Restaking Protocol Ether.fi Selects Scroll as Layer-2 Network for Settlement

-

Ether.fi is rolling out a credit card using Scroll’s zero-knowledge technology for settlement.

-

The restaking firm will also move into lending and borrowing markets.

-

TVL has increased on Ether.fi over the past month despite outflows across the sector.

02:24

U.S. Added 142K Jobs in August; UK Crypto Companies Struggle With Licensing

00:55

Pastel Network Co-Founder on ‘Resurgence’ in the Solana Ecosystem

00:43

Is the U.S. Election Impact on Crypto ‘Oversold’?

15:25

Understanding September’s Market Volatility

Ether.fi said it selected the Scroll blockchain as a settlement layer, allowing the restaking protocol to start operating its planned credit card and introduce a market for lending and borrowing.

Scroll is a layer-2 blockchain that uses zero-knowledge (ZK) technology. Its mainnet started operating in October and has secured $676 million in total value locked (TVL), up from $556 million since Aug. 5, data from DefiLlama shows.

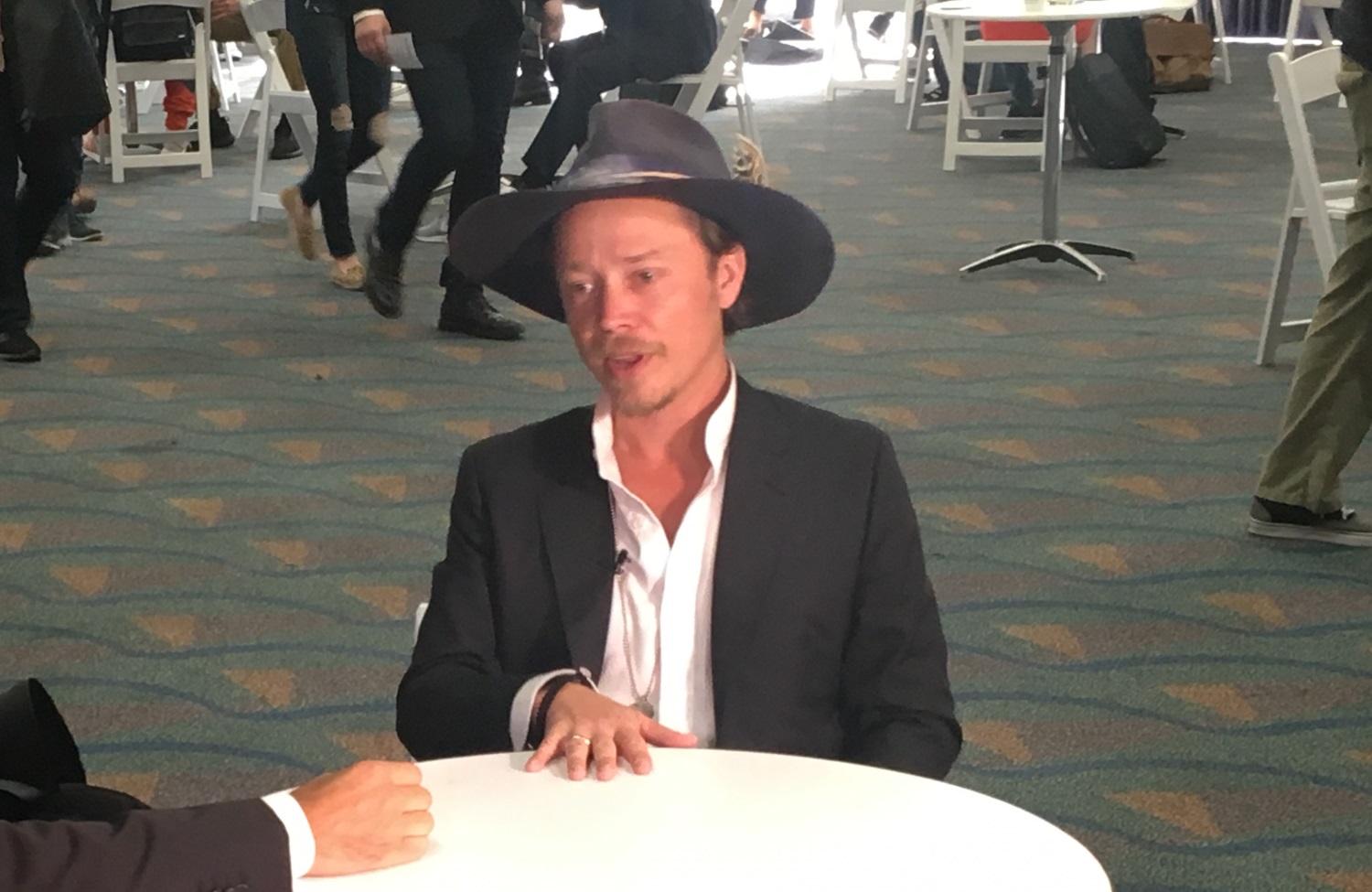

Ether.fi CEO Mike Silagadze told CoinDesk he believes the card, named ether.fi Cash, will bring “billions in TVL” to Scroll and make it the leading layer-2 network. The deal means cardholders will be able to use crypto as collateral and borrow against it for purchases before automatically paying the balance with native yields.

Transactions on the card will be “gasless” – meaning there will be no fee to pay – due to Scroll’s zk-rollup technology, which drastically reduces costs when sending or staking assets. Data from Scrollscan shows that average gas fees are around 0.09 gwei ($0.005) compared with Ethereum’s average of 32.8 gwei.

Ether.fi is one of the largest restaking protocols. It has $5.7 billion in TVL, an increase of 12% over the past month, which contrasts with the wider restaking sector. EigenLayer’s TVL has dropped by $5 billion since July 30.

Restaking protocols are designed to give investors additional yield on top of the native yield native ether (ETH) staking provides. The entire market is worth around $24 billion.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)