SelfKey vs. Civic vs. TheKey

With the Facebook and Cambridge Analytica scandal dominating headlines earlier this year, awareness about the importance of security in digital ID management has never been greater.

In the much smaller world of cryptocurrencies and blockchain, a problem that became prevalent during the incredible 2017 bull run – efficient identity verification by exchanges – has persisted in spite of the drop in interest during the current bear market.

Sorry for the inconvenience. Due to an overwhelming response from new users, registration is temporarily paused. We’re working to make the necessary tweaks and reopen signups again shortly.

— Bittrex (@BittrexExchange) April 10, 2018

Bittrex was able to resolve their issues and re-open registration quickly, but we can only imagine how big of a problem this could be if the market turns bullish once again. Exchanges and their customers stand to lose potentially millions of dollars if efficient onboarding processes aren’t in place by the time interest really picks up again.

The two scenarios above are pieces of a widespread problem with the current state of digital identity management that likewise has implications in healthcare, voting rights, and even education. They also represent one of the strongest potential use cases for blockchain technology. Given the security and efficiency advantages offered by blockchains, it seems inevitable that they will soon replace the vulnerable centralized systems that we rely on to keep our digital identities secure today.

A project which successfully solves the problems in the digital identity space stands to become one of the most valuable projects in the entire blockchain industry. Given what’s at stake, it’s worthwhile to do some deep analysis of the main players in the space now in order to determine who has the greatest probability of success.

With that being said, this article will compare 3 projects in this space: SelfKey, Civic, and TheKey. We will look at the technical differences between each, as well as other significant factors such as the strength of their respective teams, the current states of the projects, their roadmaps for the future, and the utility of their blockchain tokens.

By the end, you’ll have a well-informed idea of how you can best set yourself up to benefit from a blockchain revolution in the digital identity space.

Company Philosophies

All 3 of these companies are working towards the same general goal of being the top player in the digital identity space. However, there are differences in their company philosophies and motivations that provide a good starting point for understanding each project.

While the applications of each extend well beyond the blockchain sphere, their utility is significant even just within it.

Because of KYC “security” laws, now a bunch of ICOs, many of which will end up dead and broke, have in their servers a collection of photos of passports and a throve very private information about crypto owners. How’s that for “security”?

— alex van de sande (@avsa) April 10, 2018

There is an urgent need for these services right now, but there’s also too much on the line to rush anything. In this industry, one big reputation hit could spell doom. With that being said, let’s look at how and why each of these projects is being developed.

SelfKey

SelfKey’s founding mission is to give individuals and organizations complete ownership of their digital identities. Moreover, the SelfKey ecosystem is built around the concept of self-sovereign identity — giving individuals and organizations full control over their identity and the transactions derived from it.

SelfKey’s founding mission is to give individuals and organizations complete ownership of their digital identities. Moreover, the SelfKey ecosystem is built around the concept of self-sovereign identity — giving individuals and organizations full control over their identity and the transactions derived from it.

As stated in their whitepaper and public documents, the SelfKey foundation is established for the advancement of human rights and fundamental freedoms related to data and identity sovereignty.

The idea is that SelfKey will be more than just a secure, self-hosted data storage service. They are building an end-to-end digital ecosystem, in which participants can also validate their identities through qualified certifiers (e.g. notaries, utility companies, bank managers, government agencies) and re-use this verified identity to speed up KYC processes and access financial, cryptocurrency, immigration, and corporate services.

This complete digital ecosystem is compliant with KYC/AML and Data Protection laws. In fact, it will play a role even earlier in the process so that, as stated in the whitepaper, SelfKey is:

“censorship-proof, fair, inclusive, agile, and lean through a well-designed open source technology stack, and transparent legal & governance infrastructure through the SelfKey Foundation. SelfKey can match the current and future needs of evolving modern societies and the global Internet, ensuring human rights and fundamental freedoms of identity are met.”

Civic

Unsurprisingly, Civic’s stated goals are quite similar to those of SelfKey. Where they diverge is in what they emphasize most strongly.

Unsurprisingly, Civic’s stated goals are quite similar to those of SelfKey. Where they diverge is in what they emphasize most strongly.

For Civic, the greatest importance is placed on document authentication and the prevention of identity theft.

Civic also aims to address the issues faced by businesses when user information is stolen and fraudulent transactions occur. Damage control after a data breach can be incredibly costly, and Civic has been designed to be the go-to platform for any company facing those unfortunate circumstances.

This can perhaps be thought of as Civic niching down and specializing for a specific group of customers, while SelfKey has a comparatively larger market in which to do business.

