Report: Bitcoin Whales Sold At Least 140,000 BTC in February as Price Suffers

Following weeks of accumulating substantial quantities of BTC, Bitcoin whales seem to have reversed the trend by disposing of some of their holdings in the past several days. Interestingly, this coincided with the massive market crash, which raises the question if whales are responsible for BTC’s decreasing price.

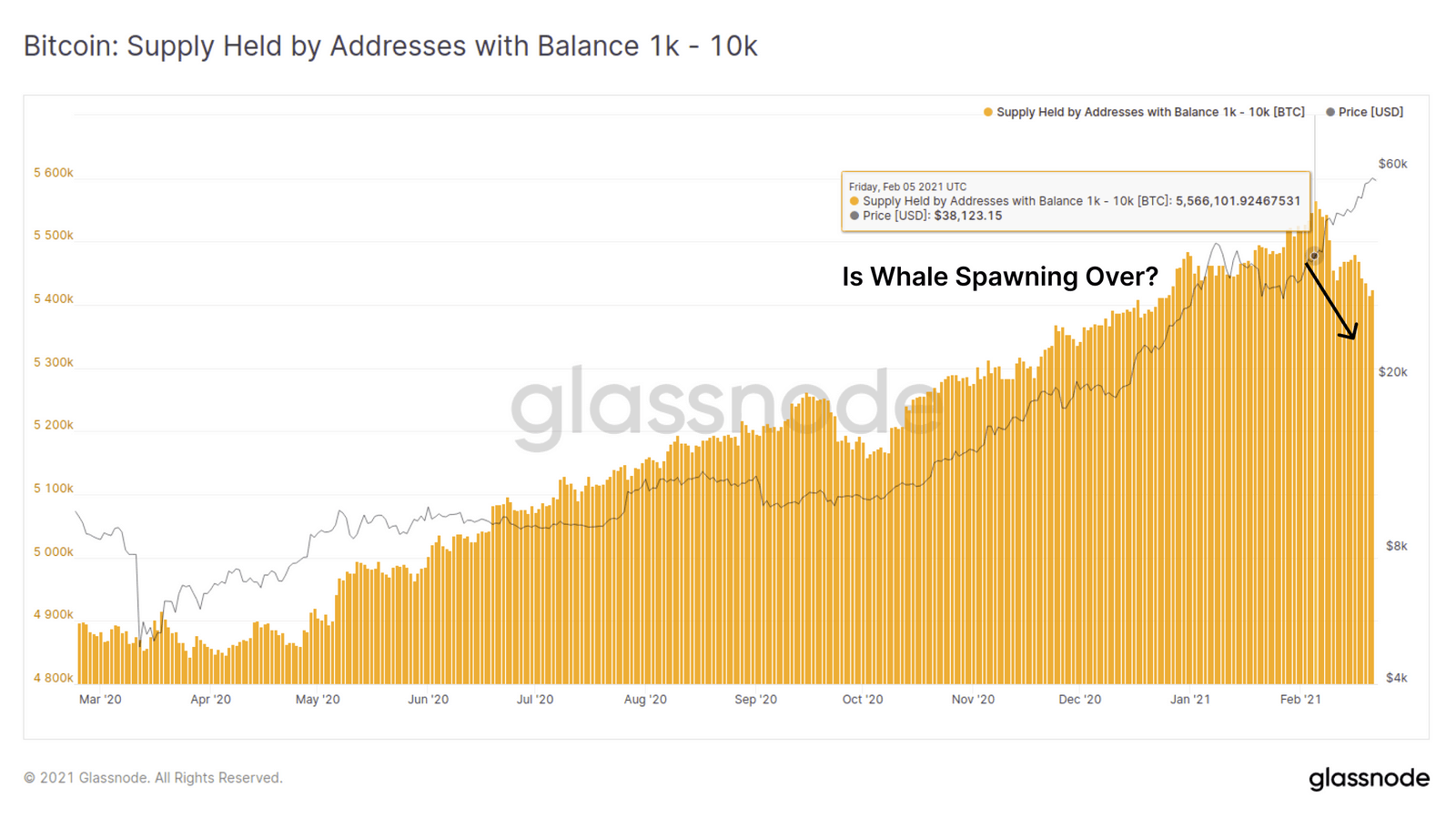

Bitcoin Whale Spawning Season Over?

