Ripio Rolls Out Crypto-Powered Loans Across Latin America

Here’s something you don’t see every day: an ICO that has actually led to a shipped, working financial product.

Revealed exclusively to CoinDesk, Argentinian startup Ripio is making peer-to-peer microloans available today to all its 200,000 bitcoin wallet users in Argentina, Mexico, and Brazil. The Buenos Aires-based company raised $37 million in an initial coin offering (ICO) last year to build the Ripio Credit Network, which matches individual lenders and borrowers across the globe through ethereum smart contracts.

Today’s full rollout of that marketplace follows a closed beta in which more than 800 loans were facilitated to customers in Argentina. Ripio said it now has 3,000 lenders on the network, many of them located in Asia, issuing loans for up to $730, though so far the average loan size is $146.

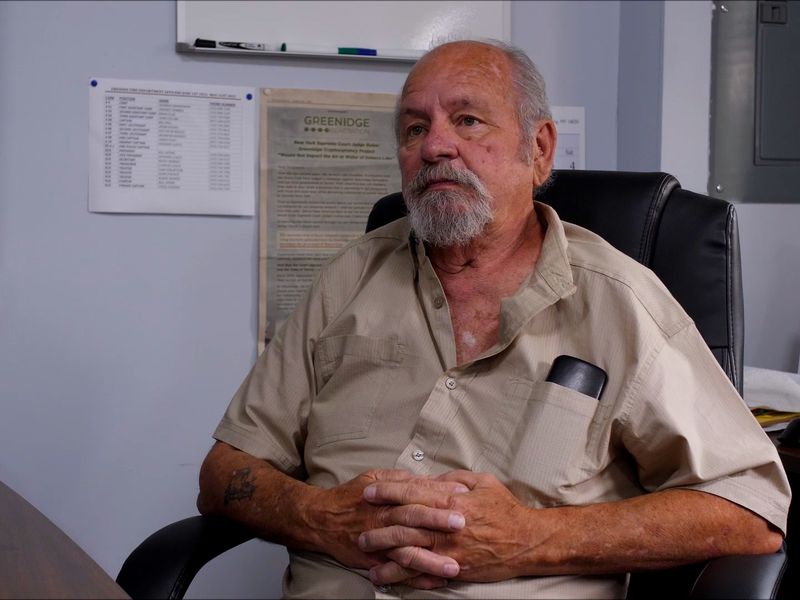

Ripio CEO Sebastian Serrano told CoinDesk:

“We have people from Asia funding people in South America, which is something you cannot do with another [app].”

Previously known as Bitpagos, Ripio is one of the longest-running startups in the crypto space, with well-established merchant processing, exchange and wallet services. It entered the credit business in 2016, lending its own funds to consumers in Argentina, before pursuing this more ambitious vision for global p2p lending.

While the borrowers receive their loans in fiat, the new network is powered by an ethereum-based token called RCN. Lenders send the funds in RCN, a cut of the tokens goes to third parties involved in the lending process – such as identity verifiers, credit scorers and co-signers of the loans – and Ripio (and, potentially, other wallet providers) converts the RCN to fiat before disbursing the money to the borrower.

Unlike most exchanges and mobile lending services, Ripio’s offerings are available to unbanked crypto users. This is essential for Latin American markets where people have diverse but overwhelmingly complicated histories with the banking industry. For example, according to World Bank statistics from 2017, around 30 percent of adults in Brazil are unbanked, compared to 54 percent in Colombia.

Although the startup doesn’t have data on how many unbanked users are on its platform, a survey of 1,000 Ripio users revealed 19 percent didn’t have a credit card. They often fund their wallets by depositing cash at convenience stores that partner with Ripio.

With the credit network, however, they now have a way to build a track record of repaying debts, which could help them obtain financial services in the future. Further, “the entire lifecycle of the credit and the loan” is contained in the smart contract on the blockchain, Serrano said.

“It gives the user credit history. Even if the marketplace disappears the code will continue to execute,” he said.

To make credit histories recorded in smart contracts widely useful, Ripio has proposed a standardized way to present claims about an identity (e.g. “Joe made all his car loan payments on time”) on ethereum. Serrano explained:

“In order for it to work across products and networks, ethereum needs to get a standard for identity claims so that every project uses one or two claim standards, kind of like we have ERC-20 [for tokens].”

Cross-border markets

Over the next year, Ripio plans to expand services to Chile, Colombia, and Uruguay.

“Every market has these different characteristics, regulations, things you have to comply with,” Serrano told CoinDesk, “Things you have to do to make it easy for users to deposit cash.”

Political instability can create roadblocks, however. For example, Ripio once operated in Venezuela and still maintains staff there, but security concerns and opaque regulations forced the startup to halt operations.

“We hope to extend service there as soon as this madness ends,” Serrano said. “It’s become very, very difficult to maintain operations in Venezuela, legally.”

In order to expand, Ripio is looking for more fiat-centric partnerships like the ones it established in Brazil with Neon Bank and Banrisul. Since users are handing over cash, Ripio needs banks for storage. Plus, expanding such partnerships in each nation could provide crucial liquidity.

Santiago Siri, the Argentinian founder of a blockchain governance project called Democracy Earth, told CoinDesk that Ripio’s partnerships are already making an impact across the continent.

For example, through its partnership with the e-commerce giant Mercado Libre, shoppers and sellers can transfer funds between their e-commerce accounts and Ripio wallets, offering new avenues for people to earn or spend crypto.

“Large populations in countries like Brazil and Mexico are unbanked,” Siri said. “So companies like Mercado Libre have to find ways to do business without credit cards. Ripio has been leading this, allowing people to do payments [indirectly] with bitcoin.”

Serrano said 15 percent of Ripio wallets’ transaction volume, millions of dollars per month, now comes from Mercado Libre. Rosine Kadamani, the founder of the educational Blockchain Academy in Brazil, praised this partnership with the largest e-commerce platform in the region, as well as Ripio’s crypto-powered loans, saying:

“When we’re trying to get people in the crypto space, it’s a good strategy to reach people where they are already comfortable… Why not provide a space for peer-to-peer loans? I see no reason at all for credit to be monopolized by banks.”

Speaking to the demand for such cross-border conduits, Siri added: “Latin America is a very fertile region for the deployment of cryptocurrency infrastructures.”

Sebastian Serrano image courtesy of Ripio

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.