Safe Haven? Bitcoin’s $350 Price Spike, While Chinese Stock Markets Reopen and Plunge 8%

The Coronavirus outbreak continues to take its toll on the traditional financial markets, especially in China. The Chinese stock markets had returned after a more extended Lunar New Year’s vacation. As expected, the indexes record significant drops, despite a huge $174 billion injection by the local Government.

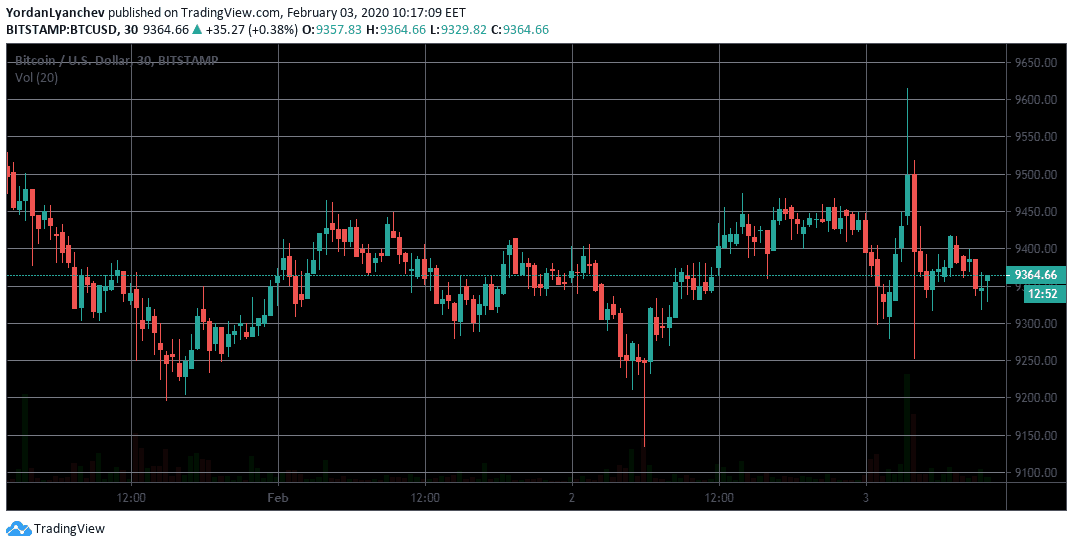

On the other hand, Bitcoin spiked to over $9,600 when the Asian markets opened, noting once again a negative correlation with the traditional markets. However, the primary cryptocurrency couldn’t hold and retraced back to the recent week’s BTC price confluence zone at $9300 – $9400.

Chinese Markets Reopen and Plunge

The notorious Coronavirus keeps spreading and has now taken so far over 360 victims in China, while yesterday saw the first death incident outside the republic, in the Philippines. Aside from the undeniable effects on peoples’ health, it causes severe financial disruptions in the economy, as well.

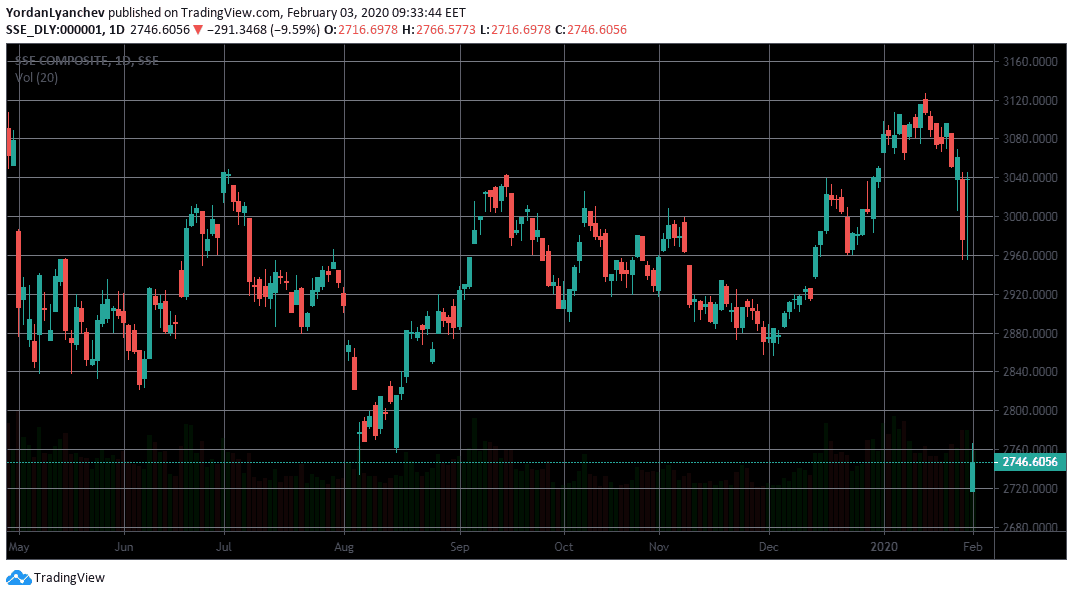

After being closed for over a week during the Chinese New Year, the country’s primary stock market index, the SSE Composite, returned to trading with approximately 10% declines since its last trading day’s close.

