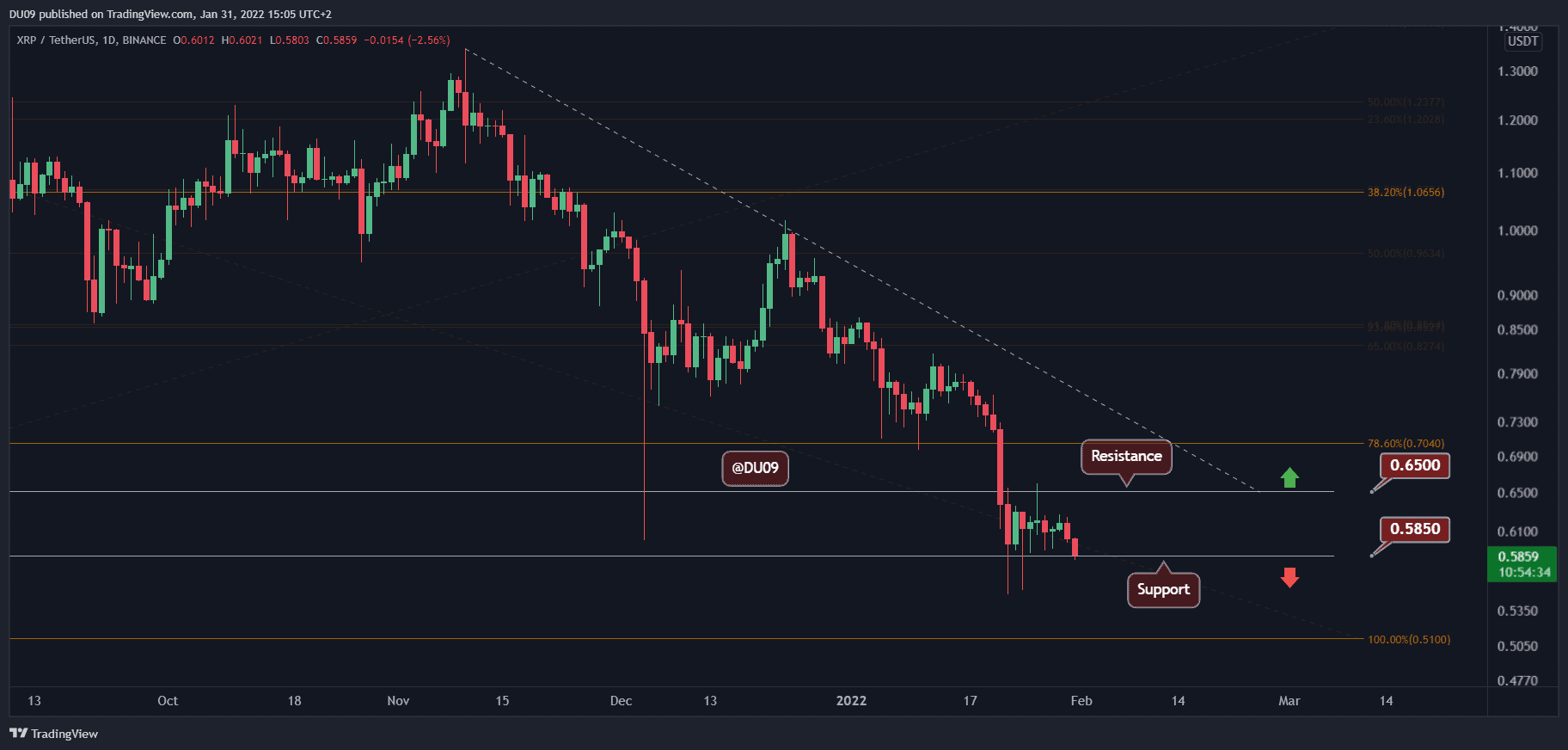

Ripple Price Analysis: XRP Facing Crucial Support Level As Bears in Control

XRP failed to push higher despite a temp recovery and dropped back towards the key support.

Key Support levels: $0.58, $0.50

Key Resistance level: $0.65, $0.70

XRP is facing once again the critical support level at $0.58 after the price broke down from its consolidation phase over the past few days.

This drop was followed by low volume; however, any weakness here may trigger a further breakdown. The resistance sits at $0.65 and is unlikely to be tested sometime over the next few days.

