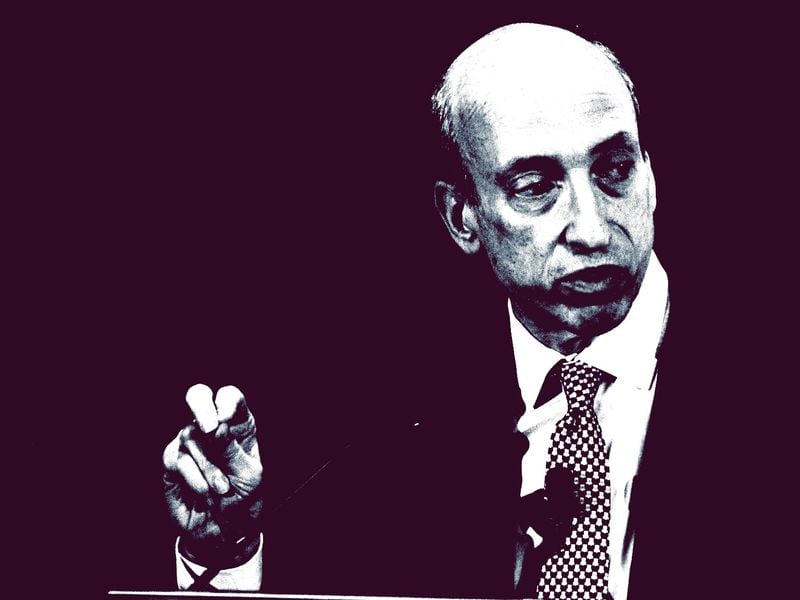

SEC’s Gensler Throws More Crypto Punches in Congressional Hearing

-

The chief of the U.S. securities watchdog fired another public broadside at industry practices, even as his agency is embroiled in court battles with crypto firms.

-

Chair Gary Gensler was tight-lipped about what the Securities and Exchange Commission will do with spot bitcoin ETFs after its recent legal setback.

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler continued his combative stance against crypto “hucksters” in congressional testimony on Wednesday, declining to answer the industry’s most urgent questions while arguing that digital assets companies have been dangerously careless with customer assets.

In remarks before the House Financial Services Committee, Gensler maintained his consistent criticism of the way crypto companies manage customers’ funds, saying that commingling assets “is a recipe that’s not led to good results.”

And the chief of the securities agency said his agency still hasn’t decided what to do about a judge’s ruling that sent the SEC back to the drawing board on its spot bitcoin exchange traded fund (ETF) position.

“It’s still an active consideration of the commission,” Gensler said in his testimony. “We have great respect for the courts.”

A judge in the D.C. Circuit Court of Appeals told the SEC in August to rethink its view on these applications for bitcoin ETFs. Circuit Judge Neomi Rao wrote that the agency’s rejection in the Grayscale Investments case had been “arbitrary and capricious.” Gensler’s testimony didn’t reveal what the agency will do next, or when it will act.

Much of the hearing focused on non-crypto issues, including a looming shutdown of the federal government and whether the SEC is focusing too much on climate or other issues. As in previous hearings, Wednesday’s meeting saw an acute partisan divide, with influential Democrats praising Gensler and Republicans alleging he was harming consumers or small businesses.

Rep. Patrick McHenry (R-N.C.), the panel’s chairman, noted the SEC’s “losing streak with the courts” and criticized its “crusade against the digital assets ecosystem” that the congressman argued is causing confusion and “lasting damage” in the industry.

During his turn to question Gensler, he elicited the latest confirmation from Gensler that bitcoin is “not a security.”

Meanwhile, the crypto industry’s business before the agency may be slowed soon. Gensler indicated the SEC is bracing for a potential government shutdown next week, which the chairman said would sap the agency’s staffing by more than 90%.

“Senior leadership would be there, but we’d be down to a skeletal staff,” he said, suggesting that the day-to-day reviews and approvals of SEC filings will be significantly slowed.

Of the agency’s 5,000-person staff, the hundreds of people who would be working at any time during a closure won’t be paid, Gensler said. “It’s hard on people.”

He declined to answer a question from Rep. Stephen Lynch (D-Mass.) about the SEC’s other high-profile legal dustup in its case against Ripple, when a judge ruled the company hadn’t violated federal securities law in selling XRP to retail investors, noting it was an ongoing matter before the court.

Lynch, who equated the SEC accusations against Binance with the pre-collapse behavior at FTX, also contended that giving the industry a harbor of regulation might perversely leave a firm legally blameless in another implosion.

Gensler responded that any congressional action would have to solve the problem of commingled assets in crypto, saying, “If Congress did anything, it would be separating out those conflicts.”

Edited by Nikhilesh De.