Ripple Price Analysis: This is The XRP’s Next Target If Bearish Sentiment Continues

The bears managed to push XRP’s price below the key support at $0.33 after a month of a sideways trend. This level has been crucial in maintaining Ripple’s price since mid-2019.

Technical Analysis

Technical Analysis By Grizzly

The Daily Chart

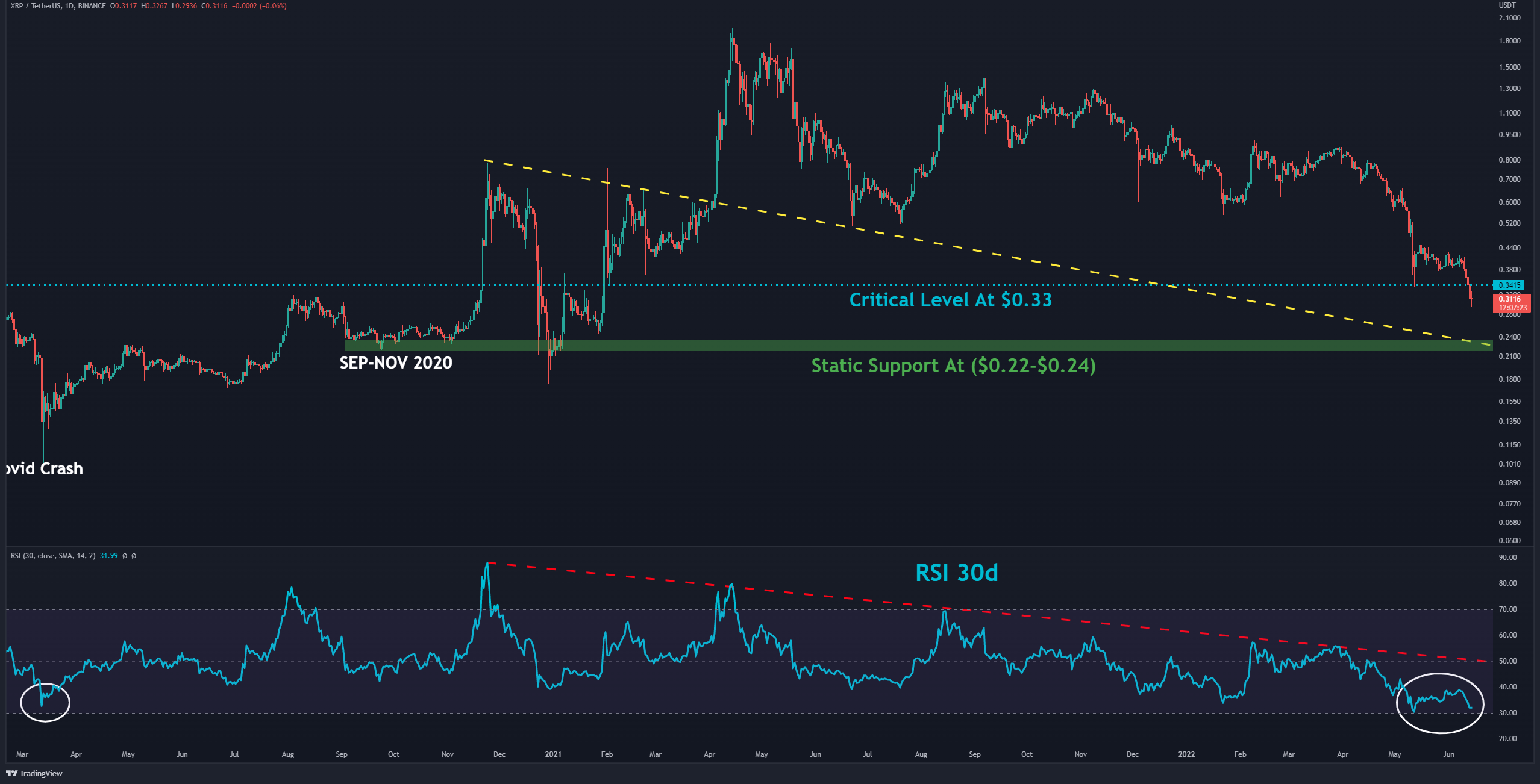

On the daily timeframe, Ripple has lost about 28% of its value in the past seven days. By the time of this writing, the daily candle indicates that the bearish momentum is probably slightly weakened. But that’s not necessarily because a bullish reversal is nearby.

In the bearish case, Ripple will likely slide down to the intersection between the dynamic support (marked yellow) and the horizontal support (marked green) at $0.24. This level has not been tested since late 2020 and early 2021, and it should be considered a strong PRZ (potential reversal zone).

On the other hand, a bullish reversal scenario will be confirmed in case of consolidation above the resistance at $0.5. The mission seems complicated.

