Rollercoaster: After Daily $1000 Plunge, Bitcoin Maintains $19K As ETH Below $600 (Market Watch)

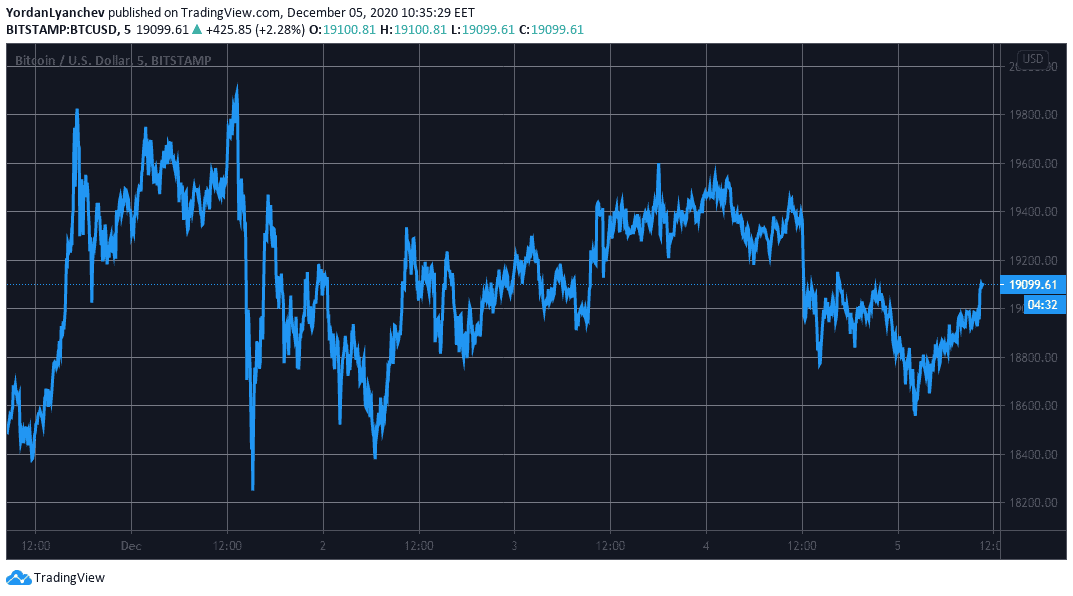

The primary cryptocurrency had a rather positive week, which saw a new all-time high on some exchanges. However, BTC’s inability to break above the coveted $20,000 price tag drove the asset down to $18,100 just minutes after the second attempt to break $20K.

The cryptocurrency recovered most losses and jumped to $19,500 in the following days. In the past 24 hours, BTC stalled around that level. The bears took control and drove the asset towards the intraday low of about $18,500, where lies a critical support area. Nevertheless, bitcoin has bounced off and current hovers above $19,000.

From a technical viewpoint, BTC needs to overcome the first resistance at $19,700 (the previous 2017 ATH zone) to head for new highs. If successful, the cryptocurrency’s next obstacles will be at $19,920, $20,350, and $20,970.

Alternatively, the support levels at $18,800, $18,600, and $18,270 could assist if there’s another retracement.

Altcoins Covered In Red

Most alternative coins have followed Bitcoin’s price developments in the past 24 hours. Ethereum went from a daily high of $620 to a low of $560. Despite recovering over $590, the second-largest cryptocurrency is down by more than 3% on a 24-hour scale.

Ripple has lost 6% of value since yesterday and struggles beneath $0.60. Bitcoin Cash (-5%), Binance Coin (-3.5%), Chainlink (-4.5%), Polkadot (-4%), Cardano (-3%), and Litecoin (-5.5%) are also in the red from the top ten coins.

Stellar has lost the most value in the past 24 hours with an 8% decrease. Thus, XLM has erased the gains marked last week after the project announced two major network upgrades.

MaidSafeCoin is next with a 7% decline, threatening MAID’s position in the top 100 coins. Kyber Network (-6%), Dash (-5%), Verge (-5%), and Cosmos (-5%) follow.

In contrast, NEM is the most impressive gainer, with an 8% increase since yesterday. On a weekly scale, XEM has added over 40% to its value. Bitcoin SV has also jumped by about 8% and trades north of $180.