Red Week: Bitcoin Drags the Entire Cryptocurrency Market Down

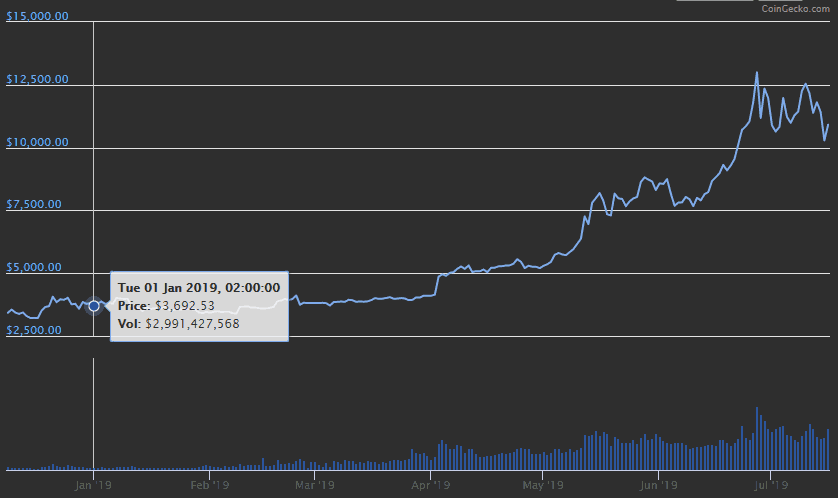

This week, the cryptocurrency market was painted in red. After the celebration of the gains made in recent weeks, we saw a correction which cooled the market slightly. However, this is not a crash but rather a healthy correction which brought relative stability to the market. Bitcoin’s price has kept its head above five digits, which is substantially higher than it was at the beginning of the year.

