Ripple Price Analysis Feb.16: XRP Is Trading In Consolidation – Waiting For a Decision

Ripple has seen a small price decrease over the previous week, down to around $0.30, at the time of writing. The market has now lost a further 7.5% over the past month as XRP/USD trades within a symmetrical triangle pattern.

After losing the second place, Ripple is currently ranked as the third largest crypto as it holds a $12.45 billion market cap value.

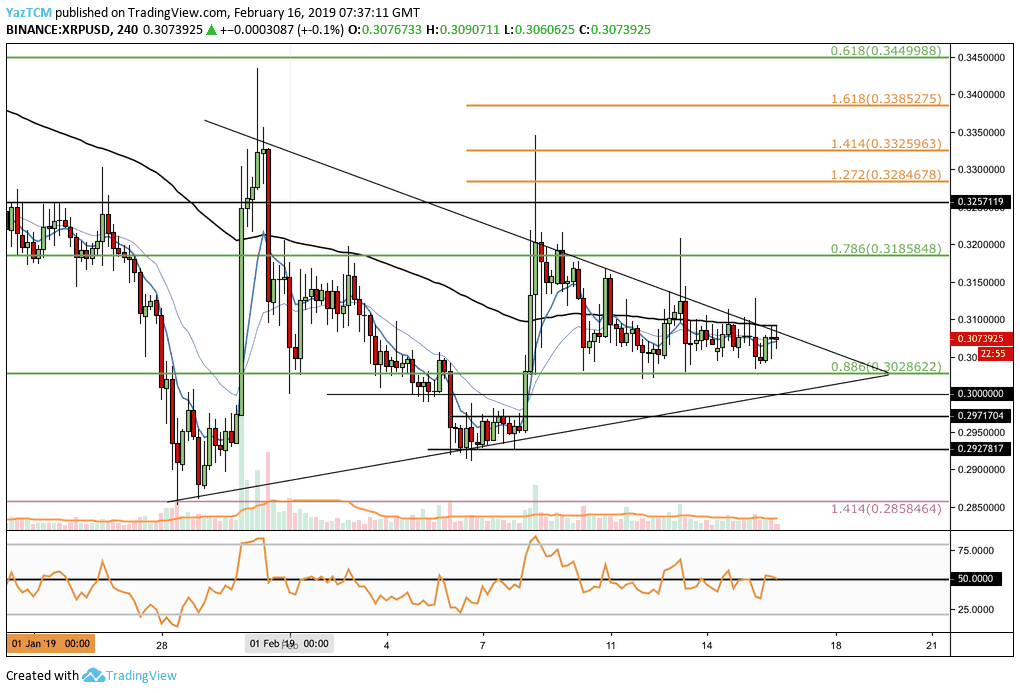

Looking at the XRP/USD 4-hour Chart

- We can see that XRP/USD is trapped within the symmetrical triangle, as mentioned, while the coin trades in a consolidation, following Bitcoin.

- A break above or below the triangle will determine the next direction for XRP’s short-term future.

- From Below: The nearest support is located at the short term .886 Fibonacci Retracement level (marked in green) at $0.30, followed by support at the lower boundary of the triangle.

- Support beneath the triangle is located at $0.2971 and $0.2927. This is followed with support at the medium term downside 1.414 Fibonacci Extension level (marked in lilac) priced at $0.2858. This level is the 2018 and 2019 price low for XRP.

- From Above; initial resistance is the upper boundary of the triangle, followed by resistance level at the short term .786 Fibonacci Retracement (marked in green).

- Further resistance lies at $0.3257, followed by resistance at the short term 1.272 ($0.3284), 1.414 ($0.3325) and 1.618 ($0.3385) Fibonacci Extension levels (marked in orange).

- The 4-hour chart’s RSI indicator remains around the 50 level which indicates the indecision of the XRP market.

- The volume remains steady and not significant.

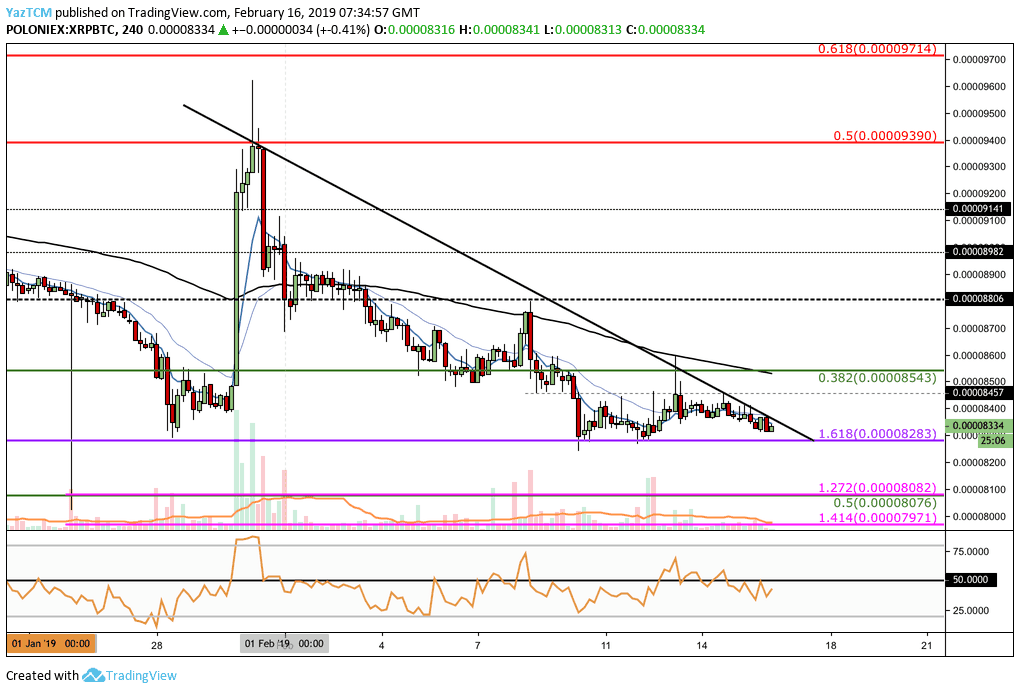

Looking at the XRP/BTC 1-Day Chart

- XRP/BTC has also formed a descending triangle pattern as the market consolidates.

- Price action is approaching the end of the pattern where a breakout is expected either to the upside or downside to determine the next short-term trend.

- From below: The nearest support is located at the lower boundary of the triangle at the 8283 SAT level.

- Support beneath can then be found at 8200 SAT followed by more significant support at the short term downside 1.272 (8000 – 8082 SAT) and 1.414 (7971 SAT) Fibonacci Extension levels (marked in pink).

- From above: The nearest resistance lies at the upper boundary of the triangle. This is followed with resistance at the 8457 SAT level and the short-term .382 Fibonacci retracement level (marked in green) at 8543 SAT.

- Further significant resistance is then expected at 8806 SAT, 8982 SAT, and 9141 SAT.

- The 4-hour chart’s RSI has slipped below the 50 area which indicates that the bears have the momentum of the XRP-BTC market. However, the RSI is battling back toward the 50 levels.

- The volume remains steady.

The post Ripple Price Analysis Feb.16: XRP Is Trading In Consolidation – Waiting For a Decision appeared first on CryptoPotato.