Bitcoin-built smart contract platform RSK (a.k.a. Rootstock) is merging with an offshoot established by its founders. The partnership will allow it to spread its roots to Ethereum — and beyond.

The company has been acquired by RIF Labs, a development lab that was established by a handful of RSK’s own founders, including CEO Diego Gutierrez-Zaldivar and Chief Scientist Sergio Demian Lerner, who will both assume the same roles at RIF.

“The RIF Labs founders also comprised renowned professionals with decades of experience in the financial and legal realms such as Alex Aberg Cobo (RIF’s CFO), Malcom Pale and Joey Garcia (Advisors),” according to Gutierrez-Zaldivar.

Like the entity that came before it, RIF develops blockchain infrastructure with a bent toward smart contracts, and the merger will accompany RIF OS’s integration into RSK’s services.

But this merger is more than a mere acquisition. With it, RSK is opening the doors of smart contract interoperability, as RIF OS’s framework could allow for RSK to interoperate with other smart contract platforms in the future.

Enter Interoperability

When asked what RIF OS implements into RSK what it can’t do already, Gutierrez-Zaldivar told Bitcoin Magazine that RIF, which he described as an “upper layer” to the RSK network, will leverage RSK’s smart contracts to execute certain P2P services. The beauty of RIF, though, is that these services have the potential to transcend the Bitcoin and Ethereum blockchains, which RSK’s smart contracts currently support, to other platforms as well.

“While RSK technology is focused on creating an Open Blockchain for Smart Contract execution secured by the Bitcoin Network, RIF OS is focused on building P2P infrastructure services (data storage, payment channels, interactive name resolution, secure communications, oracling services) that rely on RSK Smart Contracts to enforce service level agreements in case of failure to fulfill them but that otherwise run purely in a P2P fashion.

“[These] P2P infrastructure services might in the future be extended to other Smart Contract enabled platforms. The strong synergies between both projects on this point is why RIF Labs management decided to acquire RSK Labs,” he said.

Taken in tandem with RSK’s infrastructure, RIF OS’s integration into RSK will help to build a technical bridge between the sidechain and other blockchains. Gutierrez-Zaldivar believes these tangible improvements will also address some of the industry’s more metaphorical divides.

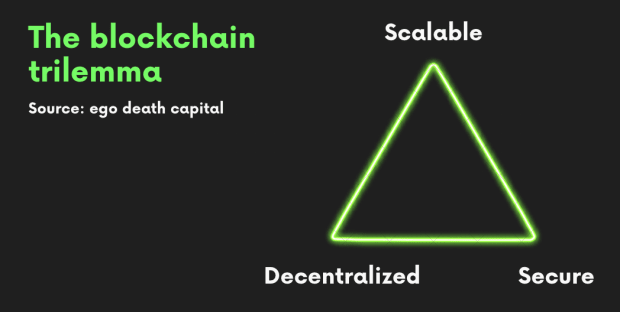

“There’s a gap between blockchain and decentralized technology and developers. And also there’s a problem in terms of scalability and transaction costs in general. Basically, this new project bridges these gaps,” he told Bitcoin Magazine.

RIF, RIF OS’s eponymous token, is the the first step toward building this bridge.

The token is compatible with ERC20, the most popular standard for building smart contract tokens on Ethereum. Users can access the token in the same way they access smartBitcoins (RBTC), the native token of RSK’s sidechain. Except, instead of pegging in and out of bitcoin to create or redeem RIF, RBTC will be used to mint RIF, and the team anticipates that secondary trading markets will be established for the token, as well.

For the immediate present, RIF will be used to fuel the upper layer of applications that RIF OS is bestowing upon RSK.

“Out of the gate,” Gutierrez-Zaldivar said, “only the directory services will be working,” the so-called Root Name Service, which is the first implementation of the RIF OS protocol. However, RSK is building a suite of off-chain services on the upper layer, including an off-chain payment channel, a decentralized data storage marketplace (not unlike Siacoin or IPFS/Filecoin), an oracle marketplace and alias addresses for anonymous transactions.

All of these features will be available directly on RSK, Gutierrez-Zaldivar indicated, though he noted that “in the future, [users] might move [their] RIF into Ethereum as well.”

But RSK won’t settle for solely bidirectional functionality between Bitcoin and Ethereum. Claiming that RIF is a “portable token,” Gutierrez-Zaldivar continued to say that RSK’s long-term goal is to give its users the ability “to consume these decentralized services from any smart contract enabled blockchain,” be it Ethereum, EOS, Cardano or others.

He also stressed that extending RSK’s capabilities to other platforms won’t endanger the project’s loyalty to its baselayer in Bitcoin. RBTC, which has a 1:1 parity with bitcoin and powers the RSK sidechain, will still be used for transactions, and RSK’s native smart contracts will still operate on the sidechain.

“Doesn’t change how RBTC work. For us, that’s very important that RSK stays fully aligned with the Bitcoin ecosystem. It’s just bringing more usage to the network, because now you have a marketplace for decentralized infrastructure running on RSK, and consuming RBTC for transactions. So smart contracts will still be run with RBTC. It’s the upper-layer of infrastructure that will be consumed with RIF.”

RIF OS’s implementation will also include a library of traditional programming languages, such as Java and C#, that is meant to make onboarding RIF OS’s services into traditional platforms easier for non-blockchain-savvy developers. Extending the bridging analogy he employed earlier, Gutierrez-Zaldivar stated this will hopefully give the RIF OS suite mainstream appeal.

“Idea is that a traditional developer that knows nothing about decentralized infrastructure or technologies [can] plug in this library to their application and use the file storage, off-chain payments, without getting into the thick of how this works. So that’s why we think this layer will bridge the gap between the base infrastructure we have today and traditional developers.”

A Vision of Inclusion

In our conversation, Gutierrez-Zaldivar stressed that RSK’s endgame is to make cryptocurrencies and blockchain-powered applications more accessible, expressing that the RIF OS integration is “part of [the team’s] vision” to deliver a usable, unified experience to its users.

And this vision looks further than those immediately active in the crypto community; it’s got its eyes primarily on those who need a decentralized currency like bitcoin the most.

“All the technology we build has one major goal in mind and that is enabling financial inclusion,” Gutierrez-Zaldivar added, going on to indicate that he believes unbanked populations will be the first to benefit from RSK and its forthcoming services.

He envisions that applications like Lumino (RSK’s version of the Lightning Network) will engender a greater degrees of financial freedom for this population, while RIF applications like its decentralized data storage will give them alternative access to internet services that are currently out of reach.

Unwavering commitment to the unbanked is fitting for Argentina-based RSK. The company lives in Latin America, a sometimes-forgotten epicenter of cryptocurrency use. With crypto’s popularity taking off in places like Venezuela as an economic ballast amidst floundering national economies, Latin America is proving Bitcoin’s primary use case as a decentralized currency for an economically underprivileged population.

As it expands its capabilities, RSK will continue to mature with these disadvantaged populations in mind. And if the project can succeed in enriching their economic lives, Gutierrez-Zaldivar expressed, then there’s reason to believe that such an inclusive system could become the new standard for populations around the globe.

“If it works for the unbanked, it will work for anyone else. Because the unbanked live in the harshest environments. There’s no money, the fiscal security is almost non-existent. If we manage to bring this technology to the unbanked, then anyone else can profit from it. As I like to say, I don’t think we want to include the unbanked in the system we have because the system we have is not prepared; it’s exclusive by nature. We want to build a financial system that’s inclusive by nature.”