Ripple (XRP) Explodes 60% Weekly, Surpassing $1.3: Bitcoin at $46K (Market Watch)

Shortly after reaching a new three-month high of over $48,000, bitcoin retraced rapidly and lost over $2,000 in hours. Most altcoins are also in the red, with the apparent exception of Ripple. XRP has surged by 60% in a week to a record of its own at $1.3.

Red Among Alts, But Not XRP

The alternative coins enjoyed the past several days with impressive gains. Ethereum led the charge by surging past $3,300. Thus, ETH nearly doubled its value since the July 20th dump.

However, the second-largest crypto has retraced by about 3% in a day and currently sits just over $3,200.

Cardano has also been among the best performers, with a 40% weekly increase. Despite the slight correction since yesterday, ADA stands at $2.1 and actually surpassed Binance Coin as the third-largest digital asset by market cap.

Polkadot (-2.5%), Uniswap (-3.5%), Solana (-0.5%), Litecoin (-2%), Chainlink (-3.5%), and MATIC (-5%) have also retraced in a day.

In contrast, XRP has surged by about 9% on a 24-hour scale. Ripple’s native token is up by 60% in a week and exceeded $1.3 hours ago for its highest price level since mid-May.

More fluctuations come from lower- and mid-cap alts. From one side, Waves (17%) and THORChain (12%) have recorded substantial gains, while from the other – Qtum (-10%), NEAR Protocol (-9%), Ravencoin (-9%), Telcoin (-8%), and The Graph (-8%) are in the red.

The crypto market cap has declined by about $60 billion in a day and sits just under $2 trillion.

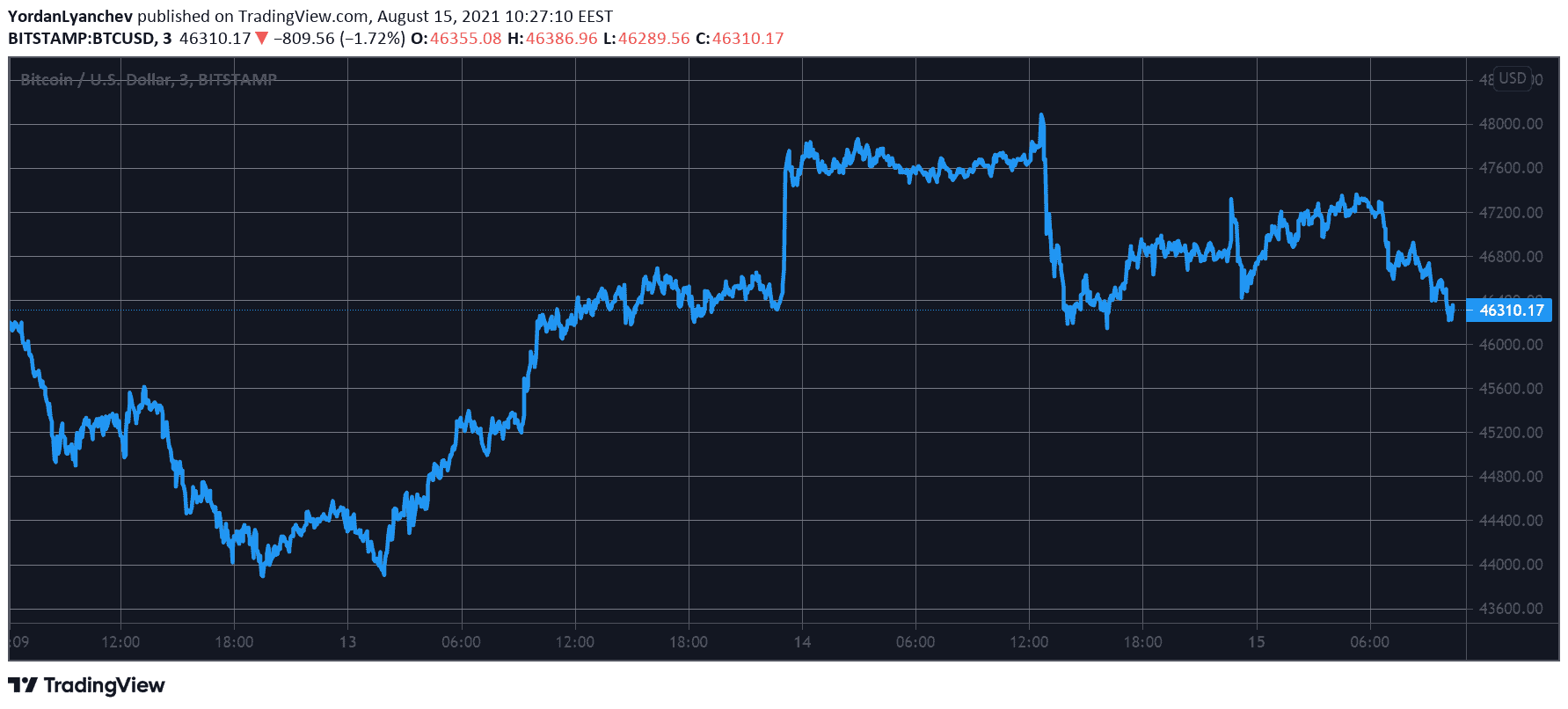

Bitcoin’s $2K Dump

The primary cryptocurrency also flew high. As reported yesterday, it’s up by more than 60% since the July drop below $30,000. In fact, the bulls kept pushing it upwards, and BTC even surged above $48,000 for the first time since mid-May.

However, this adventure was short-lived. In the following minutes, bitcoin reversed its trajectory and dumped hard by about $2,000.

This came as the general sentiment in the community had turned to “extreme greed,” which could sometimes be a catalyst for incoming corrections.

As of now, bitcoin still stands at just over $46,000, and its dominance has further declined to 44.2%, even though the market capitalization has stayed well above $850 billion.