Ripple (XRP) Defies Bear Market Trend as Institutional Flows Positive

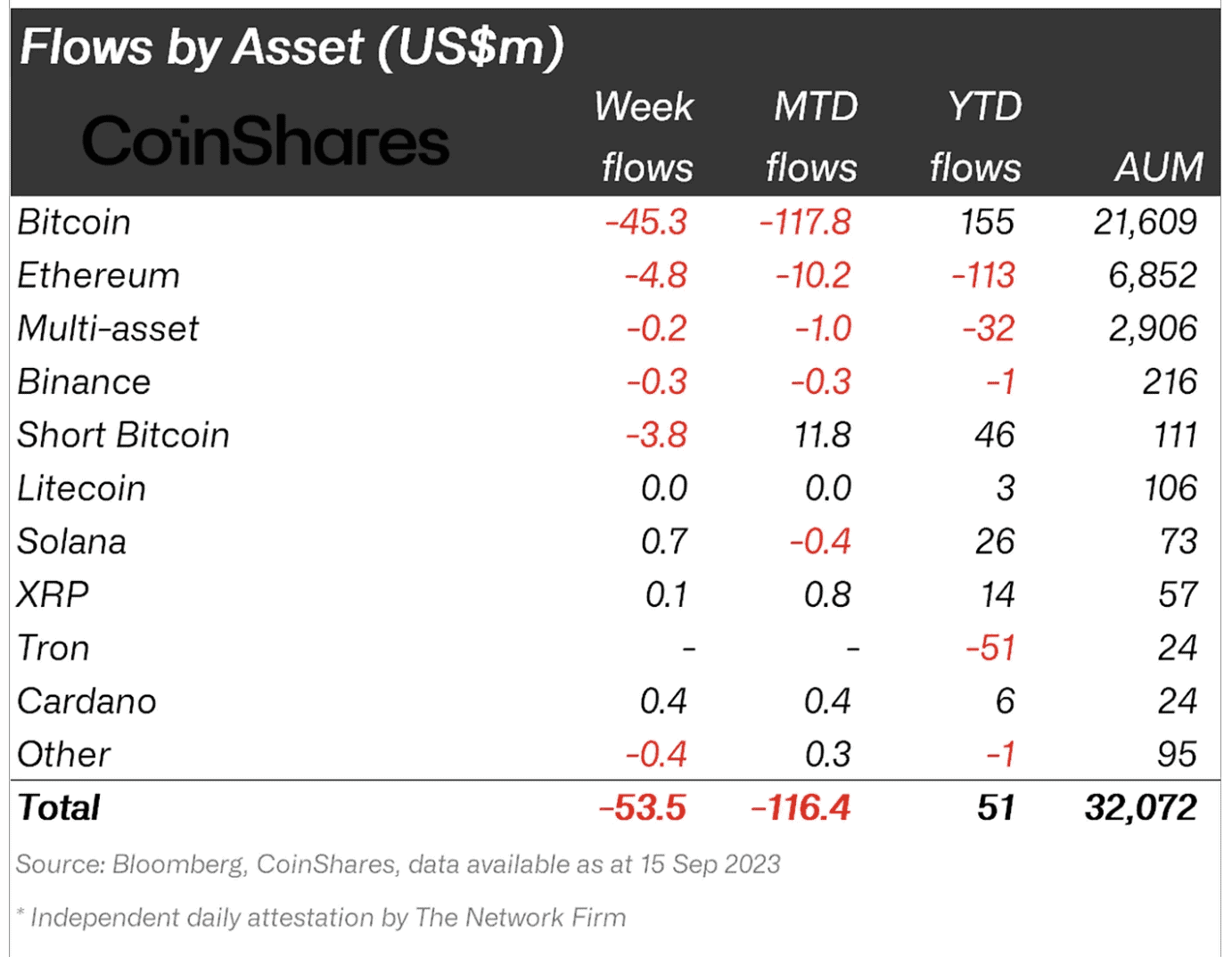

CoinShares released its weekly Digital Asset Fund Flows report yesterday. While the data there might be worrisome, it also sparks hope that institutions are showing interest in a certain group of select altcoins for the first time in a while.

The report notes that:

Digital asset investment products saw outflows totalling US$54m last week, with outflows for 8 out of the last 9 weeks that aggregate to US$455m.

It’s worth noting, though, that Bitcoin is responsible for some 85% of the total outflows, which account for $45 million of the $54 million of total outflows. Ethereum is second in line with $4.8 million.

But amongst those, there’s a group of altcoins that has seemingly attracted the interest of institutions.

Namely, these are Solano, Cardano, and XRP. They attracted inflows of $0.7 million, $0.43 million, and $0.13 million, respectively. While $130,000 worth of institutional inflows might not seem like a lot, it’s important to look at it in the context of a market that has seen inflows worth over $50 million in the same period.

That said, the XRP price continues to perform well, managing to remain above the critical resistance level of $0.5, charting an increase of 2.5% through the day. This has brought its weekly gains to 6.3%.

The post Ripple (XRP) Defies Bear Market Trend as Institutional Flows Positive appeared first on CryptoPotato.