Ripple Taps Lithuania’s FINCI to Expand ODL-Based International Payments

Ripple has announced a partnership with Lithuania’s FINCI to provide retail remittances and B2B payments through RippleNet’s On-Demand Liquidity (ODL). Thanks to this partnership, FINCI’s customers can make seamless payments between Europe and Mexico, a PR from Ripple said.

Ripple-FINCI Partnership

FINCI is an online cross-border money transfer provider, while RippleNet’s ODL provides crypto-enabled international payments. ODL taps into global crypto liquidity to give customers enterprise-grade solutions in cross-border payments. Ripple is the market leader in crypto-powered cross-border payments.

For the blockchain-focused company, FINCI is the first customer in Lithuania, and it brings the opportunity to explore the market further. Lithuania is seen as one of the most crypto-friendly nations in Europe. It’s also the first in the region to come up with its CBDC.

“We’re delighted that FINCI is our latest ODL deployment in Europe and are looking forward to soon announcing additional European partners who are preparing for a crypto-enabled future,” said Ripple’s Managing Director for Europe Sendi Young.

Easy Retail, B2B Cross-Border Payments

The coming together of the two fintech companies will make it easier for consumers and businesses to make real-time payments, including remittances and fund transfers, internationally “faster, more reliably and at a lower cost.”

“We’re excited to be working with Ripple to make it easier for FINCI customers to move money around the world. We share the same fundamental goal of removing the hidden inefficiencies affecting international payments. What’s more, the savings and operational improvements we’ll achieve by using Ripple’s ODL will allow us to put money back into the business and enhance our offering to our customers,” said FINCI’s CEO Mihails Kuznecovs.

ODL Leverages XRP to Tap into Crypto Liquidity

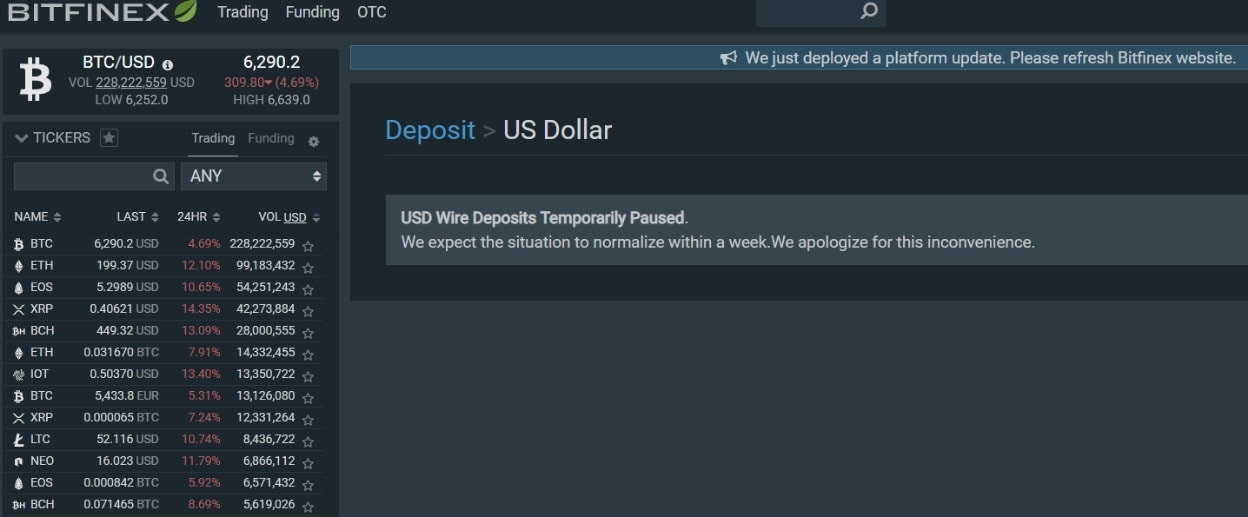

ODL leverages Ripple’s native coin XRP to settle payments in local currencies in real-time by tapping into crypto liquidity. This preempts the need for financial institutions to pre-fund their overseas accounts to provide payment services. In other words, it allows them to expand the business without deploying capital.

“In 2021 Ripple had its most successful year to date, more than doubling the number of transactions on RippleNet. RippleNet’s annualized payment volume run rate now stands at $15B,” the PR said.

However, XRP reflected the ongoing bearish market sentiments with a 42% fall last week. Talking about Ripple’s protracted legal dispute with the markets regulator, the SEC, company CEO Brad Garlinghouse said earlier this month that he believed the lawsuit would be resolved this year. He termed his firm’s legal battle with the regulator as having gone “quite well” so far.