Research Shows Majority of Pepe Investors Caught in High-Stakes Game of Musical Chairs

The majority of Pepecoin (PEPE) investors were left playing a game of musical chairs as early participants made the bulk of gains, new research from SingularityDAO shows.

The early profit taking has drained the token of substantial liquidity, leaving majority of investors unable to make meaningful profits, the report adss.

Over 80% of potential profits were accrued in the first week of pepecoin’s issuance, when the ‘Pepe the Frog’ themed meme coins went from a market capitalization of low five figures to $33 million in just over a week.

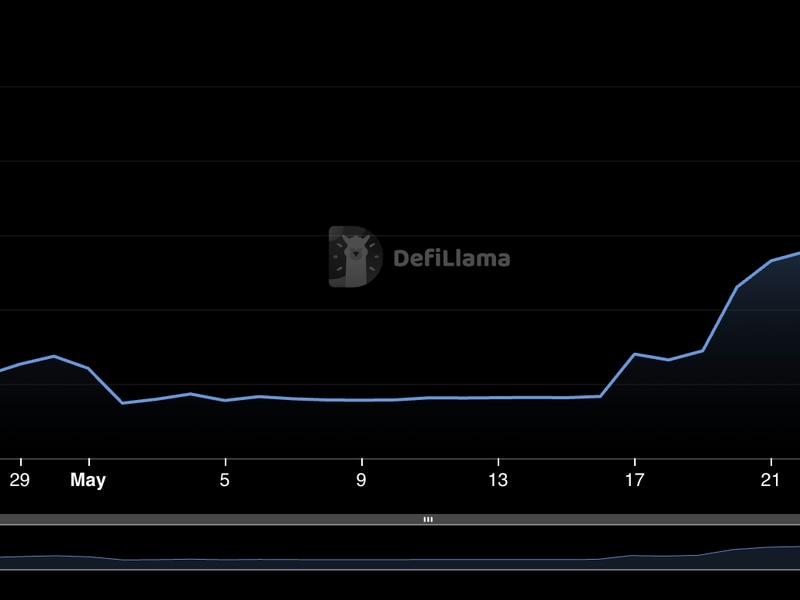

The tokens since ran to a peak market capitalization of $1.8 billion in mid-May, seeing trading volumes surpass those of dogecoin (DOGE) and shiba inu (SHIB) – which are otherwise the biggest meme coins by trading volume.

Some analysts have repeatedly rang the alarm bells around the early activity of pepecoin traders as well as the absence of retail traders. The major risk has been too many tokens in too few hands, leaving the price action dependent on a few investors. PEPE prices have dropped 73% since their May peak, CoinGecko data shows, and available liquidity remains a persistent concern.

“The limited amount of net liquidity is creating a high-stakes game of music chairs,” shared Rafe Tariq, Senior Quant at SingularityDAO in the research note. “Everyday investors are being lured in with the hopes of big profits but the reality is that a small percentage of investors will walk away with profit, while everyone else will get burnt.”

SingularityDAO also found that a small number of large-scale investors, known as “whales”, hold up to approximately 25% of PEPE, while other large investors hold up 46% of the currently circulating supply.

“This means that a minority of investors hold a high degree of influence over the coin’s price, creating an even more risky investing environment for hopeful traders,” Tariq added, indicating that the majority of investors had “already missed the opportunity to gain huge profits before even investing in the coin.”

“What appeared to be an exciting opportunity to make a quick buck on the surface was nothing more than false hope for the average individual,” Tariq concluded.

Edited by Parikshit Mishra.