SEC Doubles Crypto Unit Size to Strengthen Investor Protection

America’s top financial watchdog – the Securities and Exchange Commission – disclosed it will almost double the size of its employees, responsible for protecting investors in the digital asset ecosystem. The Crypto Assets and Cyber team will be topped up with 20 people, reaching a total of 50 experts.

SEC Hires More People Focusing on the Crypto Space

The SEC has long advocated setting up comprehensive rules in the crypto space. The agency outlined the significant progress of the industry in recent years but at the same time warned that investors should have maximum protection when delving into it.

In a recent press release, the Commission announced that its Cyber Unit was renamed Crypto Assets and Cyber Unit. It also added 20 more people who are supposed to maintain adequate control in the industry and offer security for investors. The additional positions include trial counsels, staff attorneys, fraud analysts, and supervisors.

Gary Gensler – Chairman of the SEC – argued that the US has the “greatest capital markets because investors have faith in them.” As more people invest in crypto, “it is increasingly important to dedicate more resources to protecting them.”

“By nearly doubling the size of this key unit, the SEC will be better equipped to police wrongdoing in the crypto markets while continuing to identify disclosure and controls issues with respect to cybersecurity,” he explained.

Since its creation, the Cyber Unit has resolved more than 80 enforcement cases related to fraudulent and unregistered crypto-asset offerings and exchanges. Those scams resulted in investor losses of more than $2 billion. Apart from monitoring platforms, the renamed division will focus on non-fungible tokens (NFTs) and stablecoins, too.

SEC Partnered With CFTC

Earlier this year, Gensler revealed that the SEC will join forces with the Commodity Futures Trading Commission (CFTC) to supervise crypto exchanges and enhance protection for investors.

Back then, the executive compared digital asset platforms to alternative trading systems employed in equity and fixed income markets. However, he opined that the latter is used mainly by institutional investors, while exchanges “have millions and sometimes tens of millions of retail customers directly buying and selling on the platform without going through a broker.”

Having that said, Gensler stated that the SEC will seek ways to treat digital asset trading venues like retail exchanges.

Subsequently, the Chairman praised Washington’s regulators for their successful supervision of financial markets over the years. He raised hopes that the trend will continue with the crypto sector, too:

“We ought to apply these same protections in the crypto markets. Let’s not risk undermining 90 years of securities laws and create some regulatory arbitrage or loopholes.”

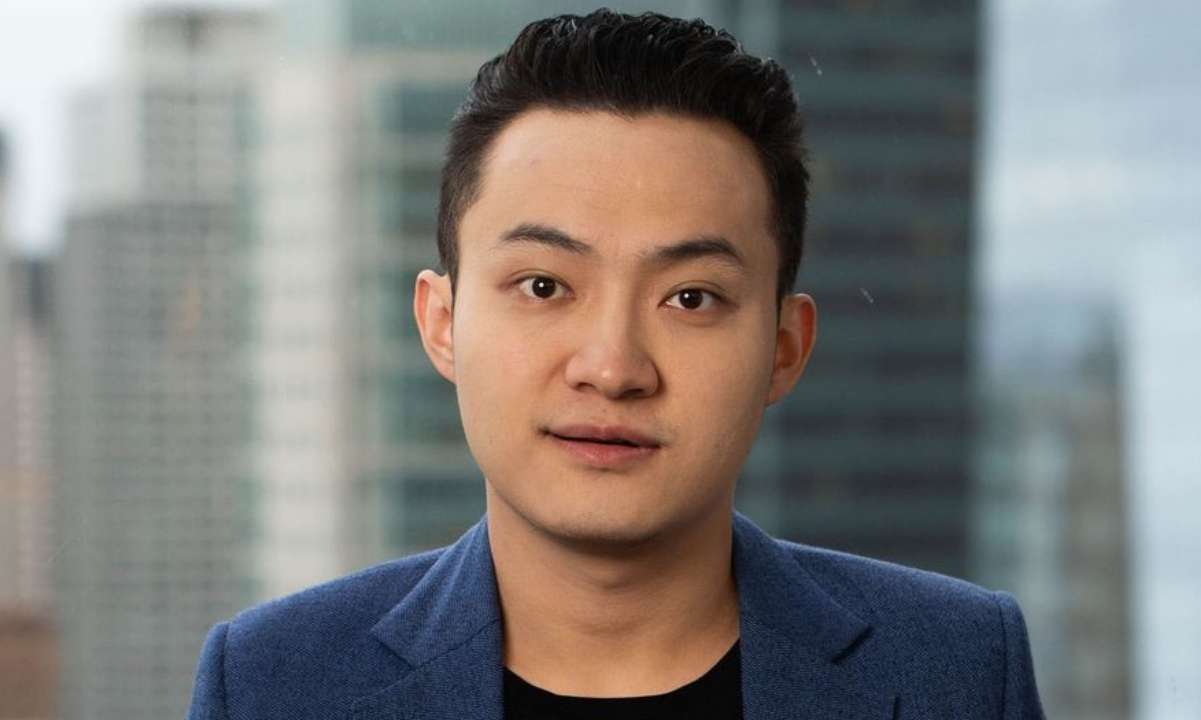

Featured Image Courtesy of Bloomberg