TheKey

The first thing to understand about TheKey is that the company is based in China and is intended to predominantly serve Asian markets. Given China’s unique economic and political structures, operating there in some ways requires philosophical differences from Western companies.

The first thing to understand about TheKey is that the company is based in China and is intended to predominantly serve Asian markets. Given China’s unique economic and political structures, operating there in some ways requires philosophical differences from Western companies.

One obvious reflection of those differences is in how TheKey has set themselves up for future success in their target market.

While SelfKey is open-source and transparent, TheKey claims to have leveraged political connections in the State Intellectual Property Office (SIPO) of the People’s Republic of China in order to obtain 23 copyrights and 15 patents thus far. However, it should be noted that, although those claims are repeated often about TheKey, actually verifying them proved next to impossible.

There are still a lot of big questions about TheKey which can put a damper on investors’ expectations as long as they remain unanswered.

From our research, TheKey’s purpose differs significantly from that of Civic and SelfKey. TheKey is intended solely for ID verification of individuals, which is done by comparing their identity with data stored in centralized databases. This already exists nowadays, but TheKey claims to be developing a more efficient and secure system using blockchain.

Civic and SelfKey are building distributed identity management systems which are secure and private by design, with the important difference being that they don’t store identity data on centralized servers.

Additionally, the political climate in China should warrant caution for blockchain enthusiasts and prospective investors in TheKey, especially those who are libertarian-leaning. The PRC government censors and controls media on platforms such as WeChat and Weibo, which is in direct contrast to the censorship-resistant feature of blockchain technology.

Technical Comparison

The very first thing to understand in a technical comparison of these 3 projects is that SelfKey and Civic are both built on top of Ethereum, while TheKey is sticking to its Chinese roots and building on NEO. The NEO vs. Ethereum debate is another conversation entirely, but it’s certainly a factor investors should consider.

The most significant differences between these projects ultimately stems not from the blockchain platform they are built on, but the society in which they are intended to be used. From that standpoint, Civic and SelfKey are easier to compare directly and TheKey is better analyzed on its own.

SelfKey vs. Civic

Technical Similarities and Differences

Both companies are enabling the so-called verifiable identity claims. Verifiable claims are identity data signed by a qualified certifier, which is hashed and anchored on the blockchain so that you can share your identity without needing to share ID documents themselves.

However, as this identity management approach is not in line with current KYC/AML regulations, SelfKey also works with current requirements of scanned and certified documents and data, including electronic document notarizations. As a result, SelfKey is compliant and ready for mainstream use.

The two companies begin to diverge when it comes to their wallets and applications. SelfKey is an end-to-end identity system, not only facilitating identity management for individuals but also facilitating service providers to perform KYC / AML checks on these identities.

In comparison, Civic doesn’t have the same breadth of functionality as SelfKey, but excels at its full KYC services.

Finally, it’s worth noting that both projects have ERC-20 tokens which need to be staked in order to use their digital ID features – these being KEY (SelfKey) and CVC (Civic).

Wallets and Open Authorization (OAuth)

SelfKey uses their own wallet that is open-source and allows users to securely store identity documents, KEY tokens, and all other ERC-20 tokens. They have a desktop wallet for Mac and Windows, and they intend to release a mobile app with a built in wallet for Android and iOS. The Beta version of the wallet was released on June 2018.

Civic, meanwhile, is only a mobile application. Both SelfKey and Civic do not store user identity data, as they always remain on the user’s device. One of the main differences between the two is that SelfKey currently allows users to store any ID documents, while Civic only allows users to store and share identity metadata.

Another key difference is that SelfKey includes a marketplace within its wallet which offers a variety of services such as crypto exchange accounts, company incorporation, bank accounts, citizenship, and residency by investment, among others. The marketplace allows users to apply for services and go through the KYC process (sharing documents and filling out forms) within the same wallet.

For its part, Civic uses an OAuth solution via scanning a QR Code placed in the service provider website to sign up/in to their services. (OAuth is an open standard for token-based authentication and authorization on the web.)

However, SelfKey has already announced that they are developing an OAuth Solution as well. Rather than working via QR Code, SelfKey’s OAuth solution will be a browser extension that connects directly to the SelfKey Wallet.

Individual vs Corporate

It is important to note that SelfKey is also aimed at organizations and legal entities, which are those who suffer the biggest pains when it comes to identity verification and KYC.

As per their roadmap, SelfKey will release a Corporate Wallet with multi-user functionality to enhance company governance and painless KYC process when setting up subsidiaries, opening bank accounts, or accessing credit card processors.

