Ripple Whales Go on a Selling Spree: Is XRP Headed for a Further Correction?

TL;DR

- Whale activity and a sell signal from the TD Sequential indicator suggest continued downward pressure in the short term for XRP.

- On the contrary, the asset’s RSI is approaching the bullish zone of 30, indicating a potential resurgence.

More Pain Ahead?

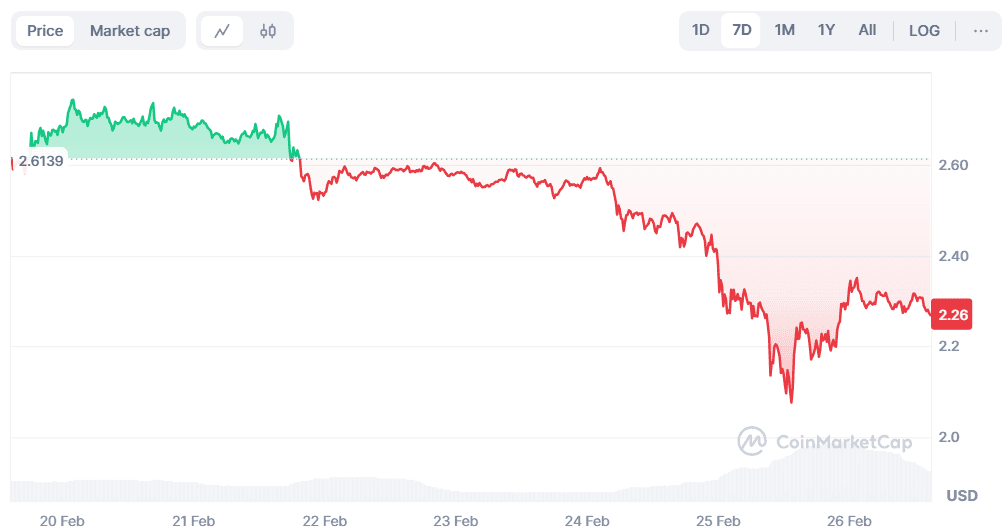

Ripple’s native token was among the worst-affected digital assets during the crypto market crash witnessed on February 25. Its price tumbled to $2.07 (per CoinMarketCap’s data) before rising to the current $2.26. Still, the ongoing level represents a 13% decline on a weekly scale.

Some factors suggest that the bears might continue to prevail in the short term. Popular X user Ali Martinez revealed that whales have sold more than 370 million XRP in the past 96 hours. At current rates, the stash equals over $830 million.

Large sell-offs increase the supply of the token on the open market, potentially overwhelming demand and creating a downward pressure on the price. It may also suggest a lack of confidence in XRP, prompting smaller players to follow suit.

In addition to the whales’ activity, Martinez touched upon the asset’s TD Sequential indicator. He claimed that it now flashes the sell signal on the two-week chart, alerting about an impending correction.

The Bullish Elements

Contrary to the aforementioned factors that signal a further pullback for XRP, some indicate a potential rally. One example is XRP’s Relative Strength Index (RSI), which has been on a downtrend for the past several hours and is nearing the bullish zone of 30. Readings below that level suggest the asset could be oversold and due for a price surge. Conversely, anything above 70 is considered a bearish sign.

The solid chances of an approved spot XRP ETF in the States should also be mentioned. Over the past few months, well-known companies like Grayscale, Bitwise, and 21Shares have displayed their intentions to launch such products. The US SEC acknowledged their applications, and according to Polymarket, the approval odds before the end of 2025 stand at around 72%.

An investment vehicle of that type will allow investors to gain exposure to XRP without needing to manage digital wallets and private keys or navigate cryptocurrency exchanges. As such, it could attract more investors into the ecosystem and positively impact the price in the long term.

The post Ripple Whales Go on a Selling Spree: Is XRP Headed for a Further Correction? appeared first on CryptoPotato.