Saylor Junior: A Bitcoin Pleb-Level Speculative Attack

A short look at the math behind loans might show the benefit of loans versus the classic dollar-cost average strategy.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the Infantry before transitioning to the Finance Corps.

This article is not financial advice — just a financially illiterate psychopath doing some math.

As bitcoin’s price crashes, I found myself thinking about Michael Saylor and his strategic use of debt to outstack basically everyone else in the world. It got me thinking, maybe I could do something similar. A pretty standard dollar-cost averaging (DCA) is a daily buy to the tune of $20–$25 a day for a pleb on a budget.

The question I had is what it would look like if I were to convert a $20 daily DCA into a debt payment and bring those future sats into the present.

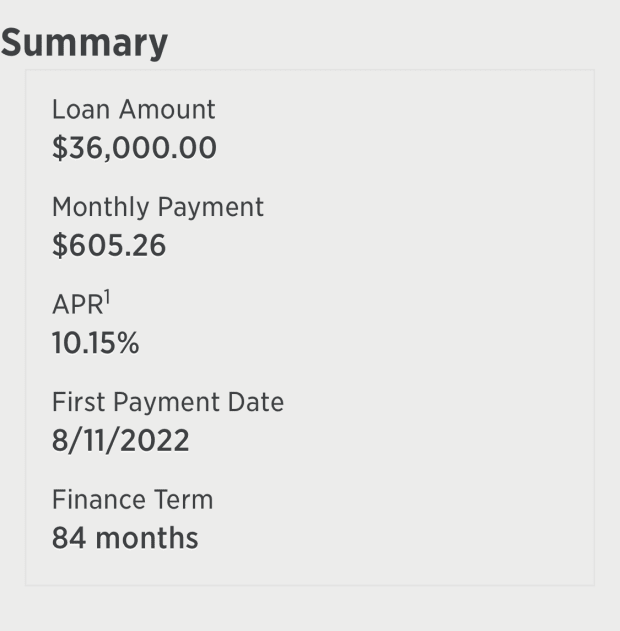

To compare the two, I got a quote for a personal loan, getting as close to the $20 a day DCA payment as possible. The actual quote is below.

The price at the time of this writing is $22,180. Let’s assume a $25,000 bitcoin price, just to add a little conservatism into the calculation.

At $25,000, a $36,000 loan will grant you 1.44 bitcoin. If you multiply the $605.26 monthly payments by the 84-month loan term, you can see that the loan will cost you $50,841.84.

If we divide $50,841.84 by 1.44, we get a bitcoin price of $35,306.83 for you to break even when compared to the cost of the loan. If you think bitcoin will be above $35,000 in seven years, this seems like a pretty good deal to me.

But what about the DCA?

A $20 purchase at $25,000 bitcoin is 80,000 sats. If we take the 1.44 BTC above, or 144,000,000 sats, and divide it by the 80,000 sat DCA, you get 1,800. This means that at a constant price of $25,000, it would take you 1,800 days to DCA into 1.44 BTC at $20 a day, or 4.9 years.

So, essentially, if bitcoin was to stay at $25,000 or below for the next five years, the $20 a day DCA strategy is mathematically better. But if you think that BTC will generally keep rising over time, it may be beneficial to convert your DCA into a loan. Even with that 10% interest rate, bitcoin would only need to exceed $35,000 at the end of the seven-year term for you to come out on top. Honestly, it seems kind of conservative to me.

Michael Saylor’s strategy is starting to look pretty appealing at these price levels. While I can’t, in good conscience, recommend this to anybody, I thought it was an interesting micro example which sheds a little light on where Saylor’s head might be.

Happy stacking. I always love these fire sales.

Just to reiterate one last time: Definitely do not do this. This is not financial advice.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.