SEC Chair Gensler Cites ‘Wild West’ of Crypto in Case to Increase Agency’s Budget

Securities and Exchange Commission (SEC) Chairman Gary Gensler made a pitch for tens of millions of dollars in additional funding for his agency’s multi-billion budget at the U.S. Senate Committee on Appropriations on Wednesday, telling lawmakers the agency must expand to, among other things, protect investors against a crypto industry “rife with noncompliance.”

“We’ve seen the Wild West of the crypto markets, rife with noncompliance, where investors have put hard-earned assets at risk in a highly speculative asset class,” Gensler said in his prepared remarks.

“With funding to meet the scale of our mission, we can be an even stronger advocate for the American public—investors and issuers alike,” he said.

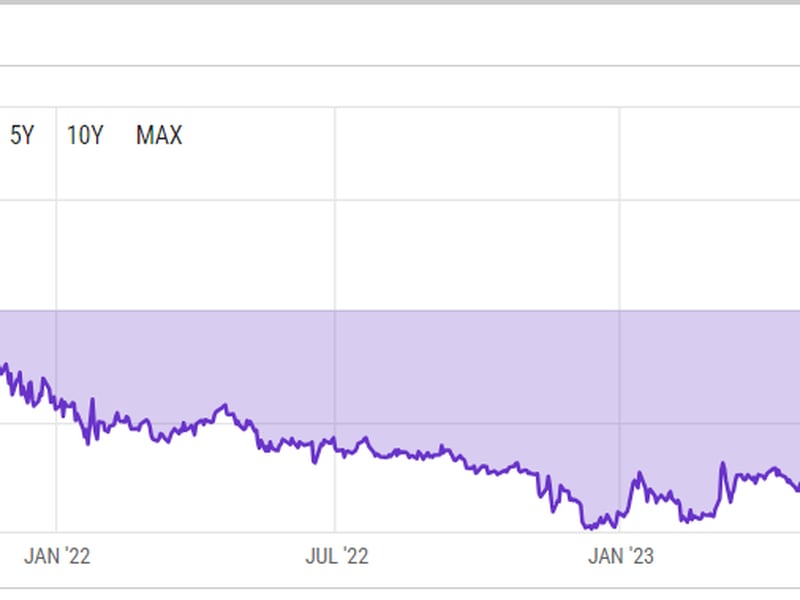

The SEC, which has undertaken wide-ranging efforts to crack down on crypto crimes, is seeking an additional $72 million to add dozens of additional full-time staff members to its roster, Gensler said. A bipartisan bill the committee approved last week to bankroll the SEC $2.364 billion for fiscal year 2024 is just enough to “support currently authorized staffing levels given inflation,” the chairman argued.

The SEC employed 4,685 people in 2023, with roughly half focusing on enforcement and examinations duties, according to data Gensler shared in his remarks. The additional funding would help the agency add 170 positions to its teams, in addition to providing full-year funding for staff members hired in 2023, potentially bringing the SEC’s total full-time equivalent to 5,139 employees.

“With funding to meet the scale of our mission, we can be an even stronger advocate for the American public—investors and issuers alike,” Gensler said. “Stamping out fraud, manipulation, and abuse lowers risk in the system.”