Ripple Closes Second-Worts Weekly Candle Since May, What’s Next? (XRP Price Analysis)

A very disheartening week in the crypto market has come to a close. Ripple saw its second-worst weekly candle since May and dropped more than a third of its market value over the last week.

Technical Analysis

By Grizzly

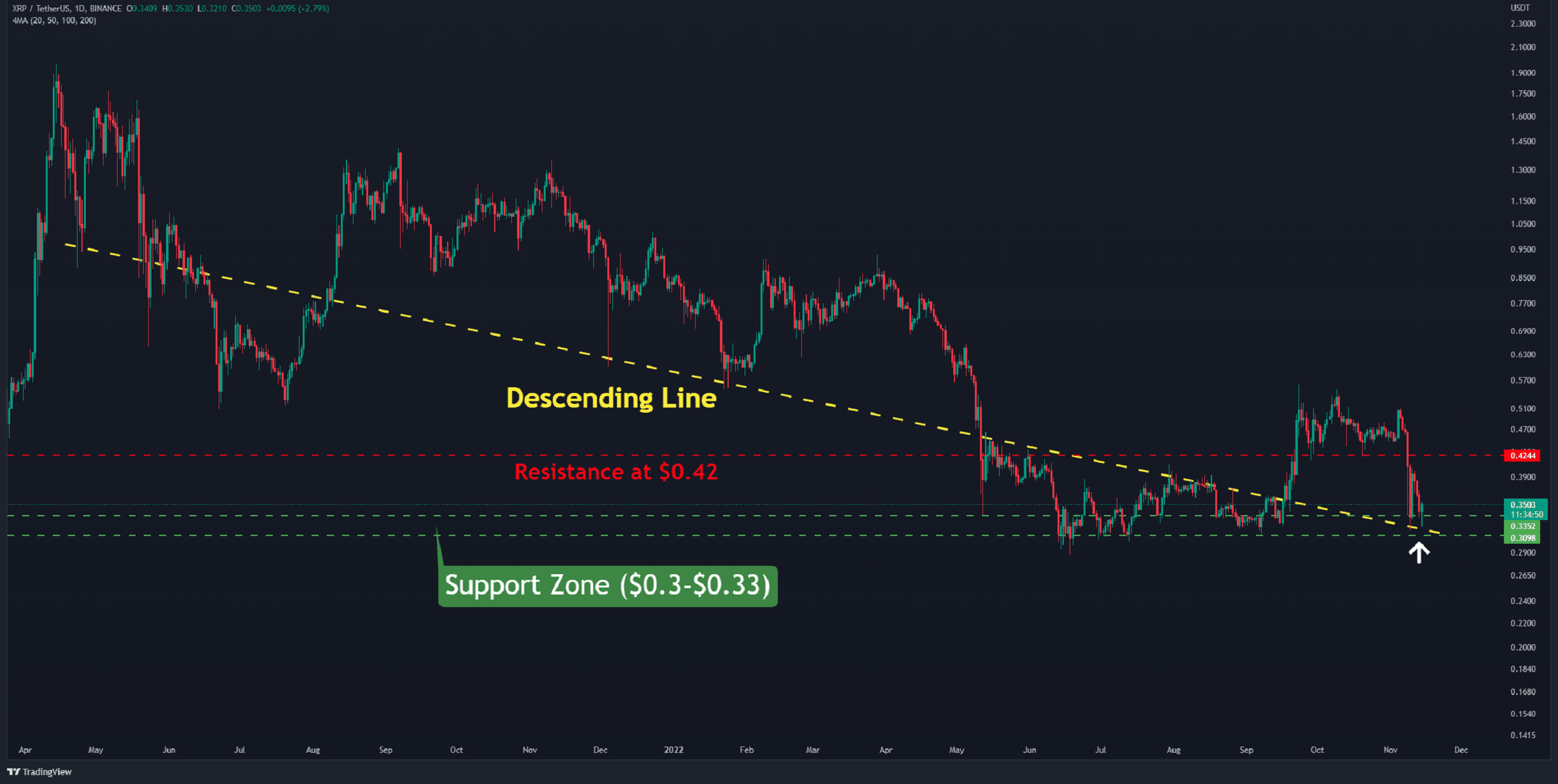

The Daily Chart

On the daily chart, the negative momentum slowed marginally as the asset approached the support zone in the $0.3 to $0.33 region (in green). However, this cannot be considered the end of the downward spiral.

After 50 days, XRP hit the descending line (in yellow), which now serves as support. If the pair closes below this level, the price is anticipated to fall to around $0.24- something it has not seen since January 2021. Until the price can reclaim resistance at $0.42 (in red), it is premature to talk about the end of the downtrend.

A break and close below $0.30 would likely be accompanied by heightened selling pressure. In this circumstance, a prolonged bear market becomes very likely.

