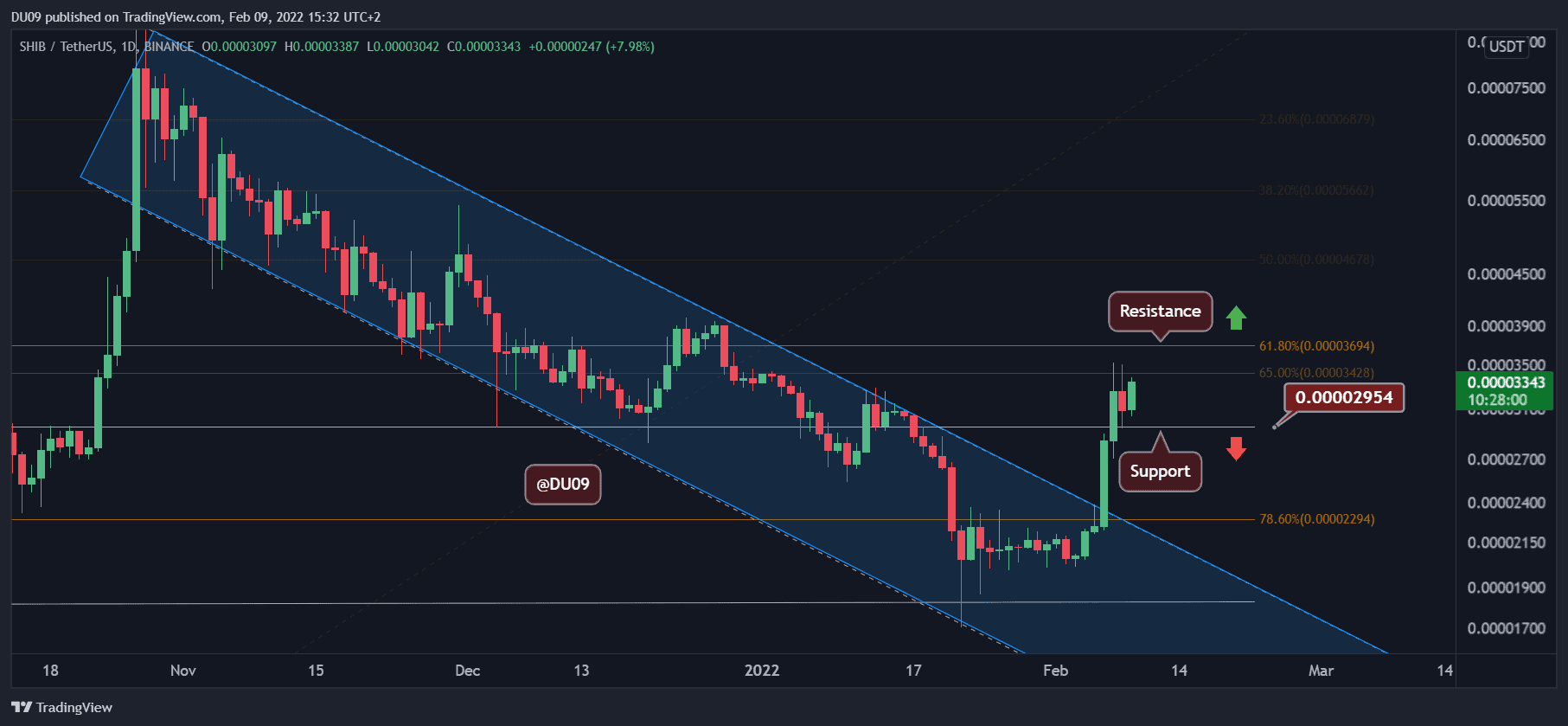

Shiba Inu Price Analysis: SHIB Attempts to Move Higher, Here is the Next Level to Watch

After a short pullback, SHIB appears keen to move higher and challenge the next critical resistance at $0.000037.

Key Support level: $0.000029

Key Resistance levels: $0.000037

SHIB had seen a short-term spike as buyers were impatient following the descending channel’s breakout. Today’s bullish engulfing candle indicates that SHIB can continue higher and challenge the key resistance at $0.000037 very soon. On the other hand, the key support level at $0.000029 and was successfully tested yesterday.