In addition, RSI 30-day indicator has reached its lowest level since the COVID crash of March 2020. The descending line (marked red) is the dynamic resistance Ripple must break to confirm a short-term reversal.

Key Support Levels: $0.24 & $0.17

Key Resistance Levels: $0.33 & $0.46

Moving Averages:

MA20: $0.38

MA50: $0.45

MA100: $0.62

MA200: $0.70

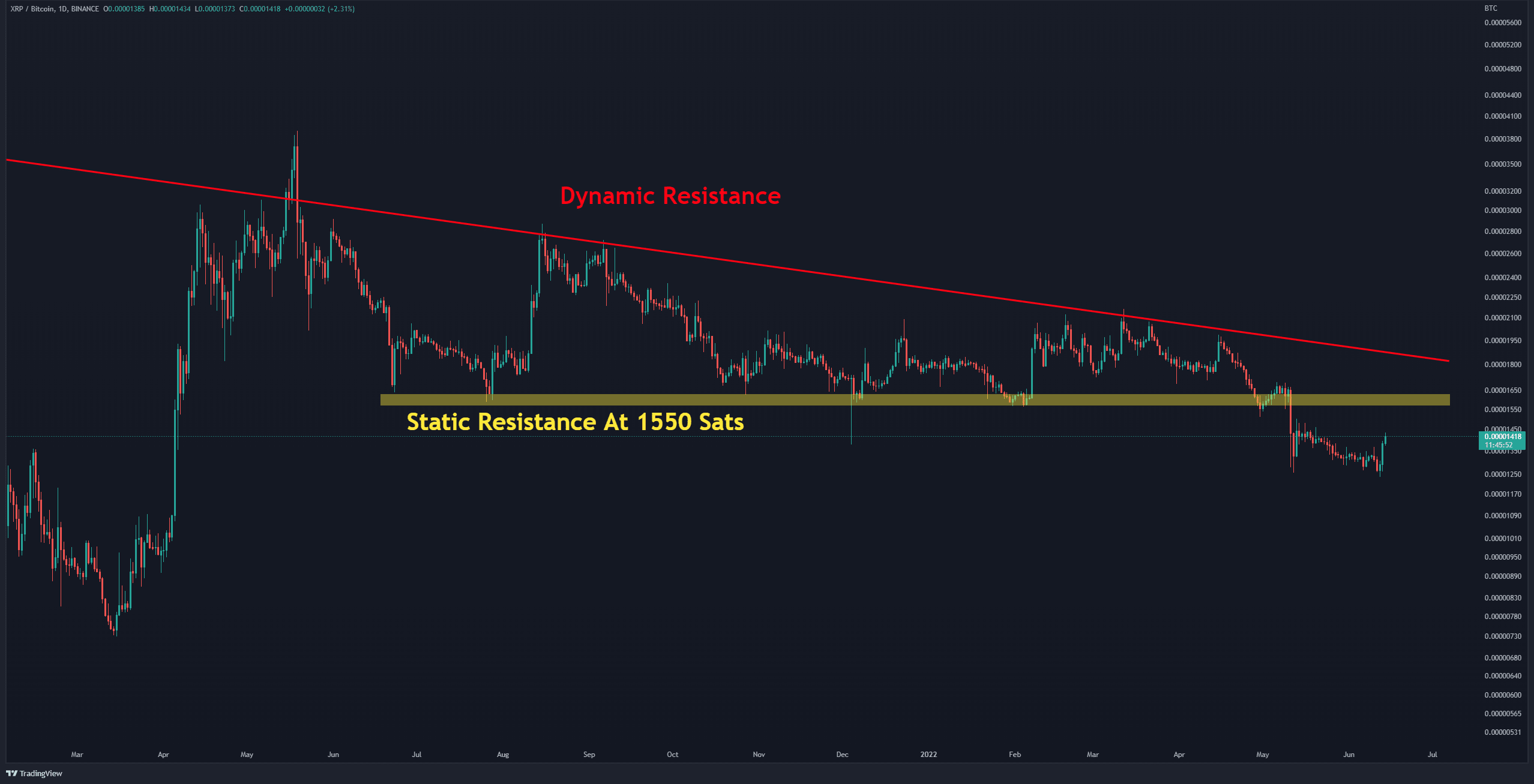

The XRP/BTC Chart

In the BTC pair chart, XRP has increased 14% against Bitcoin in the last three days. However, this should be taken with a grain of salt unless XRP can consolidate on top of the static resistance at 1500 Sats (marked yellow).

In this case, an uptrend can be considered a pullback to retest support turned resistance levels.

Key Support Levels: 1250 Sats & 1100 Sats

Key Resistance Levels: 1550 Sats & 1700 Sats