Retail Investors Bought More Bitcoins Than Institutions in Q1 2021, JPMorgan Says

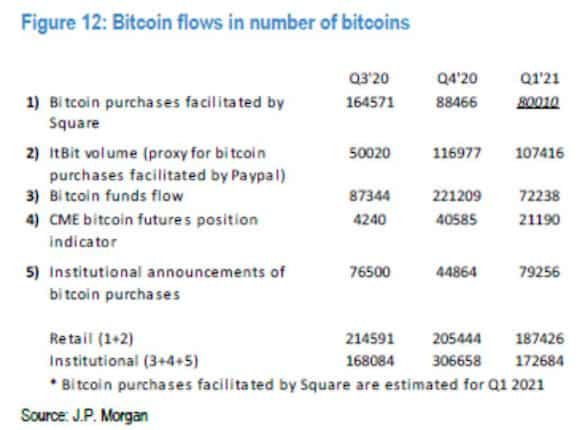

Retail investors have finally arrived at the bitcoin scene and have outbought institutions, claimed analysts from the giant multinational investment bank – JPMorgan Chase & Co. By analyzing data on popular retail-oriented brokerages, such as Square and PayPal, they concluded that smaller investors had bought nearly 190,000 bitcoins so far in this quarter.

Retail Has Arrived

The cryptocurrency community speculated for months if or when retail investors would come for BTC. After all, the digital asset initiated its bull run in October 2020, but it was mostly driven by institutions and large corporations.

Within those several months, bitcoin’s price expanded by roughly six-fold after massive purchases from the likes of MicroStrategy, Tesla, MassMutual, and more.

It almost felt certain that this impressive increase would eventually catch the eye of the average Joe and a report compiled by JPM analysts confirmed that retail has indeed started to accumulate larger portions of BTC in Q1 2021.

The strategists, led by Nikolaos Panigirtzoglou, concluded that smaller investors had used Square and PayPal to buy 187,000 bitcoins so far this quarter. At the same time, institutions have purchased 173,000 coins, while the number was over 300,000 in Q4 2020. They compiled these amounts by exploring BTC futures, fund flows, and company announcements.

Although the report admitted that this conclusion is “far from bulletproof,” it still suggests that “flows into bitcoin are becoming more balanced after institutions dominated late last year.”

Stimulus Checks Incoming Too?

The coverage also touched upon the possibility of US citizens buying more bitcoin with the latest stimulus checks sent by the government. After President Joe Biden signed the new relief bill earlier in March, the Internal Revenue Service (IRS) reported that people had started to receive their $1,400-worth checks as early as last Friday.

Interestingly, BTC’s price skyrocketed to a fresh ATH precisely over the weekend in a retail-driven rally, as explained by Galaxy Investment Partners’ Mike Novogratz.

Previously, the largest US-based crypto exchange, Coinbase, saw an uptick of deposits of $1,200 (the amount of the first stimulus checks) in mid-April 2020 – just a few days after residents received the funds.

“For many retail cryptocurrency traders, bitcoin was the bread-and-butter trade of the pandemic. Meme stock trading volatility burnt many, but Bitcoin has maintained an amazingly bullish trend that has made most winners. Retail traders got reinvigorated with the latest NFT buzz and as the stimulus checks hit their bank accounts.” – commented Ed Moya, a senior market analyst at Oanda Corp.