Securitize’s Japan Subsidiary Becomes First International Firm to Join Self-Regulatory Group

Securitize’s Japan subsidiary has joined a self-regulatory organization focused on security token issuances. (Shutterstock)

Securitize’s Japan Subsidiary Becomes First International Firm to Join Self-Regulatory Group

Securitize Japan became the first global token issuance platform to join the Japan Security Token Offering Association (JSTOA), the company announced Thursday.

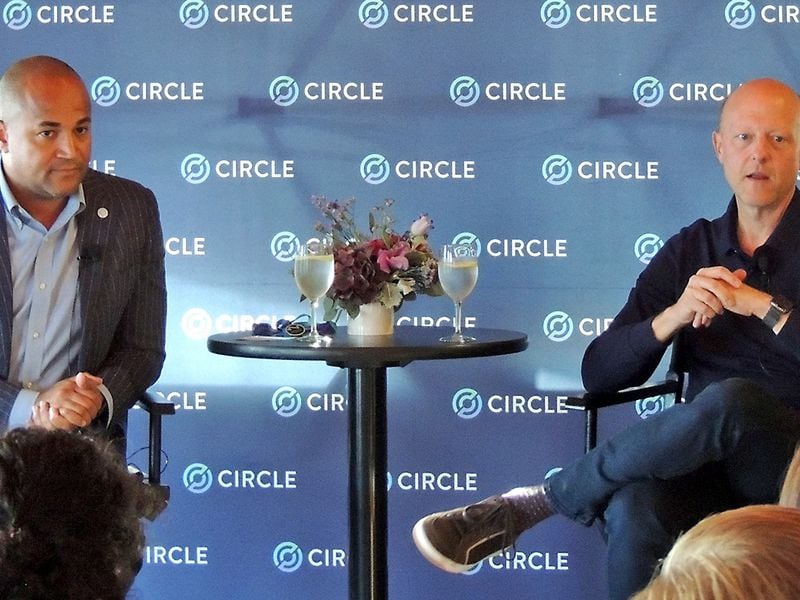

The Japanese subsidiary of U.S.-based Securitize, the company token platform could not join the association until now because JSTOA only accepts Japanese-regulated entities into its ranks. Securitize co-founder and Chief Executive Carlos Domingo told CoinDesk that a leading Japanese financial services company, SBI Holdings, was one of the founding members of JSTOA, and is a Securitize shareholder.

Six major Japanese brokerages created JSTOA as a self-regulatory organization last year in a bid to consolidate expertise on securities and develop security token business opportunities in Japan. It is a state recognized financial instruments and exchange association that operates as a self-regulated entity.

“So we had already talked to them, and some of the members about how as soon as the association was open to non-regulated members, we [wanted] to be the first company but we are not,” Domingo said.

Headquartered in San Francisco, Securitize expanded its operations to Japan last year after Japan-based VC firm Global Brain invested in the platform, and has since established a subsidiary company.

Domingo, who lived in Japan for many years and speaks the language, said there were a number of reasons why Securitize wanted to establish business ties with the country.

“Japan has been a very forward-thinking country in terms of blockchain and crypto,” Domingo said.

According to Domingo, Japanese investors are very active in the blockchain space, and Japan has comprehensive laws on cryptocurrency regulation, although it has had trouble making a clear distinction between digital assets and cryptocurrency. Large financial services institutions are also inclined towards taking advantage of adopting blockchain technology and digitization for securities, Domingo added.

“So, if you put all those things together, we definitely saw that this was an opportunity and moreover, none of our competitors had any presence in Japan,” Domingo said.

In his view, cracking the Japanese market is not an easy task for foreign entities.

“Japan can be intimidating for doing business,” he said, adding that the lack of U.S. or European securities platforms operating in the country gave them a competitive advantage.

The Chairman of JSTOA and Chief Executive of SBI Holdings, Yoshitaka Kitao, said in a statement to the media, that Securitize brings years of experience and proven market success in developing and deploying security token technology.

“We are very proud to have them join the JSTOA, and look forward to working alongside them,” Kitao added.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.