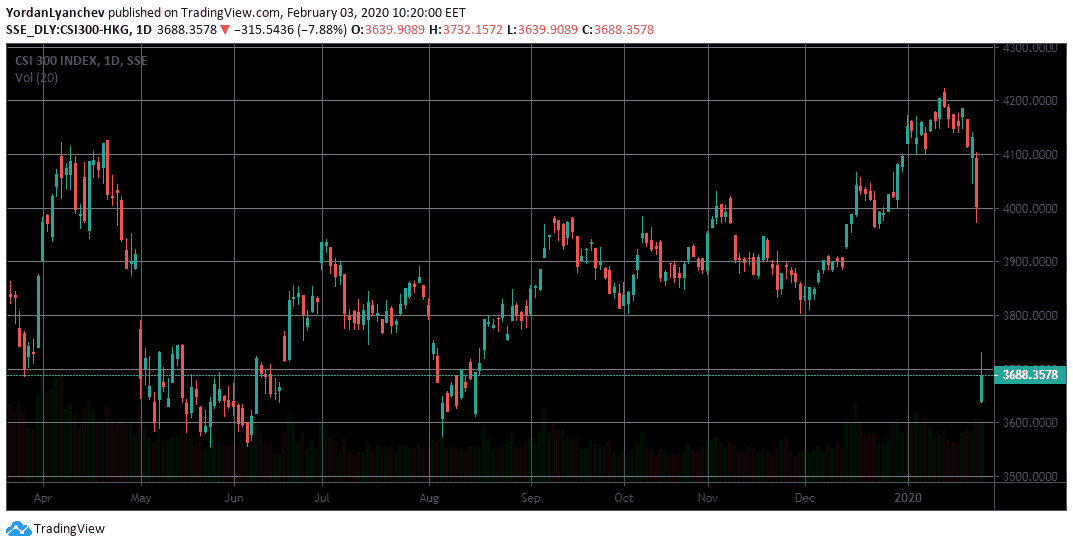

Similarly, the CSI 300 Index recorded a massive 10% drop, as well. On January 23rd, it closed at around 4,000, and it opened today just above 3,600 points. So far, this is the worst intraday price plummeting of Chinese stocks since the equity bubble burst in 2015.

Chinese Government Expected The Drop and Injected

The Chinese Government seemed prepared to act accordingly for the somewhat expected upcoming stock market plunge.

For starters, the People’s Bank of China said that it would ultimately inject 1.2 trillion yuan ($174 billion) worth of liquidity into the markets via reverse repo operations. The idea is to ensure stable liquidity levels and to support companies affected by the virus. It’s worth noting, though, that the injection is worth more than the whole Bitcoin market capitalization, and the largest since 2004.

Besides, the China Securities Regulatory Commission (CSRC) had issued a verbal directive to many brokerages in the country to bar their clients from opening short-selling positions.

The results of these actions couldn’t stop the massive price plunge. However, since the markets opened several hours ago, all Chinese indexes are slowly recovering.

Safe-Haven? Bitcoin Shows Negative Correlation

During the recent economic turmoils, the cryptocurrency community is noticing, once again, a negative correlation between Bitcoin and the traditional stock markets. Just like it happened during the U.S. – Iran clash when Bitcoin surged while the stocks plunged, Bitcoin marks itself as a safe-haven asset against the plunging markets following the Coronavirus.

Earlier today, approximately at the time when the Chinese markets opened, Bitcoin saw a notable price spike. The major cryptocurrency had increased $350, or over 3%, from $9,250 to $9,600 before it retraced back to the confluence price area between $9300 and $9400.

The two steps taken by the Chines authorities have outlined Bitcoin’s censorship-resistance benefits. Since there is no government or any central authority involved, traders can open short or open positions whenever they choose to, even if there’s a negative sentiment, and the price is expected to drop. Bitcoin is decentralized, after all.

The post Safe Haven? Bitcoin’s $350 Price Spike, While Chinese Stock Markets Reopen and Plunge 8% appeared first on CryptoPotato.