Report: MicroStrategy Boosts Latest Note Offering To $500 Million, After Receiving $1.6 Billion In Orders

MicroStrategy has raised its latest note offering, meant to fund additional bitcoin purchases, after receiving major interest.

Software intelligence firm MicroStrategy has reportedly raised its latest note offering from $400 million to $500 million, bearing an interest rate of 6.125%, which will fund more bitcoin purchases by the company, according to a recent report by Yahoo Finance.

MicroStrategy released an announcement on the pricing update.

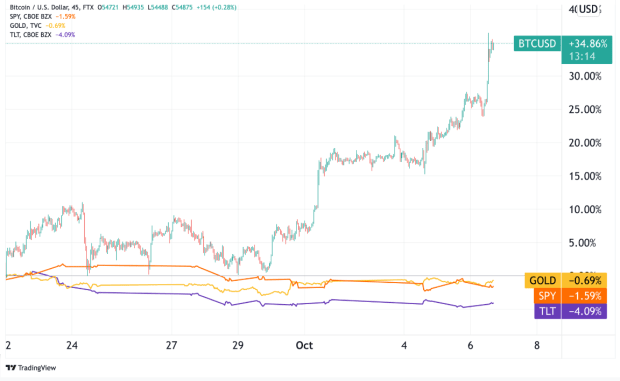

The company received a large number of orders totaling $1.6 billion from hedge funds, according to Yahoo Finance, prompting the company to increase the note sale from $400 to $500 million. The significant amount of interest for MicroStrategy’s recent junk bond sale comes as the price of bitcoin has decreased by more than 40% over the last month.

Recent mainstream news narratives have apparently hampered bitcoin’s price movements, yet institutional investors seem unbothered, as bids for notes from MicroStrategy, a company that holds 92,079 BTC in its corporate treasury, have been massively oversubscribed.

It is important to note that, though the company received a total of $1.6 billion in interest, this does not mean that the company will sell $1.6 billion in bonds to buy bitcoin, as CEO Michael Saylor and company may see the annual debt service at that amount as unserviceable.

The company predicts that after deducting purchaser discounts and commissions, as well as other expenses, the net proceeds will be $488 million. The recent move comes after the company recently announced the launch of MacroStrategy, a new subsidiary that will manage its bitcoin holdings.