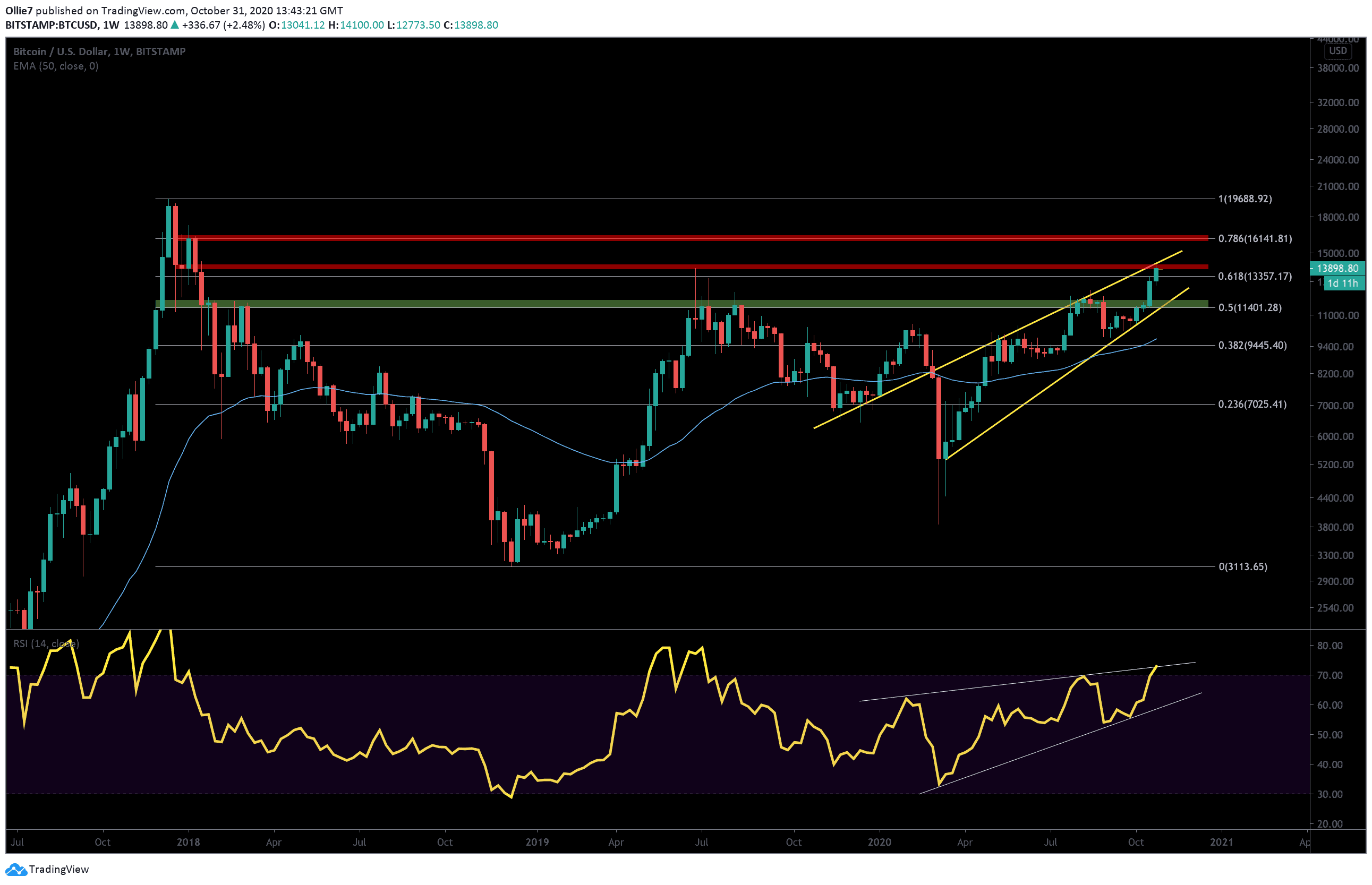

The primary cryptocurrency has enjoyed better days, and they weren’t that long ago. If we reverse time with just a week, BTC was heading for new records and painted the latest one above $58,400. However, the trend viciously reversed. The asset lost more than 20% of its value in a few days and still fails to recover.

This came as a bit of a surprise to some. The overall sentiment in the market seemed relatively bullish as institutional investors withdrew over $650 million in BTC from Coinbase, Square purchased $170 million more, and MicroStrategy allocated an additional $1 billion in the asset.

While the community speculates on what could be the potential reasons behind the adverse price developments, Glassnode data outlined the possible role of Bitcoin whales.

The analytics company said that such addresses containing 1,000 BTC or more were on the rise in the past 11 months – from March 2020 to early February 2021. The firm described this as “Bitcoin whale spawning season” as these wallets increased by more than 14%.

