Report: Bitcoin Price To Reach $15,000 After Halving, If It’s To Remain Profitable For Miners

The Bitcoin Halving will take place in May, and its impact raises several valid questions. One of them concerns miners since the block reward will be cut in half, and the hash rate continues accelerating.

New research by a popular provider of institutional trading tools indicates that Bitcoin’s price has to increase with up to 50% from current levels to remain profitable for miners.

Bitcoin Hash Rate and Halving Effect

Bitcoin’s hash rate is a good indicator of the network’s health. The higher the hash rate is, the less vulnerable the system is for a 51% attack. It measures the computing power used by miners to create new blocks every ten minutes, and this process is called mining.

Bitcoin’s network gets more secure with time since its hash rate continues to record fresh all-time highs.

However, to keep up with the increased hash rate, resources dedicated to mining rise, and ultimately so do efficiency gains and mining costs.

Additionally, in less than 100 days, Bitcoin will undergo its third Halving. It will reduce the block rewards that miners receive from the current number of 12.5 BTC to 6.25 BTC.

Essentially, these factors raise a legitimate question. What has to happen with Bitcoin to remain profitable for miners to continue operating on its network?

Bitcoin At $15,000?

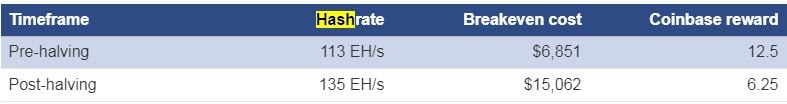

Naturally, since costs are rising and block rewards are dropping, the price of the largest digital asset has to increase to cover the differences. New research conducted on the matter concludes that Bitcoin would have to be between $12,525 and $15,000 for it to remain profitable.

The difference of approximately $2,500 comes due to the unknown factor of hash rate development. For example, if it stays nearly flat from its current levels, then the cost to mine one bitcoin would fall to $12,500.

The other option takes history under consideration. If Bitcoin’s hash rate increases in the next three months as it did during the last three months, then it would grow to approximately 136,000,000 TH/s. In this case, Bitcoin would have to trade above $15,000 to remain profitable for miners.

It’s also worth noting the current breakeven cost of the largest cryptocurrency. With a hash rate of 112 EH/s and a block reward of 12.5 BTC, the report displays a price of $6,851. With Bitcoin trading at $9,700 at the time of this writing, it means that it’s still generally profitable for miners to operate the network.

It’s worth noting, however, that the electricity costs vary in the different countries, as well as the scale of the operations. These are also things that have to be considered and it’s rather challenging to come up with a particular exact breakeven cost of Bitcoin mining.

The post Report: Bitcoin Price To Reach $15,000 After Halving, If It’s To Remain Profitable For Miners appeared first on CryptoPotato.