Report: After Buying Bitcoin’s Bottom In March, Whales Continue Accumulating

Analyzing Bitcoin on-chain data and market behaviors, a collaborative report published by OKEx insight – the research division of OKEx crypto exchange – and blockchain data firm Catallact reveals that smart money investors and institutional players may have been buying BTC since the COVID-19 outbreak.

On the Bitcoin blockchain, as the amount of BTC being transacted increases, the number of transactions decreases. In other words, “the larger the movement of coins on the Bitcoin blockchain, the less common it is.”

Small Transfer Moving With Bitcoin Price

But for one thing, smaller transfers between 0 and 1 BTC are more dominant on the Bitcoin network. Retail investors and average individuals mostly make transactions of this size. And the number of daily transactions within this range closely tracks Bitcoin’s price trend.

The number of small daily transactions, for instance, saw a significant decrease during the COVID-19 related market crash in March and only started increasing after Bitcoin returned to the $10,000 region in May.

For medium-sized transfers, the first tier is between 10 and 100 BTC, which could be from Bitcoin miners or big retail investors. The number of daily transactions for this group decreased immediately after the March crash and “remained lower than what preceded it.” They started seeing upward trends in late June.

The report suggests that the severe plunge shook out some of the big retail investors. Also, transfer activity from miners fell following Bitcoin’s third halving that occurred in May.

The next tier is for transfers between 100 and 1,000 BTC. During the March crash, these transactions saw a significant spike, before resuming its usual trend almost immediately.

Institutional Investors Accumulating?

Unlike the other transactions, the report revealed something interesting about transfer scales of above 1,000 BTC, known as real whales.

Transactions between 1,000 and 5,000 BTC were at their highest levels in mid-March when prices were low. This was followed by another significant spike in May when Bitcoin started trading near the $10,000 region.

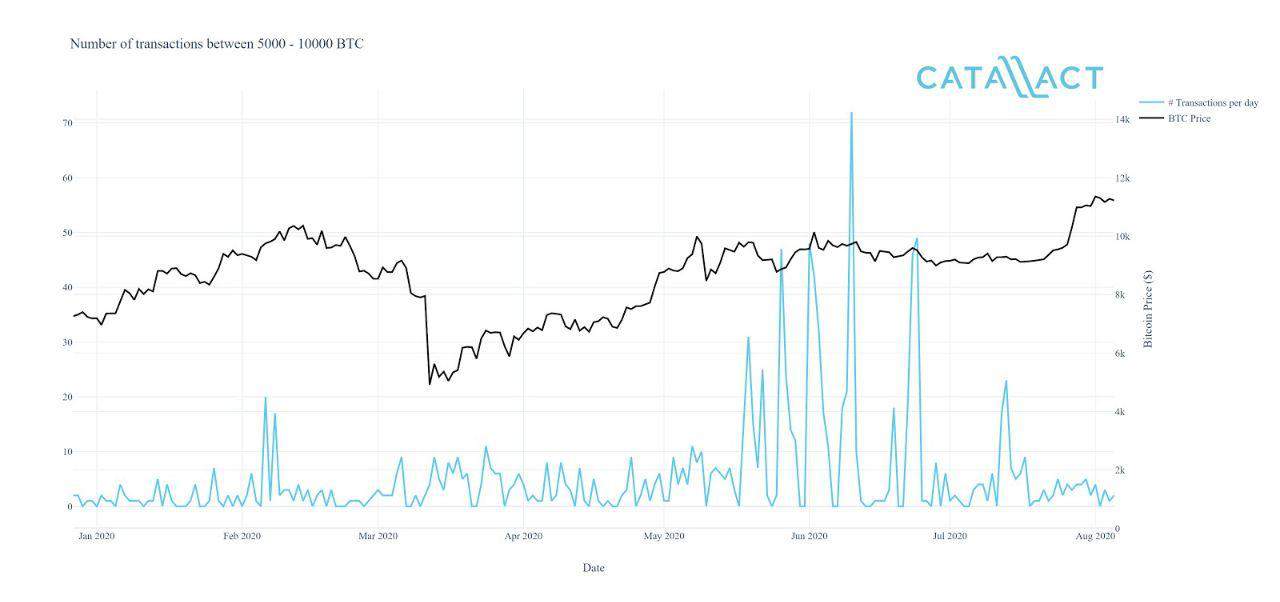

The report further revealed that massive transfers between 5,000 and 10,000 BTC “saw repeated spikes from mid-May to the end of mid-July of this year,” during Bitcoin’s price consolidation. This reiterates the report published in July that Bitcoin whales have been accumulating 50,000 BTC every month.

Considering the possible reasons for the upward trends of whale transactions between 5,000 and 10,000 BTC, the report suggests it could be exchanges transactions or institutions and large investors accumulating or distributing their assets during the consolidation period, hoping that the price would either increase further or decrease.

While the collaboration is only speculative since on-chain data cannot reveal everything, several previous papers on CryptoPotato, confirm that institutions have shown a significant interest in Bitcoin and cryptocurrencies this year.

Grayscale Investments, for instance, has been on a Bitcoin buying spree since mid-Q1, bringing its AUM to over 401,385 BTC. In May, the digital asset management company was in the headlines for buying more coins that have been mined since the third halving.

The post Report: After Buying Bitcoin’s Bottom In March, Whales Continue Accumulating appeared first on CryptoPotato.