Retail Interest in Metaverse and NFTs at a 5-Month Low

Last year, Facebook rebranded its company name to Meta in a bid to pioneer the metaverse field, and ever since, this word has spread around like wildfire.

Non-fungible tokens (NFTs), on the other hand, were undoubtedly the hottest topic of 2021, and this trend seemingly carried through in 2022 as well.

Now, however, it appears that retail interest in both is fading.

Google Trends Data Alarming

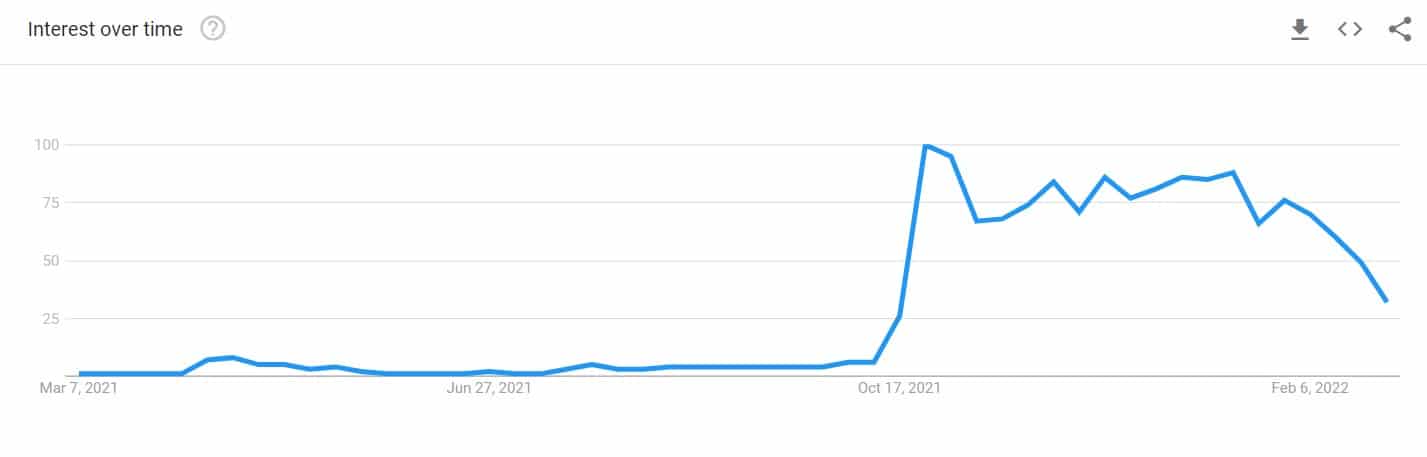

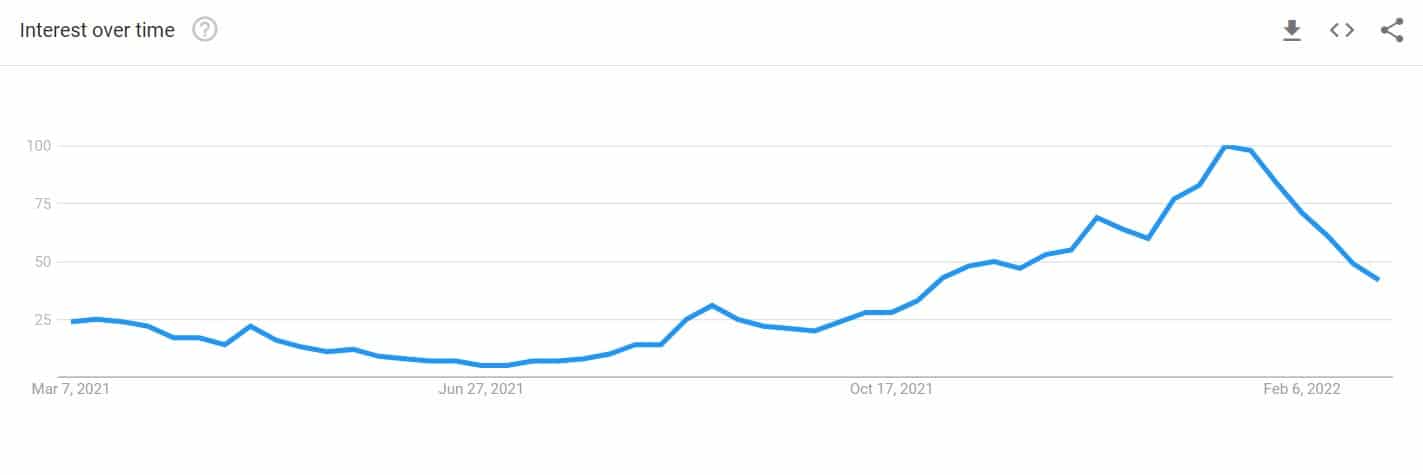

Data from Google Trends is usually a good way to gauge the retail interest in certain topics. In this case, we take a closer look at the one-year chart of the Google search volume for the keywords “metaverse” and “NFT” on a worldwide scale.

