Reflecting On The Genesis Block And Bitcoin On Its 14th Birthday

Exactly 14 years after Bitcoin was born through the Genesis block, Proof of Keys Day helps us remember why the protocol was invented and where we are today.

14 years ago today, Satoshi Nakamoto created the first block in the Bitcoin blockchain. Whether consciously or not, that move kickstarted an entire movement; one that keeps on breathing and expanding these many years afterwards. The singularity of Nakamoto’s creation has been put on display countless times since the Genesis block was mined, and today, more than ever, its purpose is becoming more clear and, fortunately or not, needed.

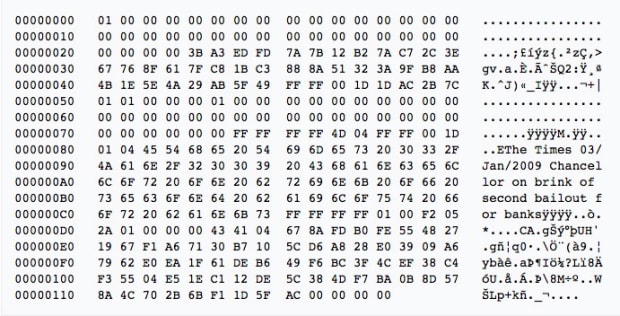

Engraved in the Genesis block is Bitcoin’s raison d’être.

“Chancellor on brink of the second bailout for banks.” A simple but powerful message. The engraving in and of itself serves as an anchor to the physical world, an atestment to Bitcoin’s birthdate –– or, at least, that it couldn’t have possibly been created before Jan 3, 2009, the date the cover was published. But more importantly, and more philosophically, the message establishes a sort of manifesto, from the start. It makes it clear that the system being ignited by that very block takes a stand against the central bank policies enabled by a culture of easy money. Bitcoin, instead, would seek to restore accountability and antifragility through a monetary system based on sound money; one that can’t be debased or controlled, manipulated or manufactured to benefit a lucky few. Bitcoin would seek to level the playing field, ensuring property rights to millions worldwide, equally and irrespective of their status, race, religious beliefs, gender or nationality.

The fundamental properties of Bitcoin would enable such dream to come true. Powered by a distributed network of nodes, each running the protocol’s software and as such enforcing its rules, Bitcoin would be able to let individuals take up the reins of their financials –– once and for all. As the days and years went by, however, more and more Bitcoin-related activity began drifting to centralized institutions, initially for buying and selling, later for custody, and nowadays for a plethora of services unimaginable in the days of Nakamoto. While such a move enabled a greater participation by people around the world, the initial ideals of Bitcoin have started being neglected. After all, true peer-to-peer electronic cash can’t be actualized in a custodial model where the movement of funds is but an update on a centralized database. Instead, that reality more closely resembles the old, traditional financial system Nakamoto sought to fight in the first place –– one that makes it impossible for people to be sovereign as they can’t be the master of their finances.

While there are multiple requirements for Bitcoin holders to break free of the established system’s reality, this article focuses on a keystone aspect that shares the holiday with Bitcoin’s birthday. Proof of Keys Day, also celebrated on January 3, was started by infamous Trace Mayer, who rallied people to withdraw their bitcoin en masse from centralized exchanges and custodians. The reason? Only by withdrawing their BTC can people ensure companies of the burgeoning industry aren’t taking part on old and established vices like fractional reserve banking. Moreover, only with bitcoin in their possession –– held by a wallet to which they control the keys –– can people be free to do as they please with their BTC. There are many different ways to do self-custody, and while it can be daunting at first, it’s a necessary step to take the leap from the old to the new system.

The “keys” discussed here are the private keys for a given Bitcoin wallet. They can be thought of as the wallet’s actual key in that it “unlocks” the wallet and the bitcoin held in it for spending. Without the keys, no bitcoin can be spent. This is because when a Bitcoin transaction is being formed, the sender “locks” the bitcoin with information about the receiver. Thanks to asymmetric cryptography, this transacting dynamic ensures that only the entity that received the bitcoin can spend it next. And this spending is made possible by the receiver’s private keys. So as long as the receiver takes good care of their private keys, only they will ever be able to spend their bitcoin –– no matter what a government, institution or agency thinks or does about that.

By holding bitcoin in a wallet you create, you ensure that only you can move the bitcoin held in that wallet. When a third party custodian holds your bitcoin for you, they create a wallet for you and tell you the address so you can deposit, but ultimately they control that wallet’s private keys and more often that not that is an information you can’t access. As such, there is a need for permission to be asked to move your bitcoin. While such an ask is automated, it is still necessary so you can move your funds. Often, this takes the form of a “withdrawal request” you issue to your exchange. Proof of Keys Day aims to raise people’s awareness to this fact and entice them to take control of their finances once and for all, making the leap from the traditional financial system to the new, decentralized, Bitcoin-based one. As the saying goes, Not your keys, not your bitcoin!

Start your self-custody journey:

- Find out how to withdraw from the exchange you use here.

- Quick and easy step-by-step guide for small amounts of bitcoin here.

- Twitter thread with links to tutorials of different levels of self-custody, from beginner to advanced here.