Securitize Opens IRAs to Digital Securities Investors With Partnership

Carlos Domingo image via Securitize

Digital asset issuer Securitize has facilitated what it says is the first direct IRA investment in security token offerings (STOs).

Alternative investments gateway AltoIRA purchased an initial investment in security tokens representing CityBlock Capital’s $20 million venture fund, with tokens issued by Securitize. The arrangement is set to open up new opportunities for retirement investors seeking exposure to digital securities, an alternative investment, said Securitize CEO Carlos Domingo.

“At the moment [digital securities] are not widely distributed,” Domingo said. “That makes it more complicated for investors to access them, creating a bad cycle.”

Before now, retirement investors were hard-pressed to find entry points into the high-risk, high-reward asset class AltoIRA CEO Eric Salz says has regularly outperformed the market.

“The idea of investing in alternative assets, much less a security token, would be anathema to [institutional] organizations,” Salz said, referring to popular services run by firms like Fidelity, TD and Schwab.

To overcome the institutional blockade, AltoIRA offers individuals those services as a self-directed IRA custodian. In effect this means AltoIRA facilitates trades and is the asset custodian, while the individual makes all investment decisions.

That introduces risk. But Salz said retirement investors are up for the effort, and are not ones to invest in asset classes of any type without “doing their homework.”

“What we’re trying to do is open the doors and provide access to the everyday investor, the same access to higher assets” that institutional investors have, Salz said.

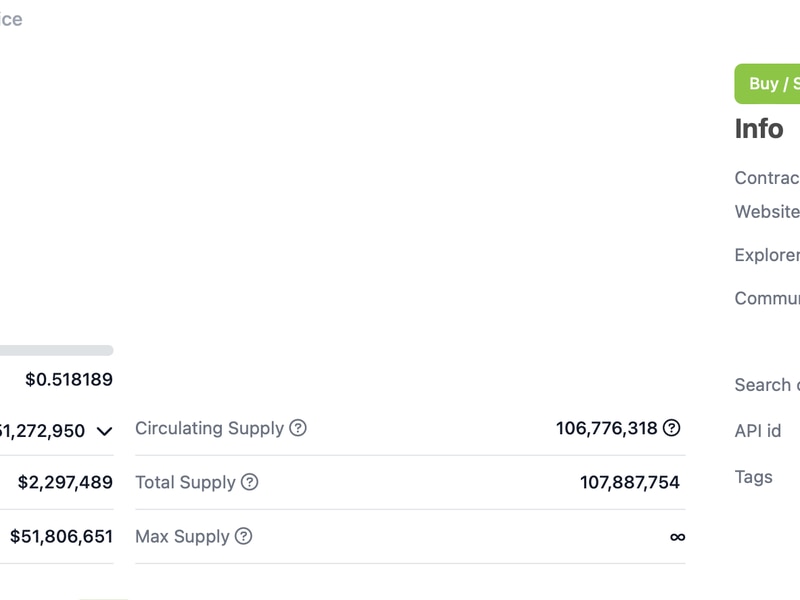

In the case of CityBlock Capital, the tokens will represent CityBlock’s ventures fund NYCQ, a private fund with $10 million allocated to institutional investors. NYCQ includes holdings in CoinBase, Bakkt, Tagomi and Nomics.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.