This is what the metaverse searches chart looks like:

This is the same chart adjusted for the NFT keyword:

It’s evident that the interest has returned to what it was back in October last year, before the winter hype that saw many collections peak in terms of their floor price.

NFT Trading Volume on the Decline

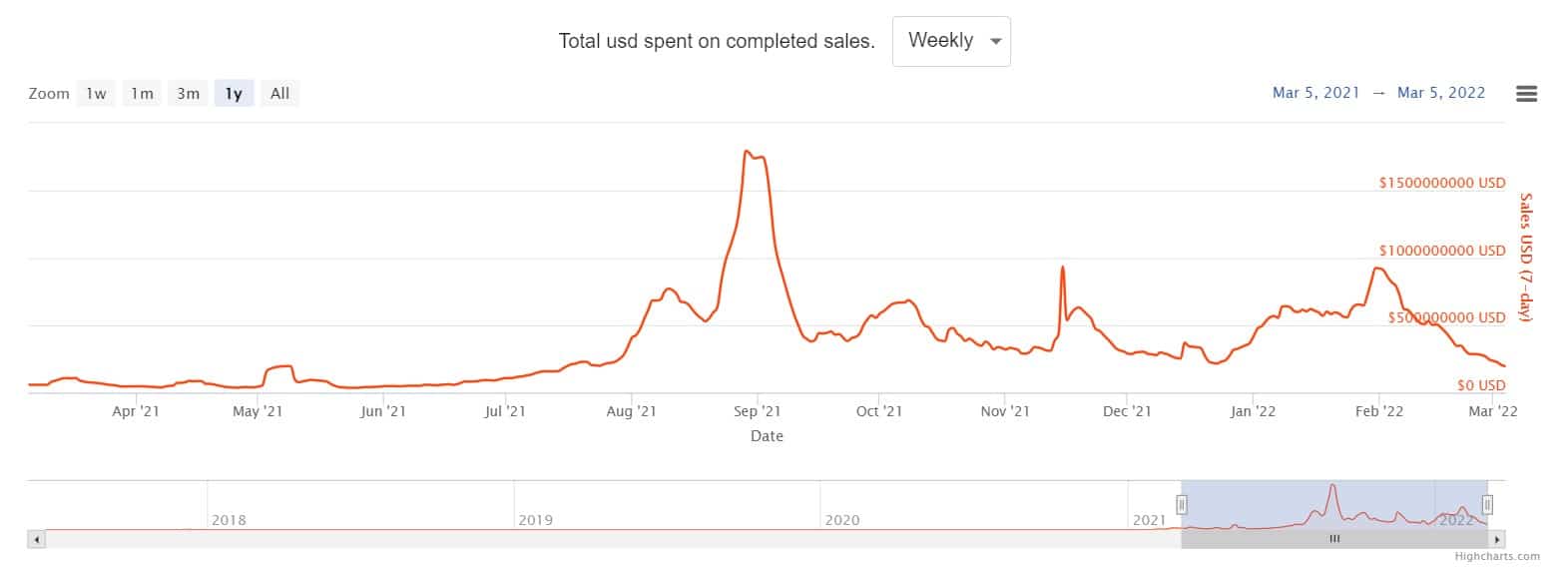

Search data on its own can hardly be used to gauge the interest, but the overall NFT trading volume most definitely supports the above.

According to NonFungible – a popular NFT resource – the weekly volume has been declining steadily for quite some time now.

It’s also worth noting, though, that retail interest in the cryptocurrency industry, in general, has been somewhat declining as of late, which has also translated to measurably lower trading volumes across the board. This, of course, has its exceptions.

As CryptoPotato reported recently, BTC trading volumes in Ukraine and Russia soared last week because of the ongoing war between both countries. This has given many Bitcoin proponents the opportunity to emphasize the cryptocurrency’s status as an uncorrelated asset.