SEC Nominee Gary Gensler’s Hearing: What’s Good and Bad for Bitcoin and the Crypto Industry

Gary Gensler’s statements to the U.S. Congress on March 2, 2021, were beautiful to the ears of crypto enthusiasts. Still, a small part raised red flags and contributed to the markets closing the day with a red candle just when bitcoin seemed to be recovering from a monstrous crash.

Gary Gensler is nominated by U.S. President Joe Biden to be the next SEC Chairman. His testimony before Congress is a formality that made it possible to probe his opinion and knowledge on various issues inherent to his appointment. The boom of cryptocurrencies is one of them.

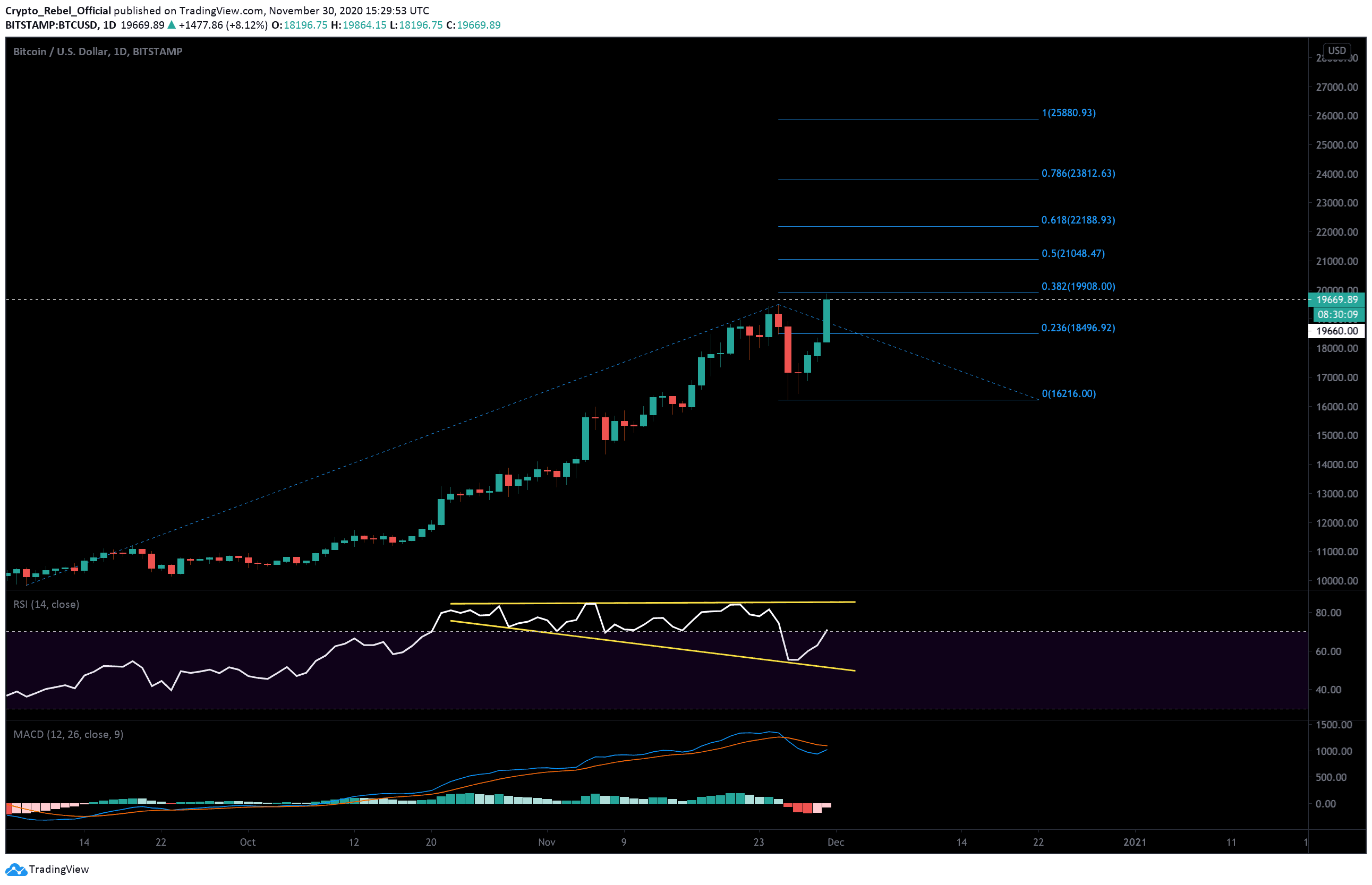

Bitcoin closed the day with a red candle of about 2.3% loss in 24 hours, but 6% down between its high and low. Gensler’s statements seemed to have catalyzed this reaction, although a few hours later, the eastern markets seem to have brought things back to normal.

Gary Gensler Means Good News…

Gensler is a well-known financial and cryptocurrency expert. Not only does he study cryptocurrencies from a legal standpoint, but he also teaches on the subject at the MIT.

During previous years, Gary Gensler worked on the famous Dodd-Frank Act, which helped shape the U.S. financial system after the 2008 crisis.

In his hearing, Gary Gensler asserted that cryptocurrencies “have been a catalyst for change.” He called for creating new legal instruments that protect investors without affecting innovation, arguing that cryptocurrencies “have brought new thinking to payments and financial inclusion.”

“(If confirmed) the SEC would work with fellow commissioners to both promote the new innovation, but also, at the core, ensure for investor protection.”

Gary’s answer to concerns of crypto. pic.twitter.com/DR9u6FfDex

— CryptoBomber (@GSL24236982) March 2, 2021

… But also Possible Bad News

However, Gensler’s interventionist approach may also be troubling to some hodlers and long-term investors.

He told the Congress that, in his view, the SEC should take a much more proactive role when it comes to regulating the markets for cryptocurrencies and other digital assets.

“(The SEC must ensure that crypto markets) are free of fraud and manipulation, and I think that’s the greater challenge, frankly, because some markets, usually operating overseas, have been rife with fraud,”

During his time at the CFTC, Gary Gensler hinted that in his view, Ether and XRP were securities. Although a former commissioner contradicted him on Ether (saying that Ethereum was decentralized enough not to be security), XRP is currently disputing this nature.

If Gary Gensler is confirmed, the situation could be an obstacle to Ripple’s pretensions of “saving” XRP. It could also set a precedent for other projects with similar conditions.

However, there is still much room for speculation. Gary Gensler still needs to act according to a specific set of guidelines —at least from a political perspective— and Joe Biden has not yet presented a strong opinion about cryptocurrencies. So nothing can be taking for granted, not even the trend Bitcoin will take after all these events.