On the other hand, Civic is mainly aimed at individuals and, at least for the time being, they do not have a corporate identity solution scheduled in their roadmap.

For more information about the technical aspects of these projects, check out the SelfKey whitepaper and the Civic Architecture Documentation.

TheKey: Technical Specs

The ultimate objective of TheKey as stated in their whitepaper is to generate undeniable and unalterable IDV (ID Verification) results. To do this, they are developing Blockchain-based Multi-dimensional Identification (BDMI) technology.

Here are the main features of TheKey’s technology and platform:

- Unique biometric data used for document and account verification.

- All data in the BDMI system is validated in advance by relevant government authorities, greatly mitigating the potential for fraud.

- TheKey App provides a channel between users and public institutions that verify data, but the data itself is kept in a database, with the data’s hash value on the blockchain.

In the project whitepaper, TheKey states that it aims to produce more reliable results at a lower cost, and with a better user experience relative to other blockchain-based ID management solutions. These claims aren’t backed up with any evidence, though, and seem rather subjective.

What’s safer to say about TheKey is that it is being developed to fit the needs of China’s unique IDV market for public medical services, while competitor blockchain projects are better designed for other global markets and industries, such as financial and corporate services.

The Project Teams

You’ll often hear from successful investors that — after filling a real need in the market — the strength of a project’s team is the best indicator of its potential to succeed long-term. And so, a comparison of these three competitors in the digital ID space would be incomplete if it didn’t include an analysis of their respective teams.

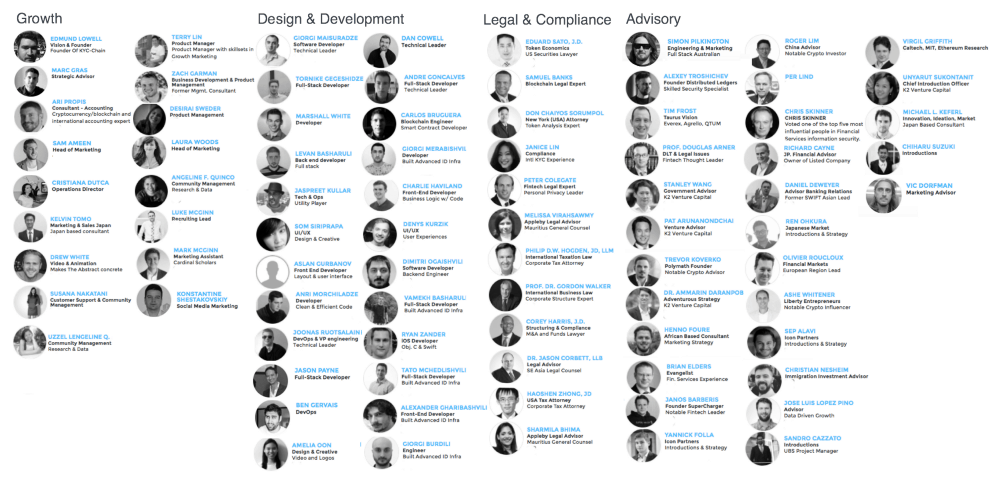

The SelfKey team is undeniably one of the project’s biggest bright spots. SelfKey’s technology is being developed 100% in-house by a group of more than 20 experienced designers and developers.

The team is led by project founder Edmund Lowell, product manager Terry Lin, COO Cristiana Dutca, and engineers Dan Cowell, Joonas Routsalainen, and Carlos Bruguera. Together, they bring a wealth of experience that will help ensure the quality of the project’s development going forward. Overall, the size and strength of SelfKey’s team is certainly a major plus for prospective investors.

Edmund Lowell has a successful background as entrepreneur, having previously founded and exited several companies such as KYC-Chain (Compliance – Hong Kong), FlagTheory.com (Corporate Services – Singapore), Iglu.in.th (Software – Thailand), and Ring.MD (Medical – Singapore).

