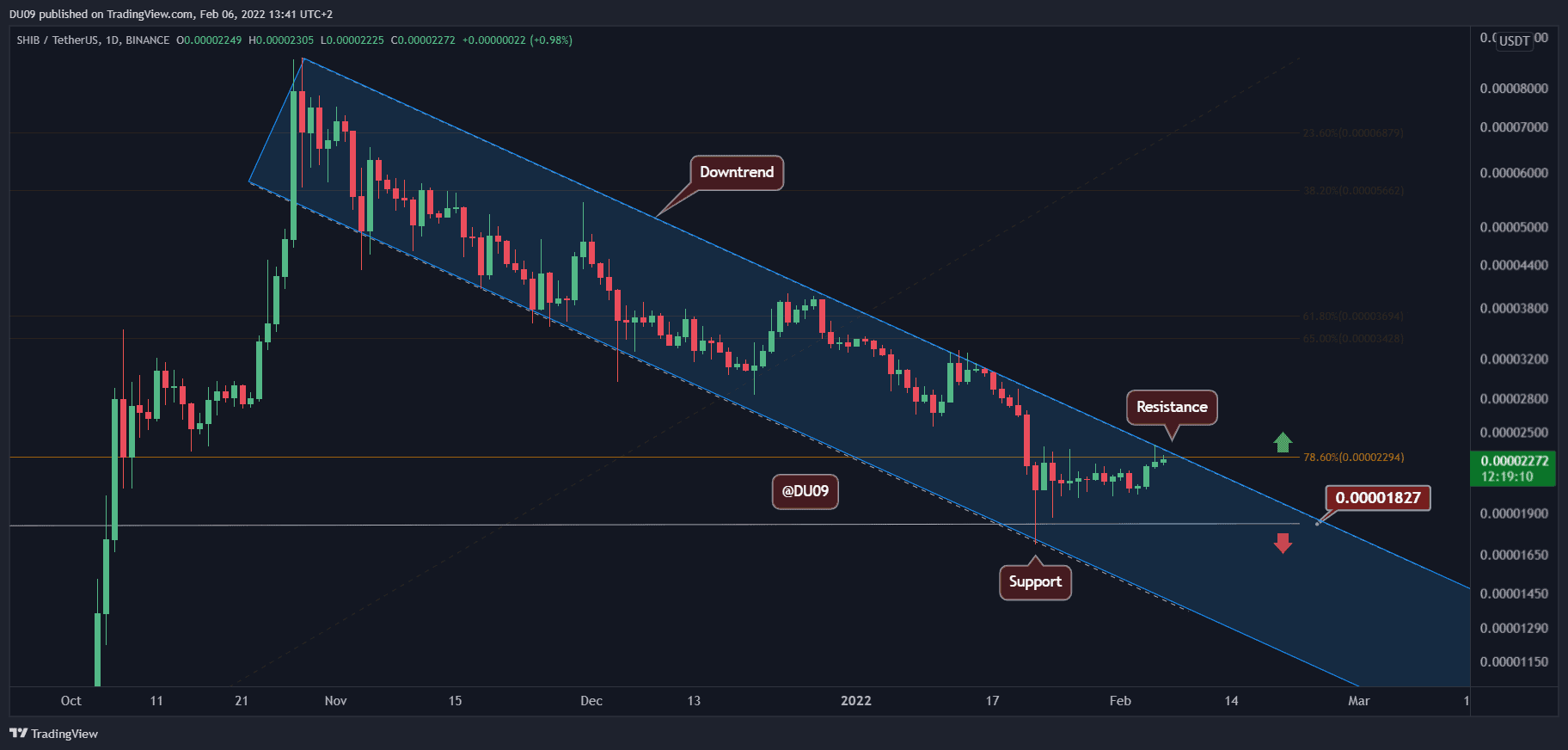

Shiba Inu Price Analysis: SHIB is Facing Huge Resistance that Can End the Bearish Trend

SHIB has reached a critical resistance level. A break above would mean that SHIB could likely go for a short-term price rally following a series of bearish weeks.

Key Support level: $0.000018

Key Resistance levels: $0.000023, $0.000026

At the time of this writing, SHIB is facing the critical resistance of $0.000023, which is the only barrier preventing the price from exiting the downtrend that started back in November 2021.

A successful break of this level would likely propel SHIB much higher. In case of a failure, SHIB has decent support at $0.000018.

