves and SHIB’s RSI nearing oversold territory suggest that a potential rebound may be on the horizon.

The Bad Days for the Bulls Might Not be Over

The past two weeks have been quite successful for most leading cryptocurrencies. Bitcoin (BTC), for instance, saw its price surging by 10%, while Ethereum (ETH) pumped by 4%.

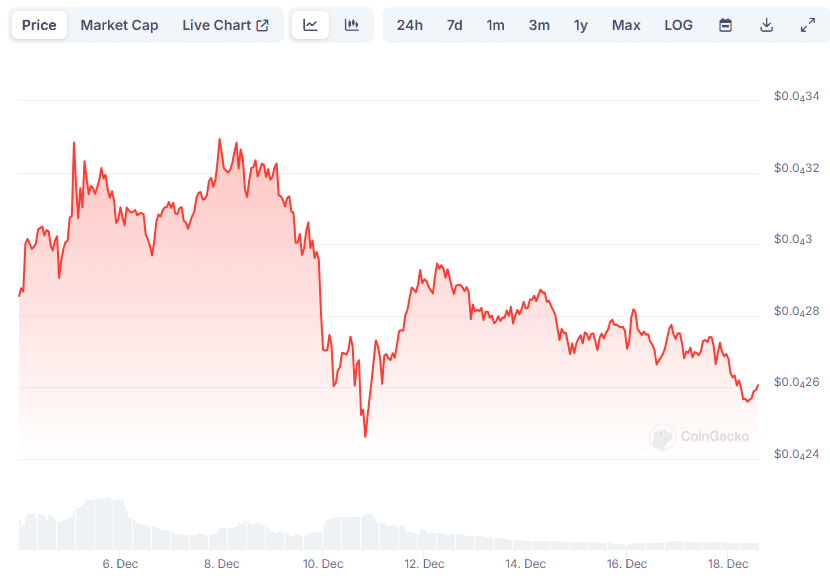

However, some assets have not performed so well. The popular meme coin Shiba Inu is among the biggest losers, with its valuation plummeting by over 15% for that period. Currently, it trades at around $0.00002575 (per CoinGecko’s data), representing a 6% decline on a daily scale.

Some factors and on-chain metrics signal that the bears might continue to prevail in the near future. One example is the red wave going through the entire meme coin sector. The market capitalization of the niche is down 4% in the last 24 hours, with well-known assets like Dogecoin (DOGE), Pepe (PEPE), dogwifhat (WIF), Bonk Inu (BONK), Floki Inu (FLOKI), Peanut the Squirrel (PNUT), and many more charting substantial losses.

Another element worth mentioning is Shiba Inu’s burning mechanism. Data shows that the burn rate has decreased by almost 70% in the past week, resulting in just 128 million tokens sent to a null address. The program’s ultimate goal is to reduce the tremendous supply of SHIB, making it more scarce and potentially more valuable (assuming demand doesn’t head south).

The Shiba Inu team and community have burned more than 410 trillion tokens since adopting the mechanism. However, the circulating supply remains quite significant, equaling approximately 589 trillion SHIB.

Last but not least, we will focus on Shiba Inu’s large transaction volume (a momentum indicator showing the number of transactions greater than $100,000). According to IntoTheBlock, the metric is down 4.2%, entering bearish territory.

It’s Not All Doom and Gloom

On the other hand, there are some indicators that suggest SHIB could soon return to the green track. An example is the Shiba Inu exchange reserve, which, according to CryptoQuant, has recently plummeted to levels last seen in the spring of 2021.

The development signals a shift from centralized platforms toward self-custody methods, which could be considered bullish since it reduces the immediate selling pressure.

Last but not least, we will touch upon SHIB’s Relative Strength Index (RSI). The technical analysis tool measures the speed and change of price movements, varying from 0 to 100. It helps traders identify oversold or overbought conditions, with readings below 30 suggesting a potential buying opportunity.

SHIB’s RSI has been on a downtrend in the last week, currently standing slightly above the bullish zone.

The post Shiba Inu (SHIB) Drops by 15% in 2 Weeks: These Factors Suggest Extended Correction appeared first on CryptoPotato.