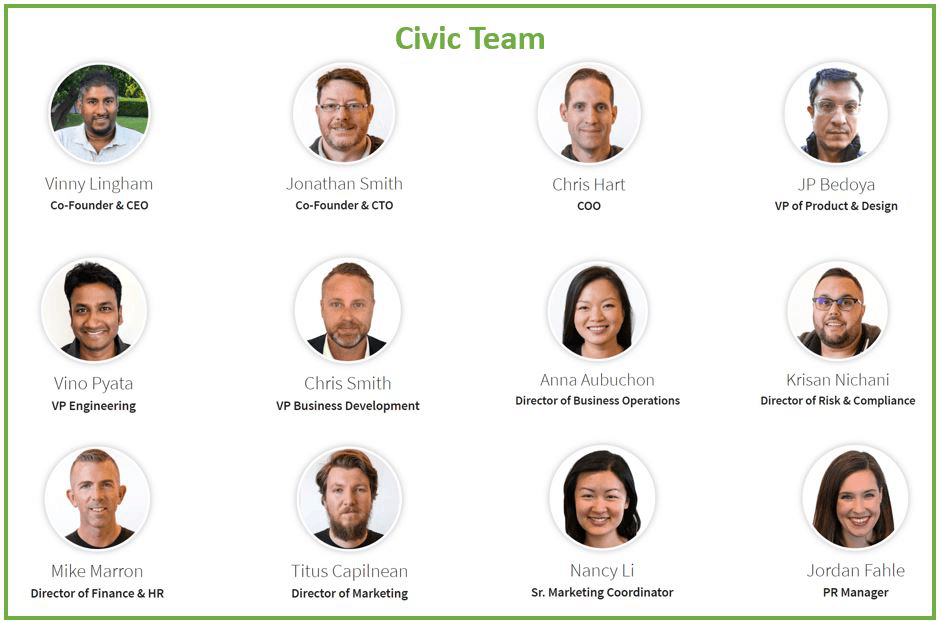

Civic’s team, meanwhile, benefits from the leadership of CEO Vinny Lingham, who is a successful entrepreneur with a good deal of influence in the greater cryptocurrency space. Vinny Lingham co-founded and exited Gyft, a digital Gift Card platform backed by Google Ventures, is a board member of the Bitcoin Foundation, and is a partner of several Blockchain venture funds. He is also a Shark in South Africa’s version of the TV program Shark Tank.

Civic’s CTO, Jonathan Smith, also has noteworthy expertise with more than 15 years of experience in security-sensitive environments of the banking and tech sectors.

TheKey’s team is led by CEO Catherine Li (Xueli), who won the award for being the most outstanding women entrepreneur in China in 2017 from the All-China Women’s Federation. There are 5 more team members, and their responsibilities include project development, data analysis, and handling government and industry related affairs.

As is the case with other Chinese projects, it’s difficult to get an accurate sense of the team’s overall reputation and expertise. To their credit, though, TheKey includes background information of all of their team members in the project whitepaper.

Progress to Date and Future Plans

The digital ID space is easily one of the most legally complex of all of blockchain’s potential use cases. Considering that, a good amount of patience is required from anybody looking to invest in one or more of these projects long term.

That said, the next year or two will be critical for these teams to develop their products and gain meaningful adoption.

Token Sales and Current Progress

While each of these projects is multiple years in the making, they only really entered the public sphere within the past year.

Civic was the first to hold a token sale, successfully raising $33 million in June 2017. SelfKey had a very successful token sale as well, raising $21.7 million and reaching their hard cap in only 11 minutes on January 14, 2018. TheKey raised $22 million in their own ICO the following day, although they actually raised some $36+ million when you include the funding raised in their presale.

Unlike Civic and SelfKey, however, TheKey’s ICO left many investors unhappy and had some people even calling it botched.

After their token sale, Civic began establishing a partner network and entered their Identity Marketplace Alpha Phase. Q1 2018 marked the transition into Beta v.1 testing, where the project currently stands. It is now possible for Civic partners to transact with CVC as a payment for verification services, and some general verification services are also available.

Civic had a good head start, but SelfKey has been closing the gap quickly so far in 2018 with the work of their large team.

On top of powering KYC for several renowned token sales such as Airswap, HoToken Aditus, Gatcoin, SelfKey has also released the Beta version of its Identity Wallet along with a functional Marketplace Demo. All of that is in addition to having partnered with companies such as Polymath, NTL Immigration, Kyber Network and two Caribbean banks.

As for TheKey, they claimed to have launched their testnet (although it is in a closed environment and thus difficult to verify). They have also acquired data from 210 million Chinese citizens living in 66 different cities and have begun testing their ID verification technology, although it is not yet blockchain-based.

Additionally, they claim to have built partnerships with several major Chinese companies including Ant Financial (formerly known as Alipay) and China Unicom. However, thorough research returned no solid evidence of the partnerships and left the door open for skepticism that they may be meant more for publicity than any functional benefits.

Roadmaps

As we are nearing the end of Q2 2018, we’ll take a look at what each project has in store for the rest of this year and beyond.

