Retail Interest Soars as ‘Buy Crypto’ Google Searches Explode To New ATHs

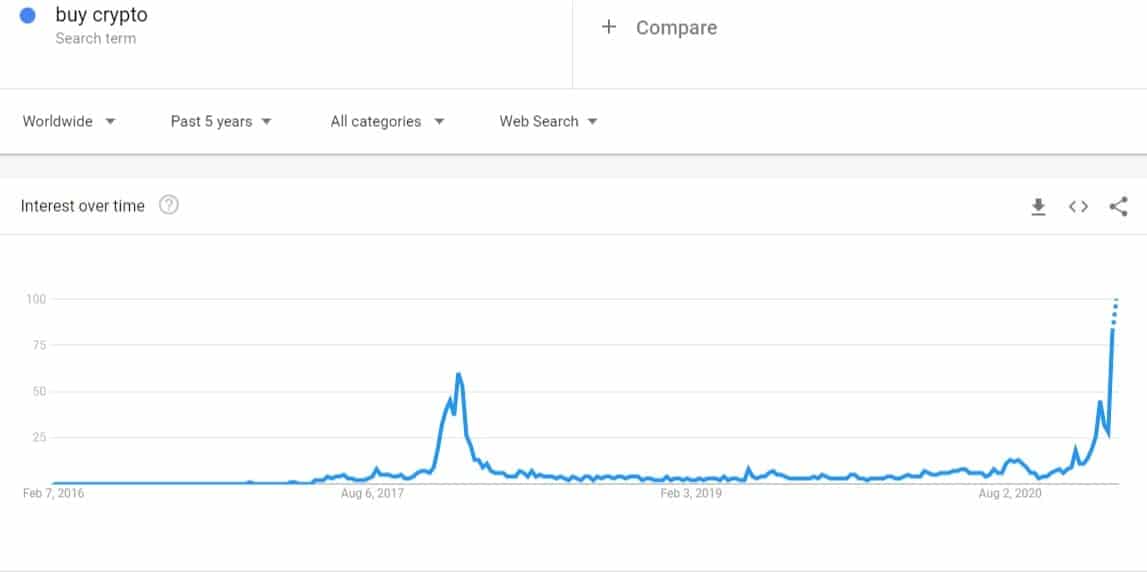

The booming popularity of the cryptocurrency industry has caught the attention of retail investors once again. Google trends data suggests that the number of worldwide searches of “buy crypto” has skyrocketed in recent weeks to new record levels.

Buy Crypto Goes Parabolic

The cryptocurrency market has enjoyed the past several months with some massive gains. Bitcoin led the charge from October to early January when it quadrupled its price to a new all-time high of $42,000.

While the primary digital asset stalled, some altcoins took the main stage. Coins such as Chainlink, Polkadot, Binance Coin, and most recently, Ethereum marched north and painted their respective new records.

It seems that these developments have finally caught the attention of retail investors. Google trends data is typically an accurate metric that exemplifies their behavior, and their interest has been surging in the past few weeks.

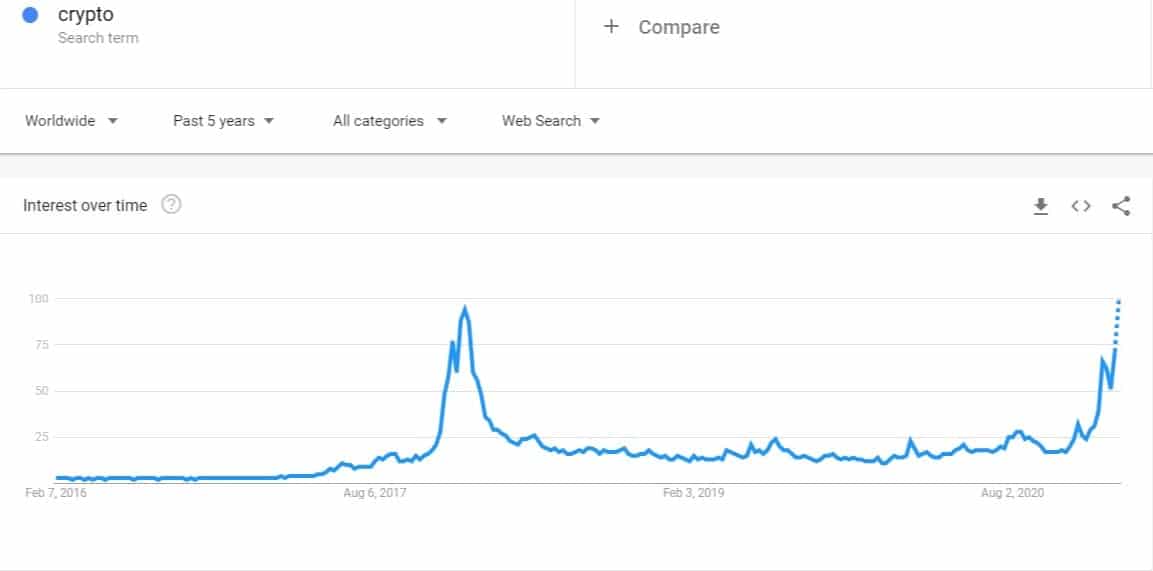

The worldwide Google searches for “buy crypto” reached its peak last week, and projections show that it will break the record this week as well. Similarly, the searches for just “crypto” are set to climb to a new record, as the graphs below demonstrate.