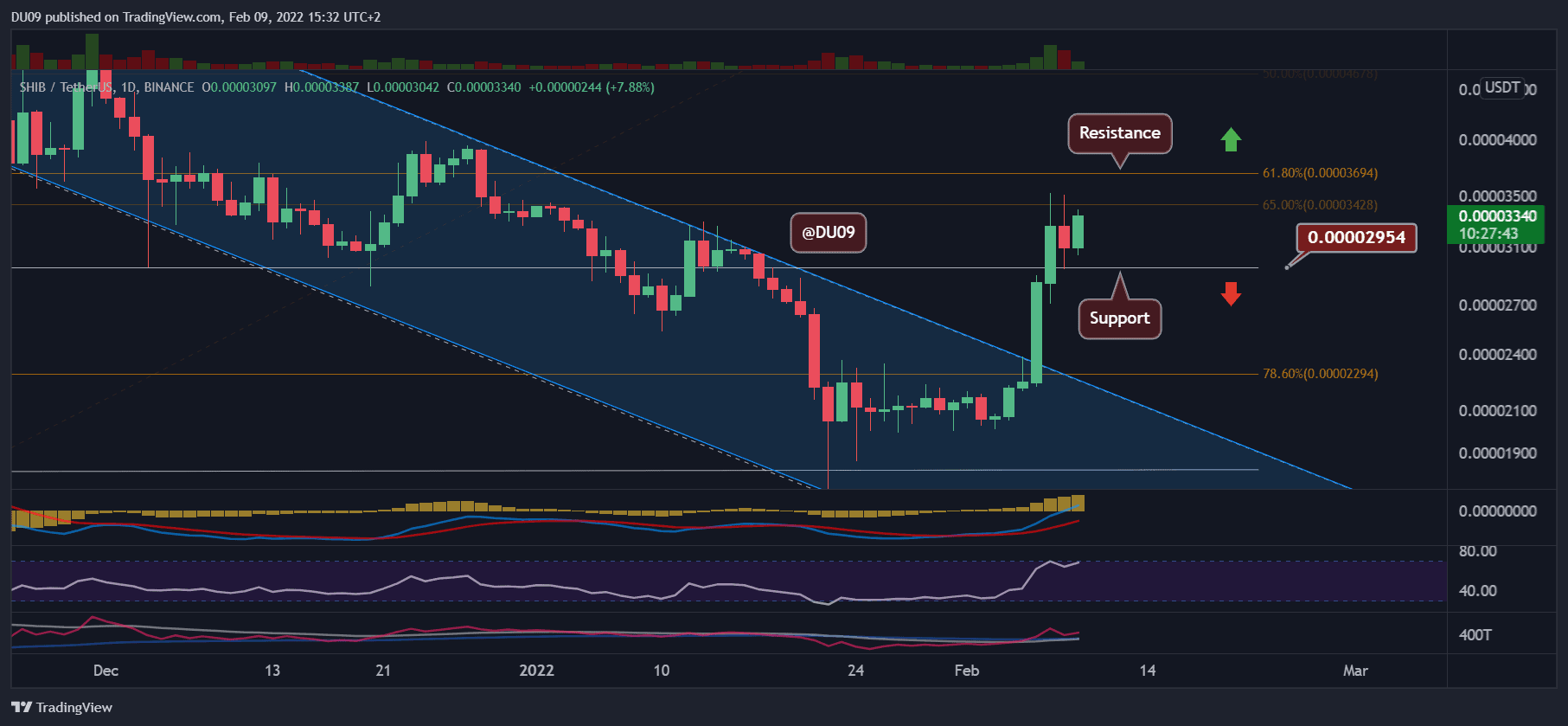

Technical Indicators

Trading Volume: After an impressive breakout, the volume has drastically decreased. This also reduced the bullish momentum, but SHIB remains short-term bullish.

RSI: The daily RSI appears ready to enter the overbought area. If SHIB moves to the key resistance, the RSI will likely become overbought. Best to be cautious when that happens.

MACD: The daily MACD expanded higher, which is a clear bullish signal. It’s important to watch how SHIB’s price action develops at the key resistance for any signs of weakness.

Bias

The bias on SHIB is bullish.

Short-Term Prediction for SHIB Price

A retest of the key resistance at $0.000037 appears imminent considering the current price action. However, SHIB may see a sharp pullback following the parabolic run (with no major correction so far). This makes the risk-reward ratio less favorable for bulls, at this moment.