SEC Requests Personal Financial Information on Ripple Executives, They Object

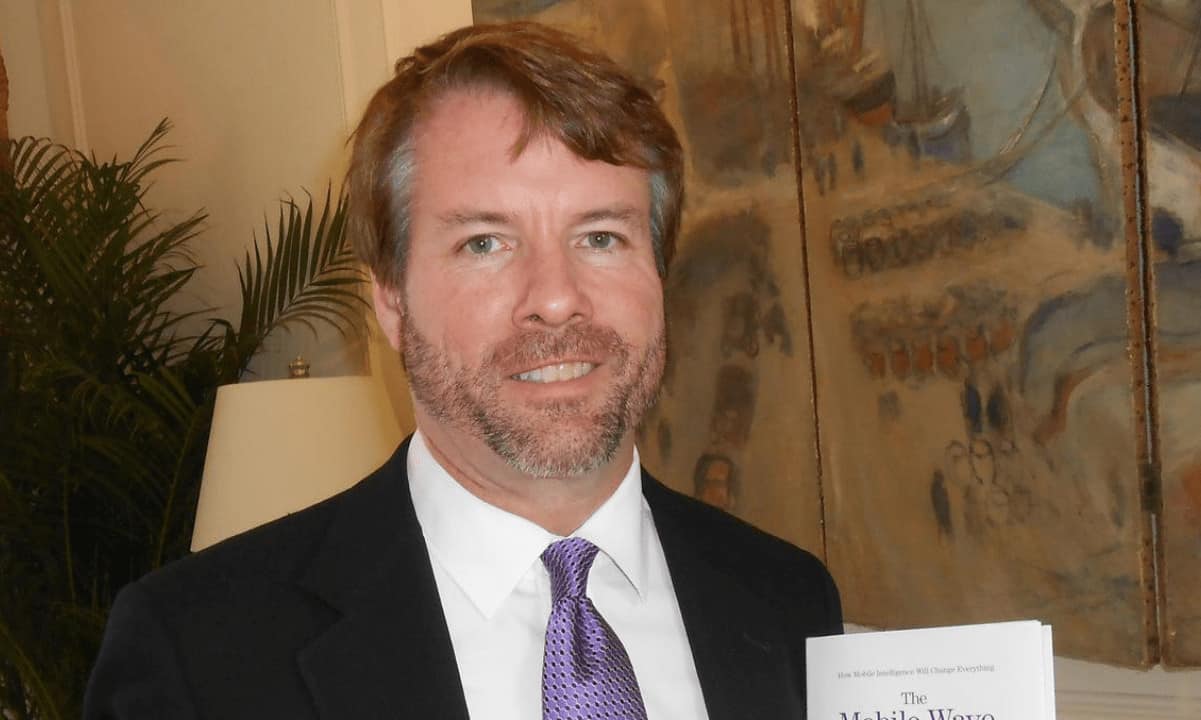

More developments on the Ripple vs. the SEC legal front as the Commission has requested personal financial information of the company’s CEO, Brad Garlinghouse, and co-founder Christian Larsen.

Simultaneously, the Japanese financial giant SBI Group has doubled-down on its support for Ripple by offering to pay its shareholders dividends in XRP.

The SEC Seeks Personal Info on Ripple Execs

The impending case between the US Securities and Exchange Commission and the blockchain payment processor Ripple has become more personal for two of the executives representing the company.

Bloomberg reported earlier that the Commission had sent subpoenas to at least six banks requesting personal financial information for Garlinghouse and Larsen dating eight years back.

However, Ripple’s executives have fought against the SEC’s attempt by filing a motion with a federal judge. Garlinghouse and Larsen have doubled-down on a previous assertion, saying that this request from the Commission is a “wholly inappropriate approach.”

Both claimed that they had agreed to provide all necessary records relating to XRP transactions and information about other compensations from the company. However, they believe that there’s no allegation that their personal finances were somewhat connected with the firm’s.

“The SEC has not offered and cannot provide a coherent explanation for why it is entitled to this information,” said lawyers representing Garlinghouse and Larsen.

As it became known at the end of 2020, the SEC brought charges against Ripple alleging that the payment processor had conducted a $1.3 billion unregistered security offering.

The lawsuit brought severe consequences for Ripple. Most recently, the company announced the ending of a partnership with the international money transfer provider – MoneyGram. Shortly after, Ripple filed documents with the SEC showing that it plans to dump its entire stack of 8.2 million MoneyGram shares.

SBI Group Enhances XRP Support

While regulators in the US are attempting to prove that XRP is a security and has to bear the consequences for it, other countries, such as Japan, have been openly more supportive of Ripple.

One of the largest Japanese organizations, SBI Group, said last year that XRP is a “cryptocurrency asset” and not security by local laws. Later, the entity set up a crypto lending service platform and enabled XRP deposits as well.

Earlier today, SBI Group reaffirmed its support by saying that shareholders will be able to receive their dividends in Ripple’s native token. Those who hold at least 100 stocks could receive 2,500 yen (roughly $25) worth of XRP.