The San Francisco Open Exchange (SFOX) has launched a new platform for tracking cryptocurrency market data.

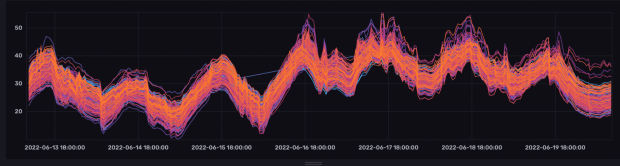

Dubbed FoxEye, the tool will be free to all SFOX users. It aggregates exchange volume for bitcoin and a handful of altcoins, such as ether and litecoin, from the world’s top 20 exchanges by volume. Time and Sales, FoxEye’s flagship feature, allows traders to crosscheck volumes, prices and the timestamps of executed trades across all of the assets that SFOX lists.

“FoxEye’s Time and Sales is the first service to provide users with aggregated, cross exchange, formatted, real-time, market-wide data for free. Anyone, regardless of experience level, can look at Time and Sales and understand at a glance what trade activity is happening on all exchanges connected to SFOX,” SFOX CEO and Co-Founder Akbar Thobhani told Bitcoin Magazine.

Making the Most of Cryptocurrency Market Data

With this latest effort, SFOX hopes to curate more accurate and transparent data feeds for its customers. Less reputable exchanges, for example, have been known to post phony trading volumes to fabricate trader demand.

Popular cryptocurrency metric site CoinMarketCap, for example, has published reported trading volumes that don’t reflect reality — according to claims by crypto analysis firm BitWise, 95 percent of this volume is fake. BitWise’s global head of research, Matthew Hougan, has said that the actual daily turnover of bitcoin relative to its market cap is similar to gold’s (0.4–0.5 percent), which he calls “extremely efficient” for a market of its size.

The issue of true volume is part of what SFOX intends to ameliorate with FoxEye. According to SFOX, the platform will “consolidate the trade history across all exchanges into a single view, similar to reading ticker tape for an individual stock, offering individuals and investors a very good view of the whole market by seeing all executed trades from the major marketplaces.” It adds that tools of this nature are typically only available to trading shops and engineers, but FoxEye will be offered at no additional cost to SFOX’s consumer base of some 175,000 users.

The tool, Thobhani hopes, will provide greater transparency to the industry and level the playing field for traders who don’t have access to exclusive tools and data feeds.

“From the start, we have believed in an open approach (hence our name, Open Exchange),” Thobhani said. “We believe transparency is critical in developing a well functioning, efficient market. The early history of the crypto market has been one riddled with sophisticated traders getting an edge with private information and data feeds … We’re confident that this trend towards increased transparency will make the markets more efficient, less volatile and give everyone fair access to cryptocurrencies.”

By covering fluctuations in cryptocurrency transmissions in real time, SFOX hopes that the use of its new tool will democratize the crypto community’s access to information as a whole, as well as make it much more difficult for exchanges to attempt this self-aggrandizement scam. If even a tiny fraction of SFOX’s users regularly take advantage of FoxEye, it could have a major effect on cryptocurrency exchanges in the future.

The post SFOX to Launch FoxEye, New Cryptocurrency Transaction Data Tools appeared first on Bitcoin Magazine.