Report: Three to Five Countries Will Replace Their Currencies With CBDCs By 2030

Three to five countries will completely replace their currency with a central bank digital currency by 2030, argued a recent report by a German-based fintech think tank.

The document also warned that if the European Central Bank doesn’t accelerate its CBDC endeavors, the digital Yuan will overtake it but won’t disrupt the Dollar’s dominance.

Countries To Fully Implement CBDCs

The European think tank focusing on fintech and blockchain research dGen published a study on the potential impact of CBDCs. By looking into the history behind today’s most utilized fiat currencies, namely the US dollar, the Euro, and the Chinese Yuan, the company outlined that the next logical step in their evolution is the release of digital currencies.

Without disclosing which countries precisely, the document predicted that at least three nations will replace their currencies entirely with CBDCs within ten years. Nevertheless, dGen highlighted a few nations that are actively pushing towards releasing a digital currency.

China is among the leaders, at least judging by the numerous reports frequently surfacing, claiming that the world’s most populated country is coming closer to launching its DP/EC (digital currency).

Sweden’s CBDC also appears close as the European nation initiated a trial group for testing the digital Krona in early 2020. Sweden also plans to eliminate cash usage by 2025, and an e-krona would assist in achieving this goal.

Digital Yuan To Overtake The Euro

The German think tank said that the Eurozone is lagging behind other regions. A notion that was recently confirmed by the President of the European Central Bank, Christine Lagarde.

In a speech, Lagarde asserted that a CBDC could operate for retail or wholesale purposes. However, she noted that the digital Euro would complement instead of fully replace the current currency.

The report from dGen predicted that if the EU develops and launches its CBDC, it would have “the opportunity to become an effective settlement method for international trade outside of the politics of the US-China currency war.”

Contrary, if the ECB fails to release a digital Euro by 2025, China’s digital Yuan will overtake it. However, the digital Dollar will remain as the most prominent fiat currency. In fact, it could only strengthen its position as various emerging and smaller countries will “consider a switch to the digital Dollar.”

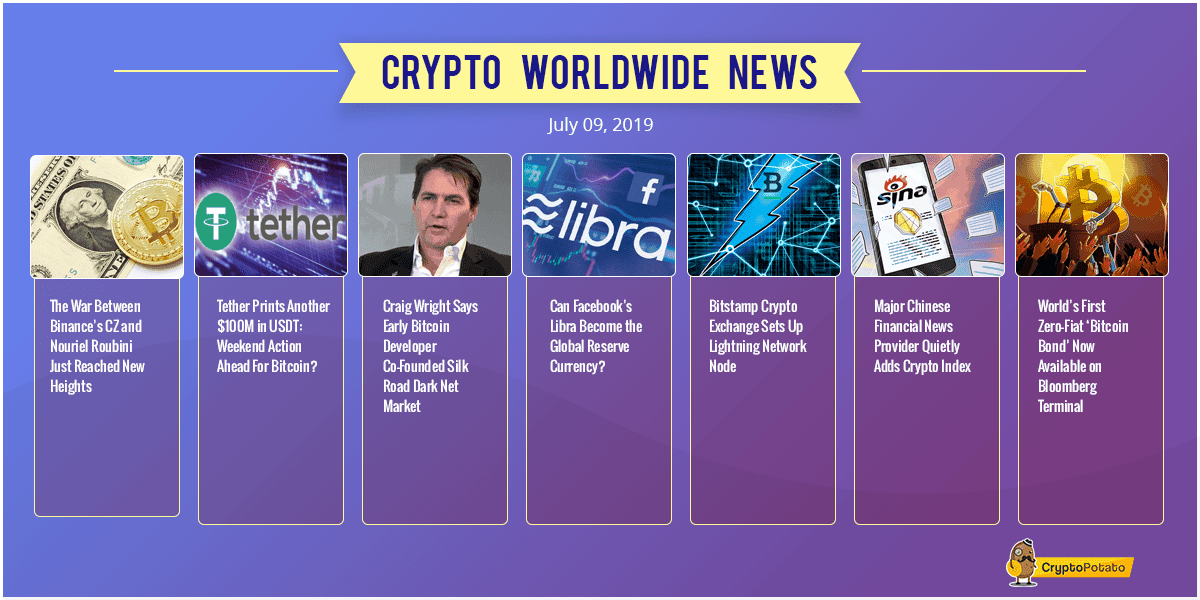

The post Report: Three to Five Countries Will Replace Their Currencies With CBDCs By 2030 appeared first on CryptoPotato.