Ripple (XRP) Back in Top 4: BTC Dominance Plunging (Market Watch)

While bitcoin has suffered below $60,000, some altcoins have taken advantage by registering impressive gains. Apart from BNB’s newest price records, Ripple is also another remarkable performer. XRP has returned above $1 for the first time since mid-2018 and has reclaimed the 4th spot in terms of market cap.

Rising Altcoins; XRP Back in Top 4

As CryptoPotato reported yesterday, there’re several signs of an ongoing altseason. And, looking at the charts, it’s hard to argue.

Ripple is among the best performers following somewhat positive news from the legal case against the SEC. The payment processor won access to the Commission’s internal crypto discussions in a court hearing yesterday.

However, XRP has been on a roll for several consecutive days. It has gained roughly 100% since April 4th and jumped to above $1.10 earlier today. Naturally, the asset’s market capitalization has surged as well, and XRP has now become the 4th largest crypto by that metric.

Binance Coin is another notable performer as BNB has set yet another new all-time high above $410.

Cardano (5%), Litecoin (6%), Chainlink (7%), and THETA (8%) are also well in the green. In contrast, Ethereum has retraced slightly and is just beneath $2,100, Polkadot is 4% down, and UNI has dropped by about 2% on a 24-hour scale.

More gains come from Bitcoin Gold (45%), Helium (33%), Qtum (32%), OMG Network (22%), KuCoin Token (22%), Ethereum Classic (16%), Solana (14%), VeChain (14%), Celsius (12%), and more.

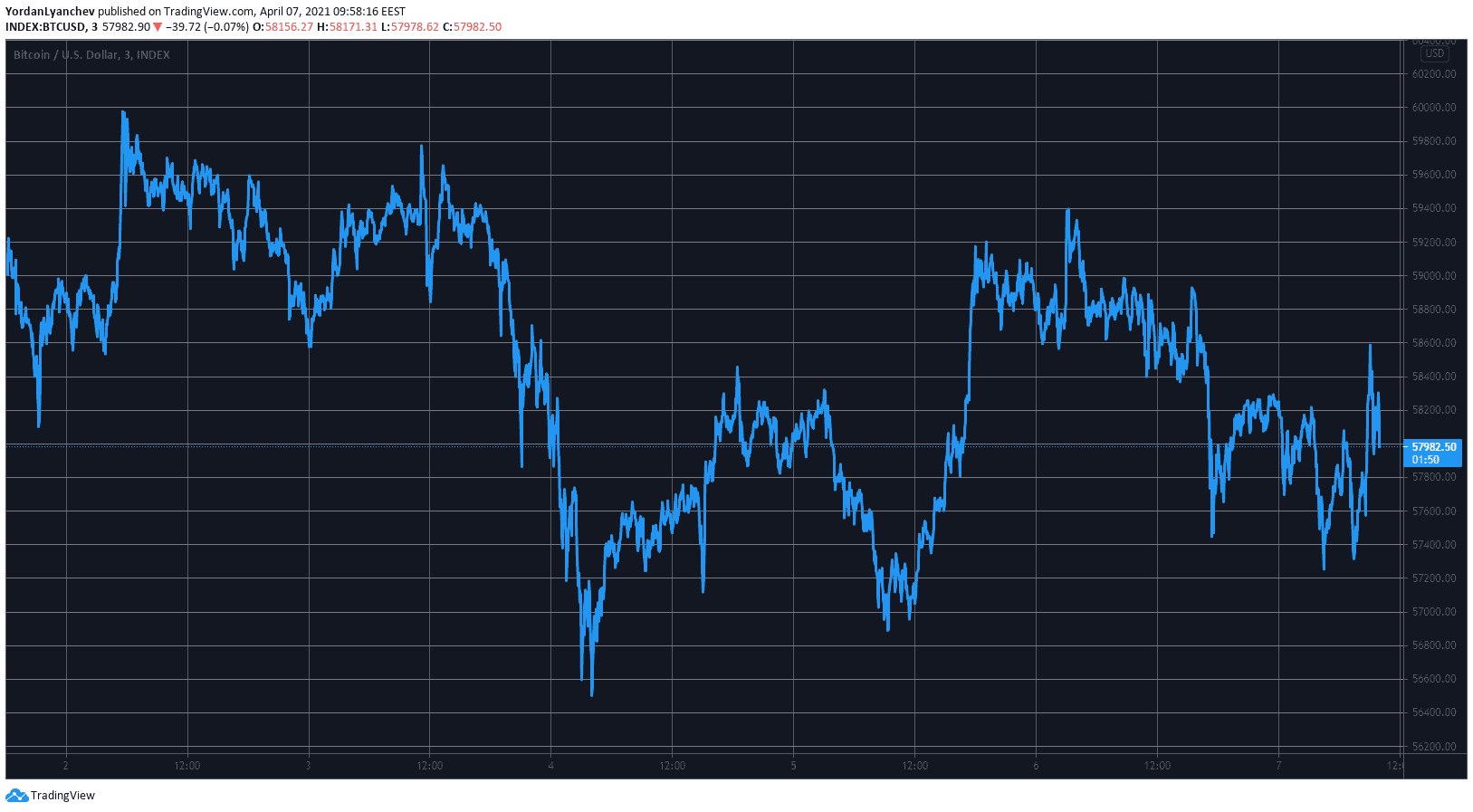

Bitcoin’s Struggles Below $60K Continue

The rising altcoins have reduced a sizeable chunk of bitcoin’s dominance over the market. The metric is down to an early low of about 55%. For comparison, it was well above 70% in early January 2021.

This is a result of BTC’s inability to reconquer its nemesis at $60,000. The asset attempted several runs but was rejected on every occasion.

In the past 24 hours, bitcoin dipped to a low of just above $57,000. Despite adding about $1,500 and touching $58,800 (on Bitstamp), BTC is still in the red on a 24-hour scale as it has retraced to $58,000.

The technical indicators show that $58,355 is bitcoin’s first resistance line on its way to the next one at $60,000. Only if the asset overcomes both could it head towards uncharted territory.

Alternatively, the support levels at $56,400, $54,675, and $54,000 could assist in case another retracement arrives.