Is It Altseason Or DeFi?

It’s worth noting that while the “crypto” interest has surged in the past couple of weeks, the same cannot be said about the largest cryptocurrencies. The global bitcoin searches are still a long way from the record levels in 2017/2018, except for a few countries.

The Ethereum searches also saw ATHs recently but have declined in the following weeks – the same applies for Polkadot as well. Other altcoins, such as Litecoin, Bitcoin Cash, Chainlink, or Binance Coin, are also below their respective peaks. As such, the narrative of an ongoing altcoin season among retail investors doesn’t have much merit.

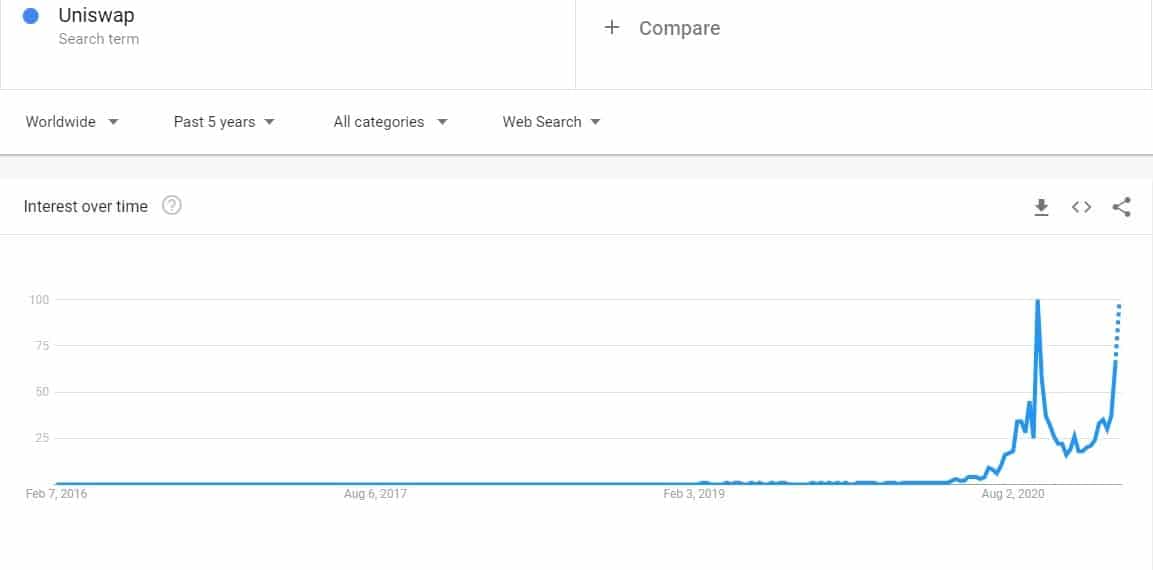

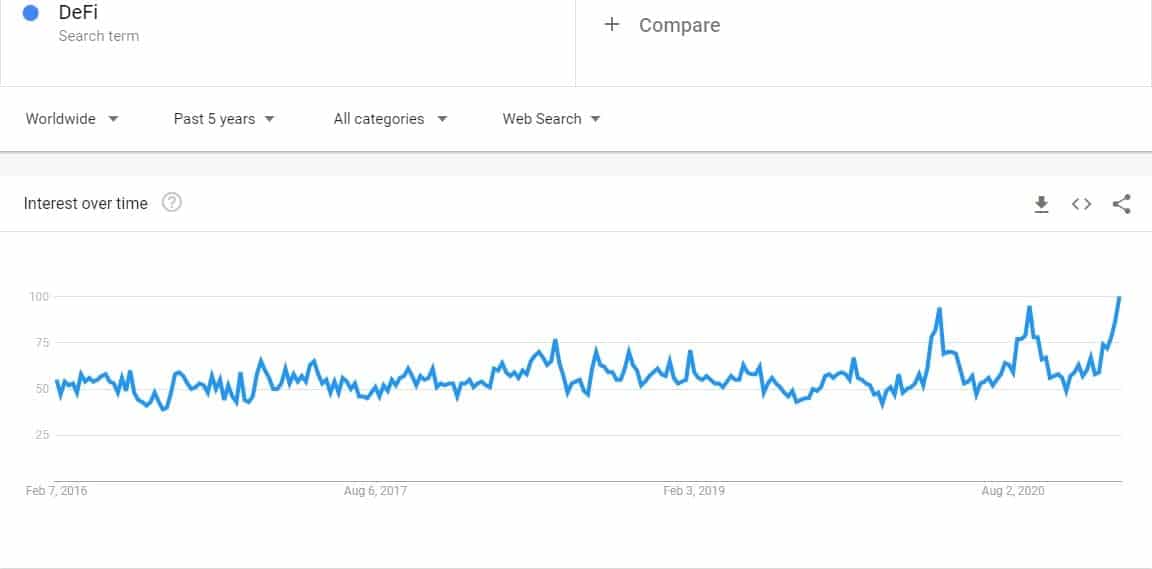

However, it could be more of a concentrated altseason to one particular field. Searches for decentralized finance (DeFi) have exploded to new highs. Furthermore, some of the most prominent representatives of the DeFi industry have also enjoyed a steady increase in retail interest.

Those include several decentralized exchanges, led by Uniswap, their respective native tokens, or other DeFi coins. As such, it might not be a surprise that the total value locked in various DeFi protocols has also increased lately to above $30 billion.