Moving Averages:

MA20: $0.43

MA50: $0.46

MA100: $0.41

MA200: $0.40

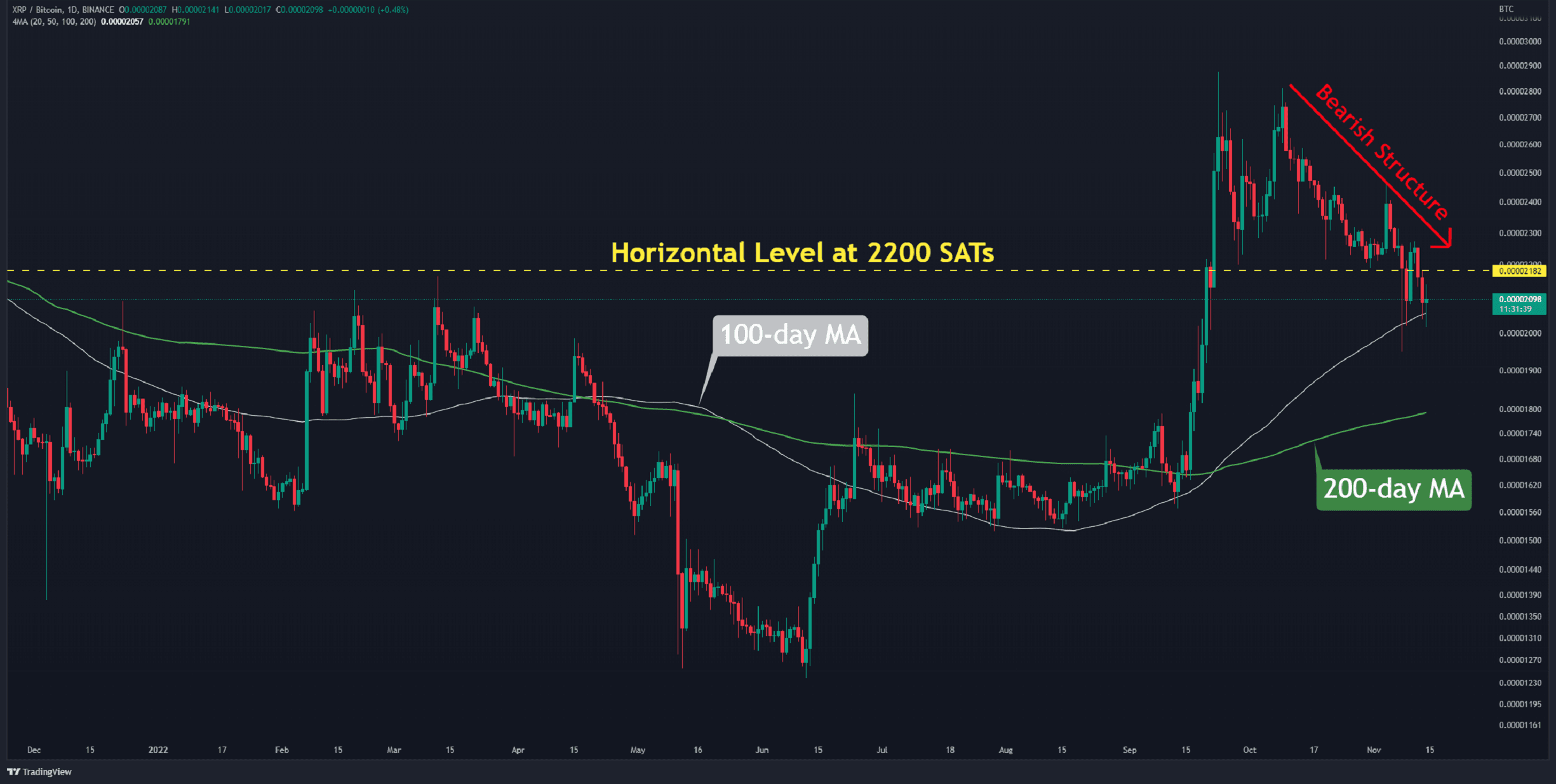

The XRP/BTC Chart

Against Bitcoin, the chart clearly shows a bearish pattern. The pair breached the horizontal level at 2200 SATs (in yellow), resulting in lower highs and lower lows.

The 100-day moving average (in white) is currently functioning as support, preventing additional dips. However, there is no evidence of the downward trend slowing.

If the price continues to fall, the next level of support will be around 1800 SATs, which coincides with the 200-day moving average (in green).

Key Support Levels: 2000 SATS, 1800 SATs

Key Resistance Levels: 2200 SATs, 2500 SATs

The post Ripple Closes Second-Worts Weekly Candle Since May, What’s Next? (XRP Price Analysis) appeared first on CryptoPotato.