Ripple’s (XRP) Price Rally, Bitcoin’s Volatility Amid Trump Assassination Attempt, SHIB Price Outlook: Bits Recap Sep 16

TL;DR

- XRP gained 7.5% last week, boosted by Grayscale’s Ripple Trust launch and rumors of a Robinhood re-listing.

- BTC dropped below $60,000 after briefly surpassing $60,500, affected by negative news in the broader market such as the supposed assassination attempt on Donald Trump.

- SHIB increased by 2% over the week amid a high level of fear, uncertainty, and doubt (FUD) in the ecosystem.

XRP’s Performance as of Late

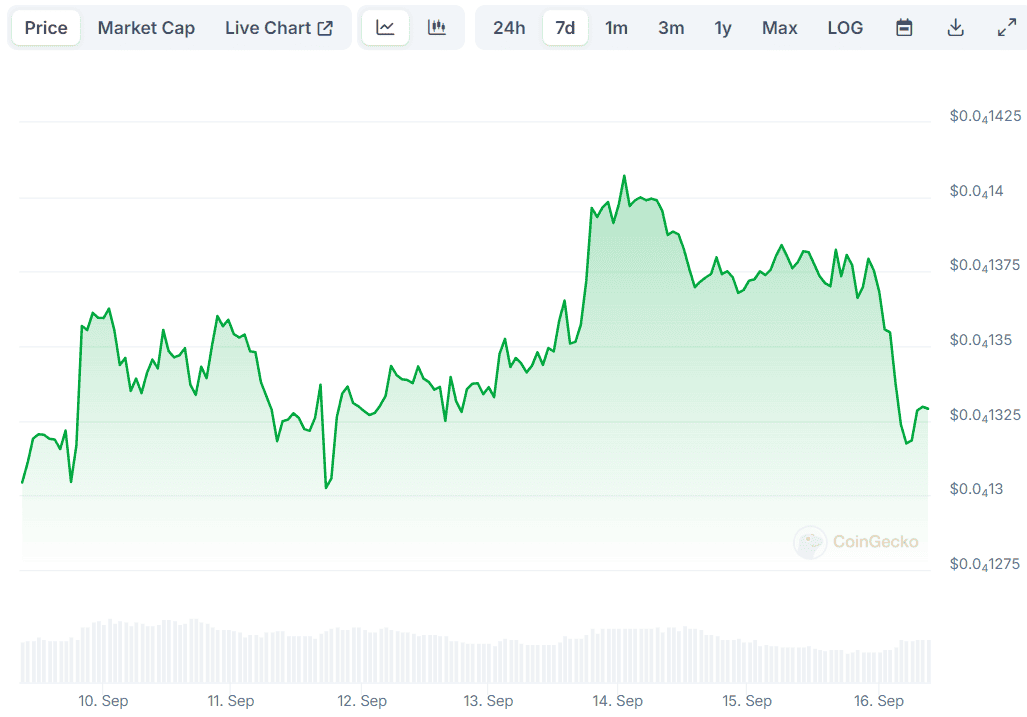

Ripple’s XRP was at the forefront of gains last week, following Grayscale’s decision to launch a dedicated Ripple Trust. The product, which allows users to have direct exposure to the asset without the need of purchasing, storing, or holding it, saw the light of day on September 12.

XRP’s price charted a substantial green candle minutes after the announcement, rising to as high as $0.57. Its uptrend continued in the following days, reaching almost $0.60 on September 15. Another factor fueling the rally could be the increased rumors that Robinhood has re-listed XRP on its platform. The company’s website shows that Ripple’s native token is indeed among the supported cryptocurrencies.

Over the past several hours, XRP has lost some ground and currently trades at around $0.57 (per CoinGecko’s data). However, it remains in green territory on a weekly scale, up 7.5% for that period. Those willing to explore some interesting predictions from popular analysts can take a look at our article here.

