Replacing The World’s Preferred Store Of Value, Bitcoin Will Make Housing Affordable Again

This is an opinion editorial by Leon Wankum, a HODLer who is active in real estate and venture capital with a master’s degree in financial economics.

On August 15, 1971, U.S. President Richard Nixon announced that the United States would end the convertibility of the U.S. dollar into gold. Since then, central banks around the world have started operating a fiat-based monetary system with floating exchange rates and no currency standards at all. The money supply has been rising steadily ever since. This forced market participants to look for ways to invest their money to protect against this inflation and one of the most popular investment assets has been real estate.

In the past, people owned real estate for its utility value, which is characterized by the fact that you can live on it or use it for production. Nowadays, however, it serves the world as the primary asset to store value. Around 67% of global wealth ($ 330T) is stored in real estate. This has pushed up real estate prices enormously and, with that, the cost of housing and the cost of living.

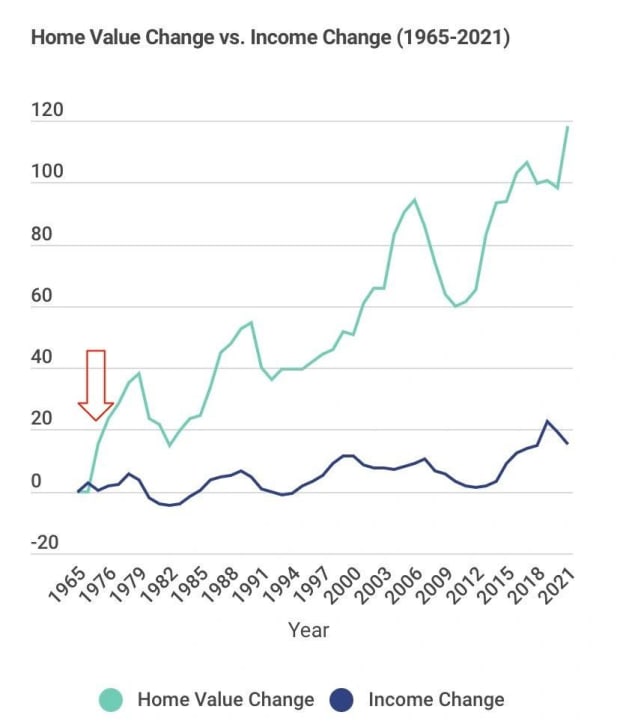

Home Value Change Vs. Income Change

The chart below shows the increase in wages in the U.S. from 1965 to 2021 compared to the increase in housing prices. It shows that real estate prices have risen excessively.

As a result, it is no longer possible for most people to afford their own home. In addition, regulation and inflation have made construction significantly more expensive, for example, due to the increased building requirements because of so-called “ESG” guidelines and the increase in raw material prices. Property owners pass this price increase onto tenants in the form of increased rents.

From Utility To Speculation

Real estate has become a speculative investment object because it is used as a store of value, a former function of money that is no longer possible due to decades of monetary inflation that has decimated peoples’ purchasing power.

The exorbitant increase in housing costs is one of the biggest problems of the fiat-based financial system because it has created a multitude of secondary problems. When the number-one store of value in the world, real estate, becomes increasingly expensive, and thus inaccessible, people can no longer save and plan for the future. When house prices and rents become increasingly expensive while money loses purchasing power, people can no longer afford adequate housing, leading to a deterioration in living standards.

In addition, aside from being used to store value, real estate is the most commonly used form of collateral in the traditional banking system. It is frequently used by a borrower to secure the repayment of a loan to a lender. Banks lend to people and institutions that own real estate. This has created an exclusive financial system as real estate has become unaffordable. In an inflationary environment where money loses value over time, it is a problem if most cannot borrow because saving is not an efficient way to accumulate capital. Debt becomes necessary to be productive.

These developments, which can be observed worldwide, are among the main drivers of wealth inequality.

From Speculation To Utility

Real estate should be reduced to its utility value as a dwelling or place of production, rather than used as a store of value by proxy if we ever hope to solve the growing gap in wealth inequality. Since bitcoin is a nearly perfect store of value, it offers a straightforward solution to the housing crisis.

The properties associated with bitcoin make it an ideal store of value. The supply is finite. It is easily portable, divisible, durable, fungible, censorship-resistant and noncustodial. Real estate cannot compete with bitcoin as a store of value. Bitcoin is rarer, more liquid, easier to move, harder to confiscate and cheaper to maintain. You don’t have to worry about daily maintenance, rent or repairs. It is easily accessible and cheap to store.

You can buy any amount large or small. You can self-custody bitcoin. All you need to store it safely is a basic computer without internet access and a BIP39 key generator – or a $50 hardware wallet.

People can buy bitcoin to store value instead of doing so through a home or rental property. As a result, real estate prices will fall and allow people to afford buying a home for its utility value.

Bitcoin Presents A Solution

As explained in a recent episode of “The Hard Money Show,” real estate has become a store of value in a world where fiat currencies are losing power, with many negative implications for society. But Bitcoin presents a solution.

As Bitcoin adoption increases, the money that would otherwise be invested in real estate, and some that is already invested in real estate, will flow into bitcoin. As pointed out above, this will make housing affordable.

By functioning as an actual store of value, bitcoin will absorb the monetary premium that real estate has accumulated over the past decades due to the broken monetary system. Under a Bitcoin standard, housing will eventually collapse to its utility value. The easy access to Bitcoin will create a financial system that is far more accessible than it is today.

Unfortunately, this will not solve the problem of rising rents in the short term. This is a structural problem of the fiat system. Due to the ever-increasing supply of money, it loses purchasing power over time and prices rise. However, as our financial system adjusts to a Bitcoin standard, deflation will cause prices to fall.

It should also lead to a more decentralized and less regulatory form of governance, as governments increasingly become service providers.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

![Bytom Is Connecting Physical And Digital Assets – [BTC Media Sponsor]](https://www.lastcryptocurrency.com/wp-content/uploads/2018/10/7325/bytom-is-connecting-physical-and-digital-assets-btc-media-sponsor.jpg)