SEI Token Could Reach Nearly Half a Billion Market Cap on Binance Debut

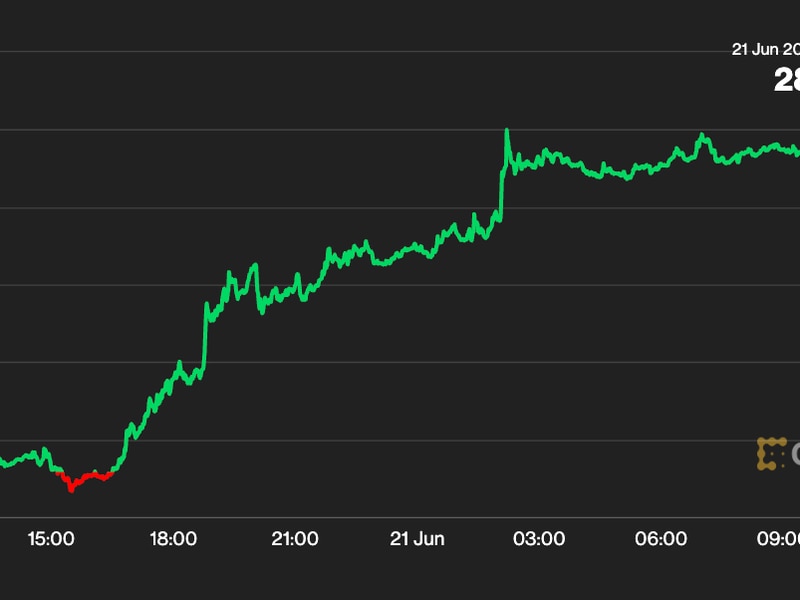

Dominant cryptocurrency exchange Binance is set to list layer 1 blockchain SEI Network’s native token SEI on Aug. 15. As of now, traders see SEI changing hands at 26 cents immediately after the debut, data from decentralized exchange Aevo’s pre-listing futures show.

Aevo’s pre-listing futures market debuted on Wednesday with SEI contracts, allowing traders to speculate on the potential post-listing price of the cryptocurrency. The product is analogous to IOU futures offered by some exchanges.

“The pre-launch futures improve price discovery as users can go both long or short,” Aevo’s Co-founder and CEO Julian Koh told CoinDesk.

SEI’s circulating supply upon listing will be 1.8 billion or 18% of the total supply of 10 billion, per Binance. So, at an early price of 26 cents, the cryptocurrency will have a market cap of $486 million and rank among the top 100 cryptocurrencies. As of now, SEI is not available for trading on any cryptocurrency exchange, according to data tracked by Coingecko.

Once the cryptocurrency goes live on Binance, the pre-listing futures will start referencing the index price and charge funding rates to traders to keep prices aligned with the spot market value.

In other word, the pre-listing futures will become perpetual swaps after the exchange listing. Funding rates are periodic payments by bullish long or bearish short position holders. Longs pay shorts when perpetuals trade at a premium to the spot price. Meanwhile, shorts pay longs to keep their bearish bets open when perpetuals trade at a discount.

Aevo has put strict position limits and open interest caps in these markets, considering the experimental nature of the product. The futures are margined and settled in the dollar-pegged stablecoins USDC.

Edited by Parikshit Mishra.