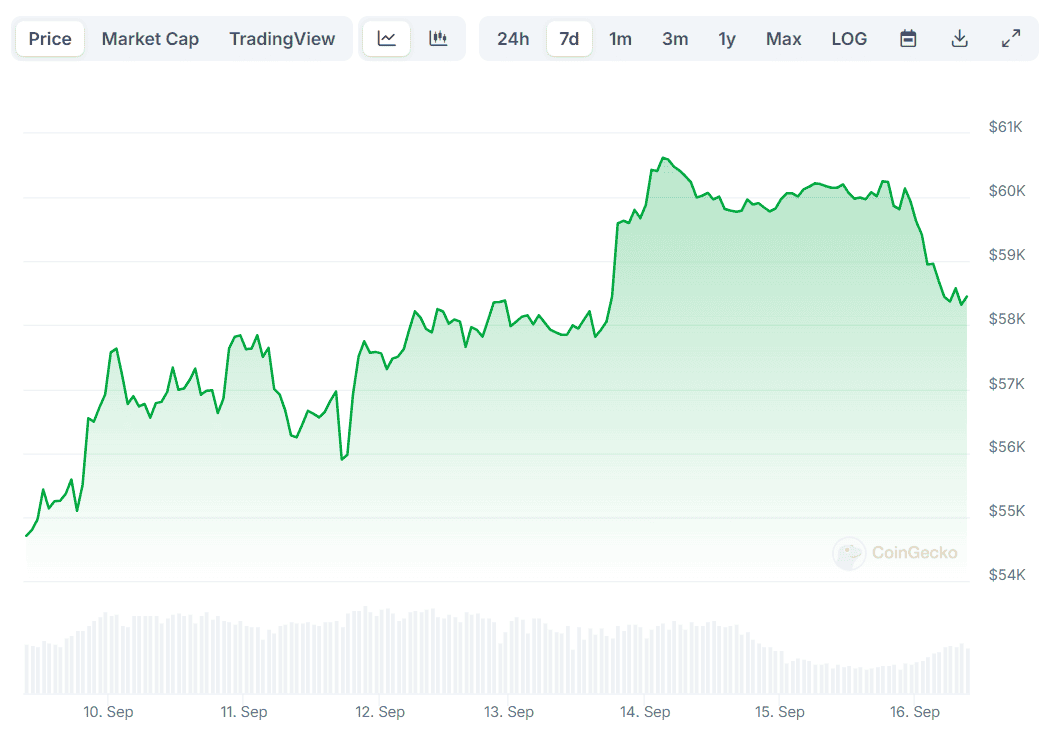

BTC Lost the $60K Level

The primary cryptocurrency also witnessed a significant uptick in the past week, with its valuation jumping above $60,500 over the weekend. The rally was interrupted in the last several hours following the reports of an attempted assassination on Donald Trump.

As CryptoPotato reported, the FBI has started an investigation into the incident where numerous gunshots were fired at the golf club at the time the presidential candidate was playing.

The cryptocurrency sector reacted negatively to the news, and its global market capitalization is down 4% on a daily scale, currently set at approximately $2.12 trillion. BTC fell well below $60,000, hovering at $58,400 as of the moment of writing these lines.

It will be interesting to see whether the asset’s downtrend will intensify in the following days or it will recover after the FOMC meeting (scheduled for September 18). Multiple industry participants expect the US Federal Reserve to lower the interest rates, thus making money-borrowing easier and potentially boosting investor interest in risk-on assets such as cryptocurrencies.

What About SHIB?

The second-largest meme coin recorded a mild increase in the last seven days, with its value rising by 2%. Not long ago, the crypto analytics platform Santiment estimated there is a “tremendous” amount of FUD within the Shiba Inu ecosystem.

Fear, Uncertainty, and Doubt (FUD) describes the dissemination of negative or false information, rumors, or emotions that create panic among investors, potentially triggering selling pressure in the market. Such a rise is often viewed as a signal of impending significant price fluctuations.

The post Ripple’s (XRP) Price Rally, Bitcoin’s Volatility Amid Trump Assassination Attempt, SHIB Price Outlook: Bits Recap Sep 16 appeared first on CryptoPotato.