Report: Whales Depositing Bitcoin to Exchanges As BTC Price Tumbled $4000 In Hours

Although bitcoin has retraced following its all-time high of $42,000 earlier this year, CryptoQuant’s CEO predicted further bearish price developments for the asset. He based his short-term prediction on the growing number of BTC whales depositing on various cryptocurrency exchanges.

Whales Prepare To Dump On Coinbase?

Ever since BTC skyrocketed to its newest ATH of $42,000 in early January, the cryptocurrency has failed to maintain its advance. Just the opposite, bitcoin dipped on a few occasions beneath $35,000 – where it’s situated at the time of this writing as well.

Furthermore, Ki-Young Ju, the CEO of the crypto analytics platform CryptoQuant, envisions more short-term price slumps for the primary cryptocurrency.

He touched upon the behavior of BTC whales – wallets containing at least 1,000 coins. Ju said that such accounts have started to deposit substantial quantities of bitcoins to digital asset trading venues.

The graph above illustrates that the so-called “whale ratio for all exchanges” has jumped into a “bearish / sideways” position. The ratio is compiled by dividing the top 10 transactions by the total inflows.

It typically stays below 0.85 during a bull market, but it has increased to about 0.87. The last time the ratio was at a similar level was in early January when BTC painted its then ATH of $35,000. However, the cryptocurrency indeed slipped by more than $5,000 in the following hours to below $30,000.

Nevertheless, Ju said that he is still bullish on bitcoin for the long run as he had “no doubt it will hit $100,000 this year.”

Crypto Twitter Also Bearish On BTC

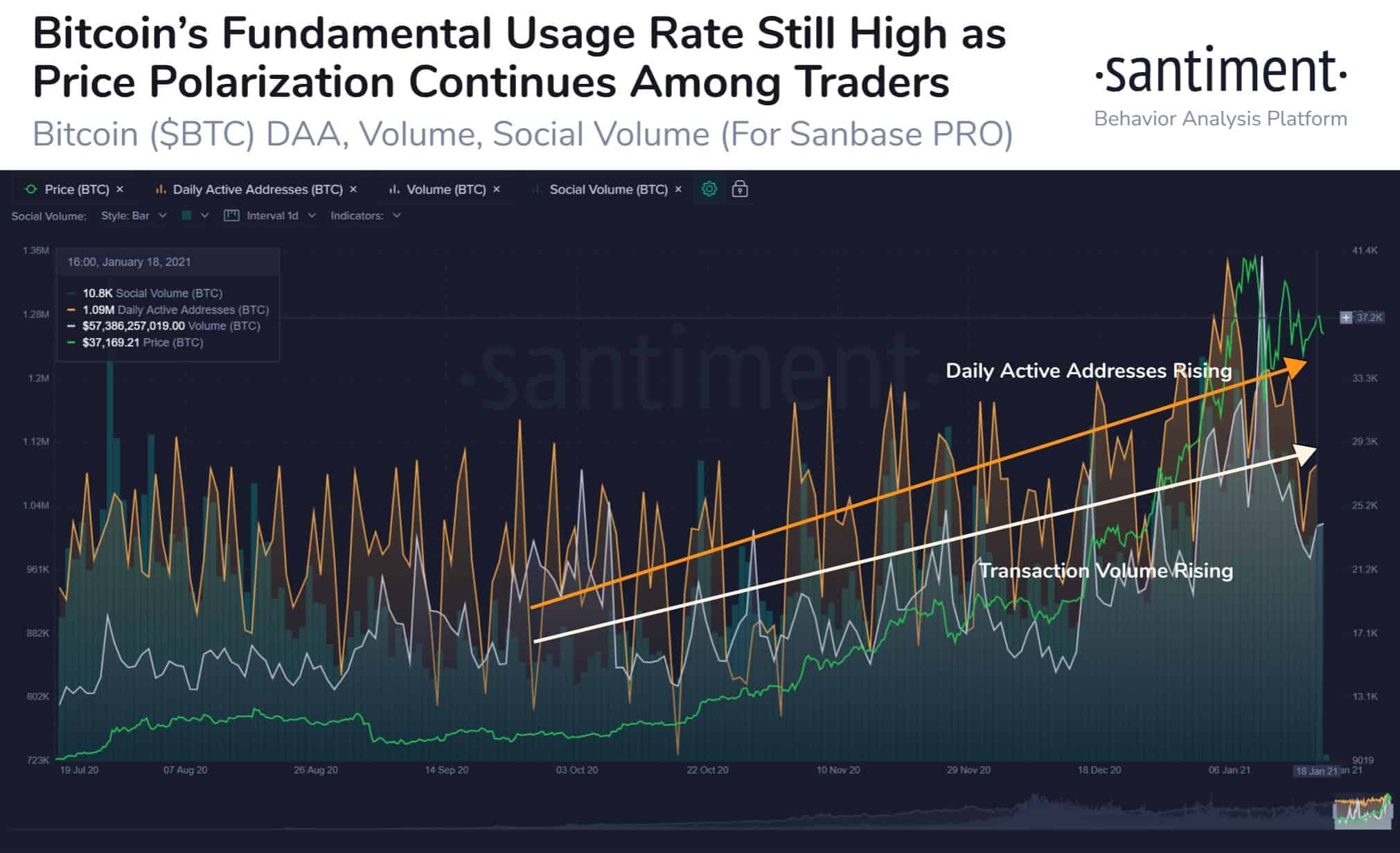

Data from the monitoring company Santiment confirmed to an extent Ju’s short-term prediction. It said that the main sentiment among the community on Twitter and other social media platforms has been bearish in the past few weeks – “there is an increasing amount of trader doubt that Bitcoin will revisit $40,000.”

Despite the general feeling among investors, though, the firm outlined several key network factors that are “plenty healthy” for the long-term.

The number of daily active addresses, a metric that Santiment has repeatedly linked to BTC’s price performance, has recovered from the recent drop and is back above one million.

The trading volume has also been gradually increasing since the summer of 2020 and has maintained a considerably high level in the past several weeks.