Sam Bankman-Fried’s Sentence Might Be Lighter Than You’d Expect

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Sam Bankman-Fried, found guilty of fraud last year, is due to be sentenced next month.

-

The FTX bankruptcy looks likely to make its creditors whole as a result of the jump in crypto markets matters.

-

Restitution paid to victims is a factor when it comes to sentencing, but only when the return took place before the offense was detected.

Former FTX boss Sam Bankman-Fried (SBF) may be handed a lighter sentence than otherwise when he faces District Judge Lewis A. Kaplan next month because customers of the bankrupt exchange will probably be made whole thanks to a bounce in crypto markets and the buoyancy of certain investments held by the estate.

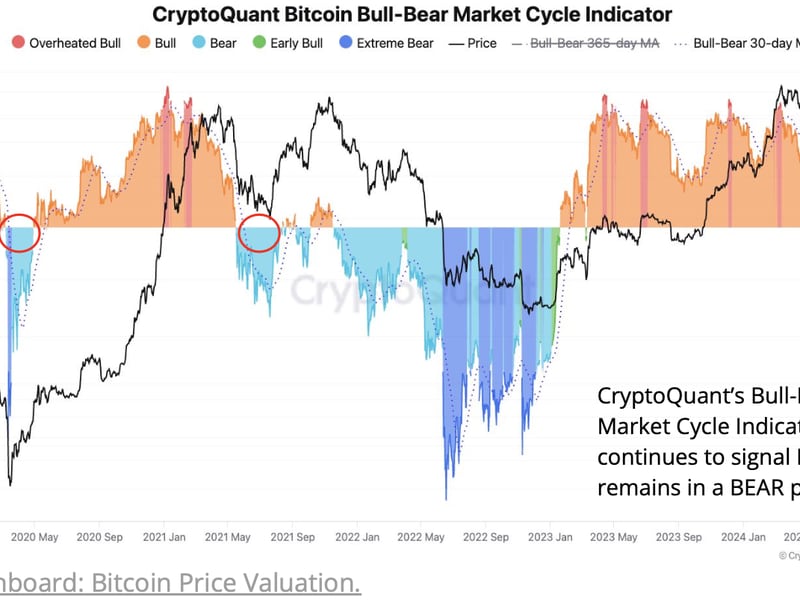

Bankman-Fried was found guilty of fraud in November 2023, about a year after his crypto trading empire collapsed. During the bankruptcy process, the crypto market has risen sharply – CoinDesk Indices’ CD20 gauge has gained more than 130% – meaning many thousands of hapless creditors are going to receive all the funds they had locked in, albeit at November 2022 prices. In July last year, the bankruptcy team said customers were owed $8.7 billion.

The jump in crypto markets matters because restitution can be taken into account for sentencing. For example, for low losses, the guidelines suggest a range of 24-30 months. A high-loss amount, in contrast, could lead to a draconian range of upwards of 20 years’ imprisonment, or even life, according to Jordan Estes, a partner at the New York City office of law firm Kramer Levin.

“I would expect the loss amount to be hotly contested at sentencing,” said Estes, a former assistant U.S. attorney who co-led the general crimes unit in the Southern District of New York, where the trial took place. “In particular, the defense may argue for a substantially lower loss amount, or even a loss amount of $0, if all customers and creditors will be made whole,” she told CoinDesk via email.

That said, the U.S. sentencing guidelines that give defendants credit for amounts returned to victims apply only when the return took place before the offense was detected. In this case, it’s clearly not SBF who is giving the money back, and the payments come well after discovery of the offense.

A possible parallel is the case of fraudulent financier Bernie Madoff, who died in prison at the age of 82 while serving a series of consecutive sentences that ran to 150 years. In Madoff’s case, the bankruptcy trustee also recovered large sums of stolen money, but he didn’t receive any credit for that. Prosecutors estimated the size of the fraud to be $64.8 billion.

Judges in the Southern District of New York often impose sentences below the guideline range in white-collar cases – easier now that they are advisory rather than mandatory – but when the court views conduct as particularly egregious, there is equal latitude to impose a higher sentence than the guidelines suggest, according to Martin Auerbach, an of counsel in the litigation and arbitration team at international law firm Withers.

“The magnitude of SBF’s offense, as well as considerations like its sophistication, and the court’s likely view that SBF’s testimony was untruthful at trial and is a compounding factor (in addition to reflecting a lack of acceptance of responsibility), may well lead the court to impose a hefty and carefully constructed sentence that would be difficult to challenge effectively on appeal,” Auerbach said in an email.

Edited by Sheldon Reback.