SelfKey has been busy so far and still has a lot in store for 2018. In Q2, the SelfKey Wallet Beta was made publicly available, and complying with KYC regulations for token sales became easier than ever.

Their next goal is launching the Exchange Marketplace, providing Wallet users an instant sign-up option. Some of the exchanges announced include Trade.io, Golix, TagCash, and Gatecoin, among others.

The company incorporation marketplace will be also launched in 2018. More improvements and launches are scheduled for 2019, including the bank accounts and citizenship by investment marketplace, as well as the mobile app and corporate wallet, which you can read by scrolling through the Roadmap on the project website.

Civic plans to release the Beta v.2 of their marketplace soon. The update includes open enrollment of identity providers so that any Civic-vetted organization can begin attesting to data, and also allows enrolled partners to use fiat currency balances to transact on the marketplace.

The Civic Marketplace is then scheduled to be opened up to all participants in Q3, with an Open CVC Exchange launch in Q4 so that participants can submit orders in CVC or USD on an open platform run by Civic.

TheKey’s roadmap is more succinct than the other two projects, with just one event listed for the future: the mainnet launch of the BDMI technology this December.

Without any publicly accessible demos, it’s hard to gauge what progress TheKey has made so far, but at least that should change within a couple of months.

Token Economics

One last point of comparison that we’ll cover for these 3 projects is their respective token economics. In the case of all three, total token supply is capped. The general idea is that, as more companies use these blockchain-based solutions for ID verification, the demand for tokens will increase and drive up their value.

As for the specifics, let’s start with SelfKey and the KEY tokens. Owning KEY tokens is a necessary part of the SelfKey marketplace, and each member of the ecosystem is required to “stake” a certain amount of KEY in order to use SelfKey services.

For example, a notary must stake tokens to incentivize them to provide honest services, which works because the staked KEY are lost in the event of a bad practice.

Civic’s CVC token is used in much the same way as KEY. A company that wants to cut costs and improve security for ID verification could switch to Civic, and must then purchase enough CVC to participate in the Civic identity marketplace. As more companies use Civic, demand for CVC tokens rises while supply stays constant, driving value up.

TheKey’s TKY token will be the sole currency used to settle smart contracts in TheKey ecosystem, making its token economics very similar to the other two projects. One point that’s unique to TheKey is that it gives all participants the ability to actually earn TKY tokens in addition to spending them, which can be done by providing a service or by selling data.

Other Players in the Digital Identity Space

Just after TheKey and SelfKey finished their successful token sales, Microsoft announced that they would be making their own foray into blockchain-based KYC business.

Rather than building a competitor platform, though, Microsoft joined the Decentralized Identity Foundation (DIF), where they will work alongside SelfKey (KYC-Chain), Civic, and more than 50 other members in the digital ID space.

Microsoft is specifically collaborating with other members — including SelfKey — on creating a universal resolver for decentralized identifiers (DIDs). The end goal is essentially to provide a means for individuals to create, own, and manage their digital identities independently of any centralized registries, identity providers, or certificate authorities. This idea of ‘self-sovereignty’ is well-aligned with the core ethos of the blockchain industry.

Investment Opinion and Final Thoughts

Digital ID management certainly isn’t the most glamorous of applications for blockchain technology, but it is one of the most important. As anybody who has had their ID stolen can attest, the way our identities are managed online today leaves far too many individuals helpless and vulnerable.

The need is great enough that it’s possible for each of the 3 projects discussed in this article to succeed in providing real value to society. That being said, the progress each makes in the latter half of 2018 will be great indicator of whether or not they will be able to succeed in the long-term.

Considering the size and strength of their team, SelfKey appears best positioned to make this a big year and take the lead in the blockchain-based ID management space. In addition, SelfKey is the only one of the three projects analyzed that is regulated. The board of investment granted a Sandbox license to the SelfKey Foundation to develop its identity system under a greater regulatory certainty.

TheKey, meanwhile, is an extremely risky investment choice at this point. It’s difficult to comprehend just how they will create an ecosystem using cryptocurrencies while complying with the incredibly restrictive Chinese government at the same time. And that’s not to mention the fact that they have yet to release any actual products, while clearly having spent a lot of resources on marketing.

When you take into account the fact that SelfKey currently has a market cap of about $30 million, while Civic and TheKey are nearly double that, SelfKey looks like by far the best bang-for-your-buck in the digital ID space for anybody with a long-term investment outlook.

The post SelfKey vs. Civic vs. TheKey appeared first on CryptoPotato.