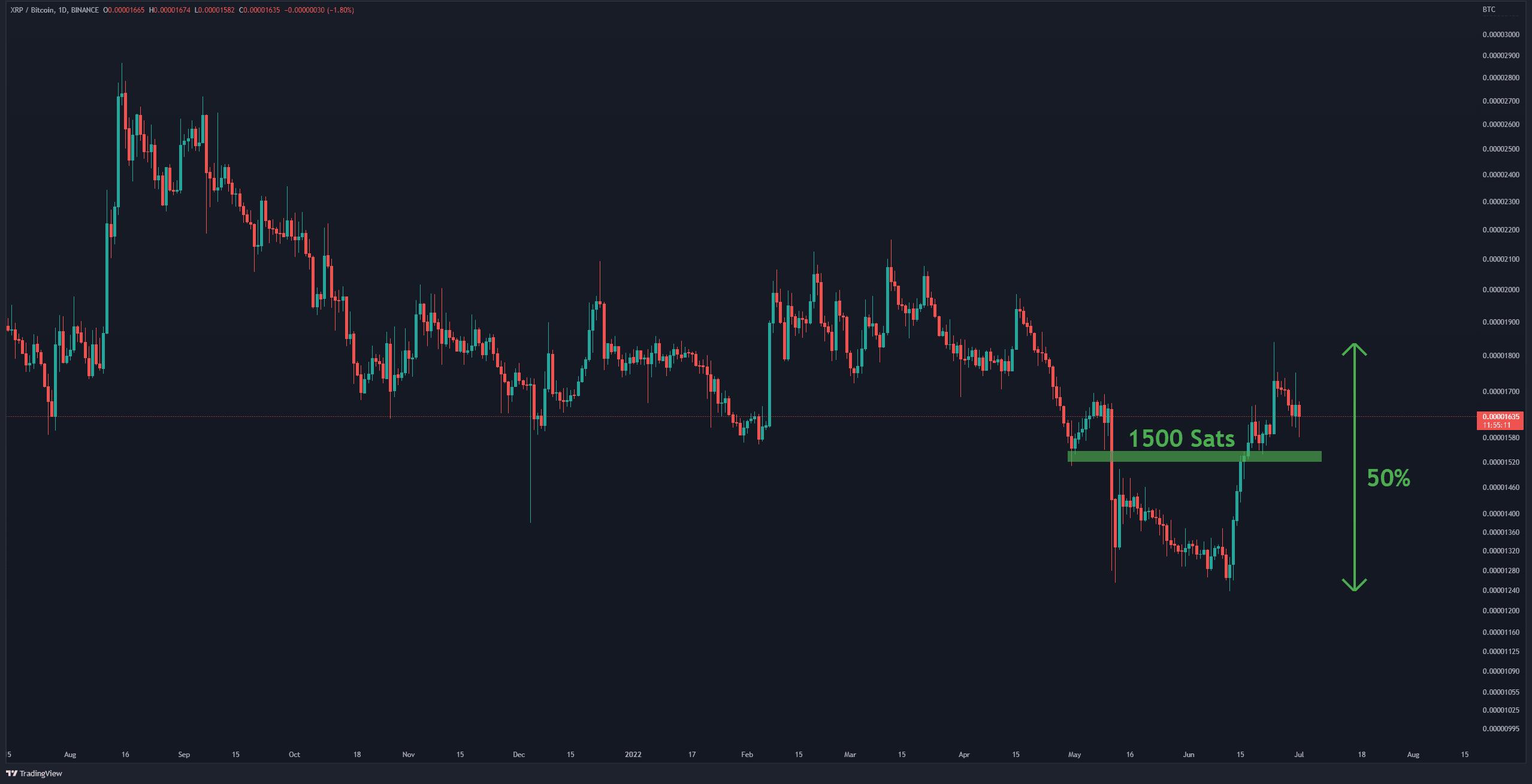

During the same period, BTC’s price skyrocketed from its mid-March low of $4,000 to nearly $60,000. However, whales seemed to have taken profits last week as their holdings decreased significantly, as the graph below demonstrates.

The supply of the so-called “whale to humpback” category (1,000 to 10,000 bitcoin holdings) has decreased with about 140,000 coins in February. In USD terms, this considerable amount is over $6.5 trillion.

What about the First North American BTC ETF?

Glassnode also touched upon the still-underestimated role of the recently launched Bitcoin ETF in Canada. The Purpose Bitcoin ETF became the first approved North American exchange-traded fund tracking the performance of the primary cryptocurrency.

The product’s first weeks of existence have been quite optimistic as it garnered $400 million in just days. More recent data shows that the holdings have increased to over 10,000 bitcoins (nearly $500 million).

Being the first regulatory-approved Bitcoin ETF in the large North America region, it could have a massive long-term impact on BTC’s adoption and, subsequently, price.