SEC Says It Shut Down More Than a Dozen Illegal ICOs in the Past Year

The U.S. Securities and Exchange Commission (SEC) brought more than a dozen successful enforcement actions specifically related to token sales in the fiscal year that ended Sept. 30.

At least three of these sales reportedly raised more than a combined $68 million from investors before being shut down, the agency said in its annual report Friday.

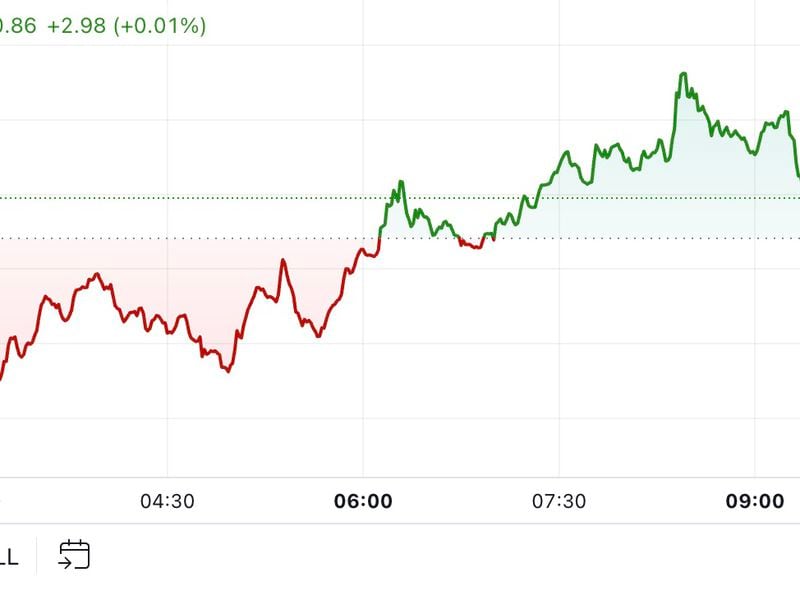

To be sure, that’s just a sliver of the more than $3.945 billion in disgorgement and penalties the SEC collected during fiscal 2018. But the increase in enforcement actions surrounding initial coin offerings (ICOs) and other crypto-related startups was significant.

“Given the explosion of ICOs over the last year, we have tried to pursue cases that deliver broad messages and have market impact beyond their own four corners,” the report stated.

In the report, the SEC Division of Enforcement noted that its new Cyber Unit, formed at the end of the 2017 fiscal year, has helped it expand its focus on cyber-related misconduct. As a result, “the SEC’s enforcement efforts impacted a number of areas where the federal securities laws intersect with cyber issues,” this year.

To that end, “the Commission brought 20 stand alone cases, including those cases involving ICOs and digital assets,” it reported. By the end of the fiscal year, “the Division had more than 225 cyber-related investigations ongoing.”

Nor are those the only cases the SEC brought this year. Further in the report, it added:

“While many of these cases have involved allegations of fraud, the Division also has pursued enforcement actions to ensure compliance with the registration requirements of the federal securities laws. In the past year, the Division has opened dozens of investigations involving ICOs and digital assets, many of which were ongoing at the close of FY 2018.”

Beyond startups offering ICOs, the SEC Enforcement Division has gone after startups and other entities acting as unregistered broker-dealers facilitating token sales, it reported.

SEC image via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.