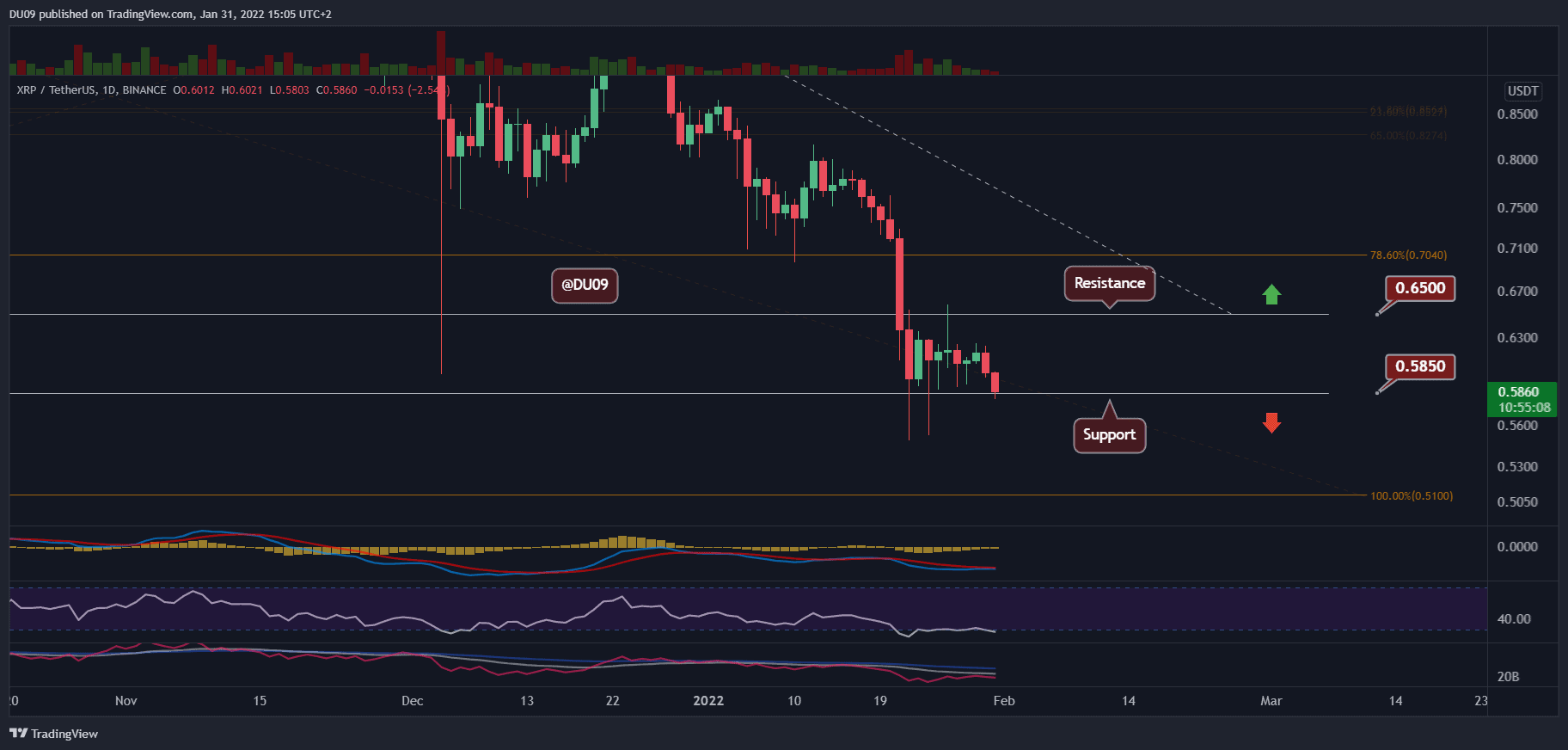

Technical Indicators

Trading Volume: XRP suffers from a minimal amount of volume, and buyers have been unable to move XRP’s price higher. Volume has also been declining since the sell-off on January 22.

RSI: With this latest drop in price, the daily RSI fell into the oversold area, and this shows weakness in the price action.

MACD: The daily MACD is bearish, and now the moving averages and histogram are expanding. This indicates on a bearish price action.

Bias

The current XRP bias is bearish, as indicators show weakness and bears appear to have the upper hand and control of the market.

Short-Term Prediction for XRP Price

After some hesitation and consolidation in a tight range, XRP fell back to the critical support at $0.58. If buyers cannot keep XRP above this key level, then XRP will likely fall to $0.50 where buyers may show more strength. At the time of this post, the momentum favors sellers.