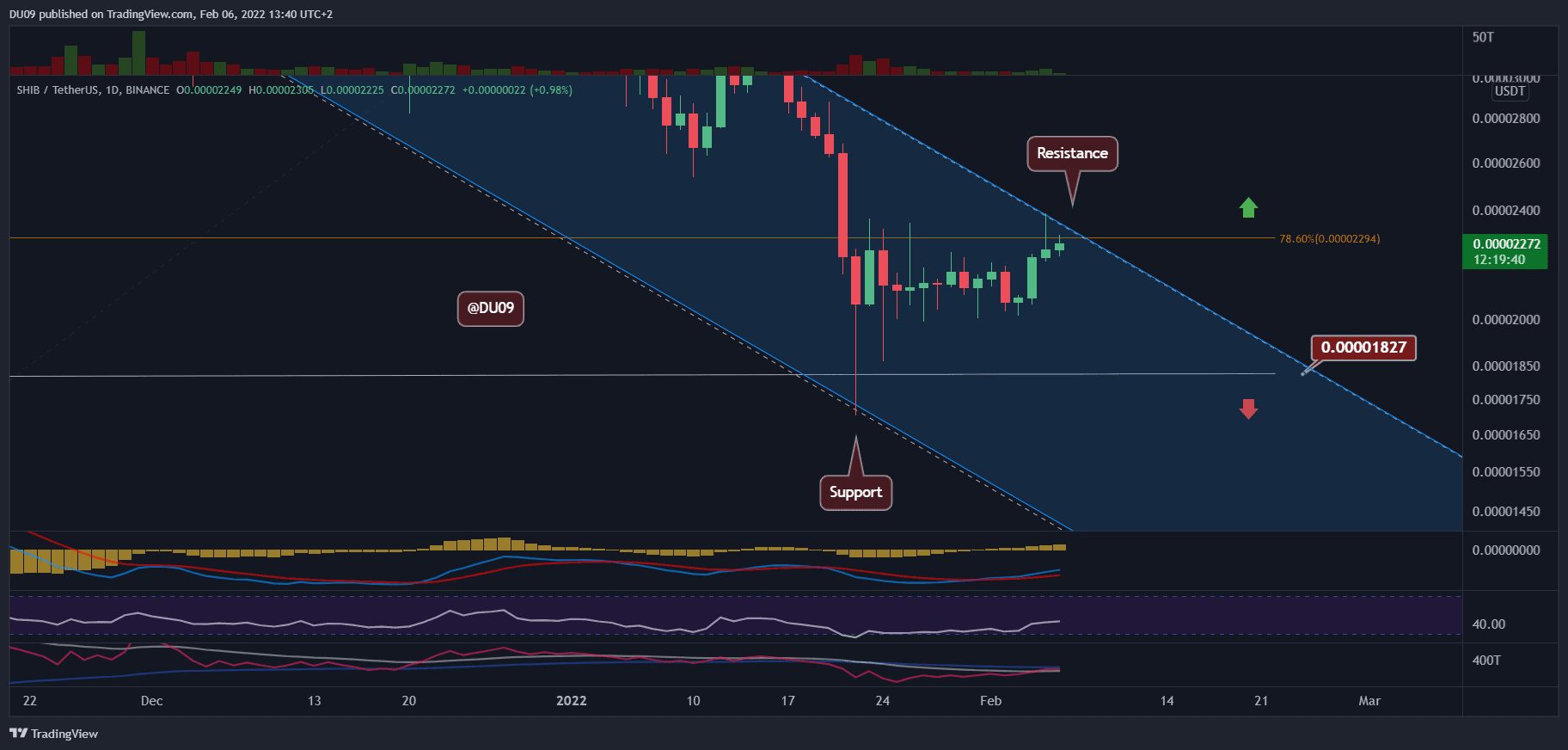

Technical Indicators

Trading Volume: Volume spiked on Saturday following another attempt to break the key resistance. The bears stepped up and pushed SHIB back under this critical level, but a new attempt appears likely.

RSI: The daily RSI is making higher lows and also seems close to performing a higher high, particularly if the price can break the key resistance. If successful, SHIB may enter a significant rally.

MACD: Good positive momentum on the daily MACD with higher-highs on the histogram and expanding moving averages. As long as this persists, SHIB has an excellent chance to move much higher.

Bias

The bias on SHIB is bullish unless SHIB fails to break the key resistance over the next hours or days.

Short-Term Prediction for SHIB Price

Considering the indicators and latest price action, a break of the critical resistance at $0.000023 seems inevitable. This is likely to take place early next week if this momentum maintains. The current price action favors the bulls, and sellers appear exhausted.