RIGZ ETF Provides Exposure To The Infrastructure Underpinning Bitcoin

Viridi funds has announced the launch of RIGZ, the firm’s new clean energy Bitcoin mining ETF that goes beyond just miners.

According to a press release sent to Bitcoin Magazine, registered investment advisor and emerging fund manager Viridi Funds has announced today the launch of its Cleaner Energy Crypto-Mining & Semiconductor (RIGZ) exchange-traded fund (ETF).

Veridi said a growing number of investors are interested in gaining exposure to Bitcoin through regulated investment avenues while seeking “commitment to environmental sustainability.” The release claims investors can now grab such exposure through RIGZ, which began trading on July 20, 2021, in the New York Stock Exchange (NYSE).

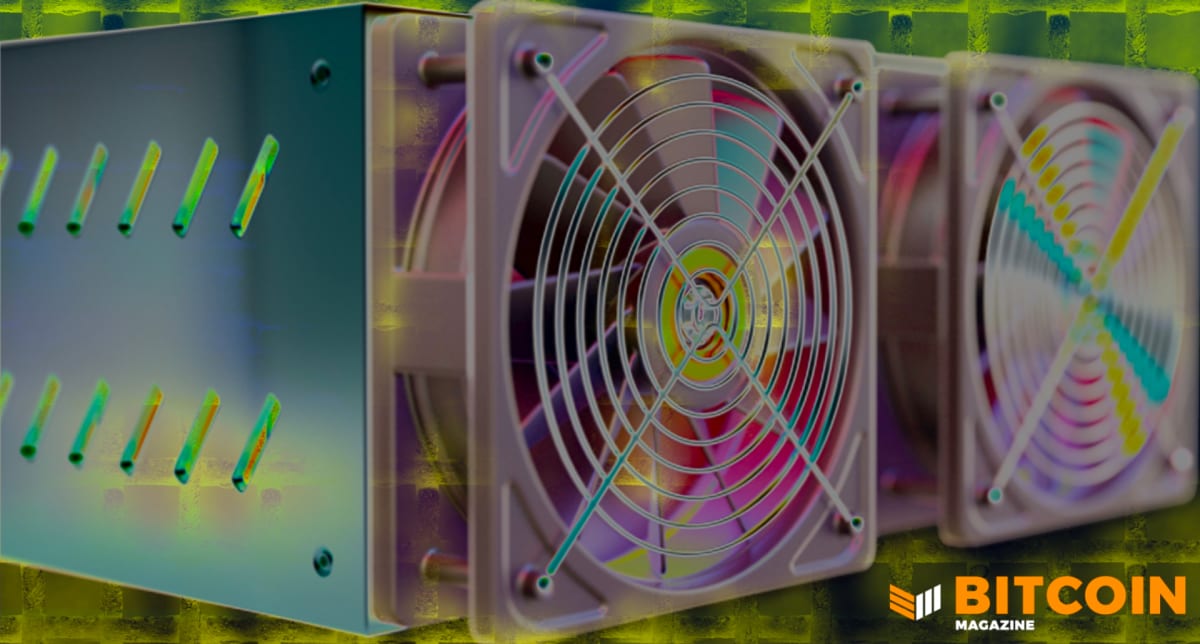

“Bitcoin mining is a sector that is particularly well suited to such an investment product as, according to recent figures, over 50% of North American bitcoin mining is done using renewable energy sources, which is a trend that Viridi hopes to encourage through products like RIGZ,” the release said.

However, RIGZ is not a bitcoin ETF –– it offers exposure to clean energy bitcoin mining and encompasses a broader range of related businesses. Viridi CEO Wes Fulford explained in a video how the fundamental value proposition of their ETF is actually to “invest in the infrastructure that underpins the Bitcoin network.”

“We have expanded the portfolio allocation to further down the value chain [to] some of the semiconductor companies and the manufacturers of equipment themselves,” Fulford said. “We want to be a niche…infrastructure offering…targeting retail and institutional investors.”

Bitcoin exchange-traded funds have been all the buzz this year. But while countries like Canada and Brazil have already listed bitcoin ETFs in their stock exchanges, the U.S. is yet to see one approved by the Securities and Exchange Commission (SEC).

However, following unparalleled institutional bitcoin adoption levels seen in 2021, Bloomberg’s top ETF analyst claimed the SEC might capitulate soon. Additionally, the former chair of the Commodities Futures Trading Commission recently painted a positive picture for such an approval –– claiming it could benefit both investors and regulators.

And in the case of RIGZ, it can provide an alternative, more convenient avenue for investing in the physical infrastructure that powers the digital Bitcoin network –– from mining companies to rigs and semiconductors manufacturers. However, those who wish to reap the benefits of mining directly while contributing to network security can consider setting up some rigs in their own homes.