Ripple Joins ISO Global Standards Body on Cross-Border Payments

Ripple claims to be the first DLT-focused member of the global ISO 20022 standards body, driving international standards for interoperability between financial institutions.

Ripple has become a member of the ISO 20022 standards body, which is driving a new data standard for payments and data messaging between global financial institutions.

The company claims to be the first distributed ledger technology (DLT) focused member of the group, which includes a number of international commercial and central banks along with payment processing entities like SWIFT and Visa.

The route to an international standard

ISO 20022 proposes a single standardized approach in methodology, process and repository to enable communication and interoperability between all global financial organizations.

While convergence into a single standard is the long-term objective, in the interim several existing legacy standards need to co-exist and share information. ISO takes common data points from the models of individual institutions and groups them into a standardized format, which can be shared between systems.

The standard has already been adopted in 70 countries, and it is estimated that by 2023, 87% of global financial transactions will be supported by ISO 20022.

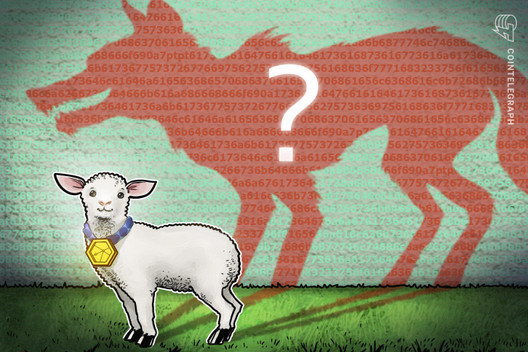

Is Ripple crypto’s Jekyll and Hyde?

Ripple’s membership of the standards body marks a further validation of cryptocurrency and DLT in the world of traditional finance. It also allows Ripple and its customers to have a say in the future direction of cross-border payments.

Adherence to the ISO 20022 standard also simplifies counterparty connections and reduces associated costs.

Ripple seems to be constantly walking a fine line between respectability and suspicion in the eyes of the public.

As Cointelegraph has recently reported, for every new high profile partnership there is a market dilution of XRP by Ripple or its former executives, along with ongoing allegations of XRP being an unlicensed securities sale.