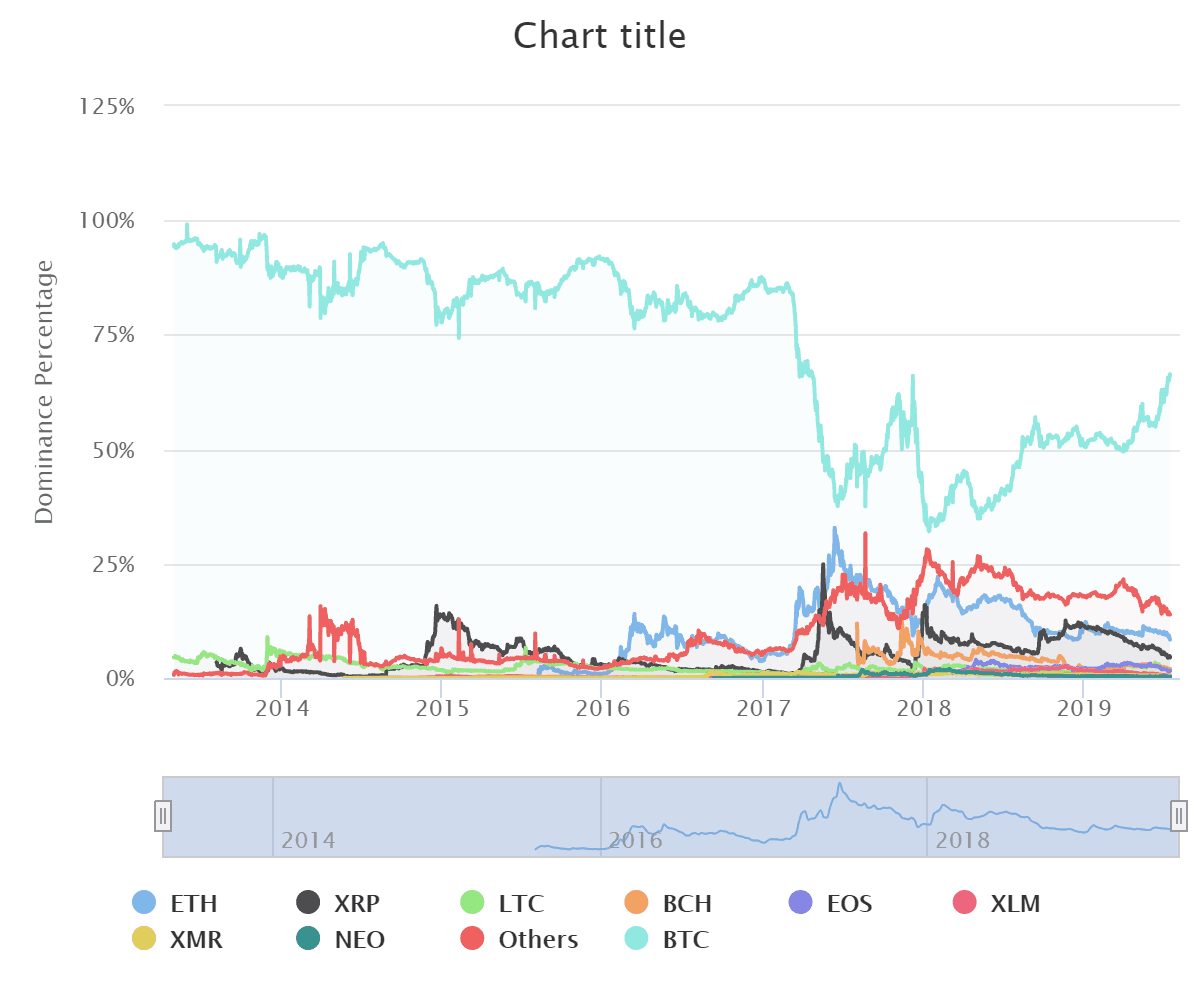

The altcoin market is also cooling off, as alts have continued to free fall, especially against Bitcoin. Some of them are already reaching all-time lows against BTC, whose dominance has grown to over 65%.

However, despite the declining prices, the regulatory sector continues to warm up. Facebook’s cryptocurrency project, Libra, keeps on generating waves and has prompted various legislators to clarify their positions on the matter. Meanwhile, the Secretary of the US Treasury, Steven Mnuchin, has said that the relevant authorities will provide clarification and enforcement in order to regulate the industry and remove risks as much as they can.

All in all, the markets had a mixed week, filled with corrections and characteristic uncertainty. Overall, 2019 has so far been a positive year for Bitcoin, especially in light of the great interest in Libra and the many attempts to compare it to Bitcoin. With respect to altcoins, the situation is less positive. However, the declines seem to have slowed, and the support has held.

So, are we going to see another altcoin season in 2019? If Bitcoin keeps its relative stability, traders will feel much more comfortable and there is a good chance that would wake up the altcoin market. But after a particularly turbulent year, we’ll have to wait for the dust to clear before we can determine future trends.

BTC Longs (BFX): 23.1 K BTC

Crypto News

Binance Officially Opens Margin Trading. Binance, the world’s largest cryptocurrency exchange, has officially enabled margin trading on its platform. Users can now place leveraged orders. The marginable assets include BTC, ETH, XRP, BNB, TRX, and USDT.

US Federal Reserve Chairman: Bitcoin Is a Store of Value Like Gold. In what appears to have been a massive validation for Bitcoin, the Chairman of the US Federal Reserve has acknowledged that it’s a “store of value…, like gold.” Jerome Powell also stated that it might be possible that widespread adoption of cryptocurrencies diminishes or removes the need for a reserve currency.

There’s No Such Thing as Bad Publicity: Trump Bashes Bitcoin. Donald J. Trump, the President of the United States, has finally communicated his stance on cryptocurrencies and Bitcoin. While he bashed them for facilitating unlawful behavior and illicit activities, interest in Bitcoin surged immediately after his tweet, demonstrating that there’s no such thing as bad publicity.

Tether Accidentally Printed $5 Billion Worth of USDT. Popular stablecoin issuer Tether mistakenly printed $5 billion worth of USDT. All tokens were consequently burned. However, the price of Bitcoin reacted immediately, decreasing by about 3.5% following the news.

UK’s Head of Treasury: We’re Not Going to Try to Stop Facebook’s Libra. Philip Hammond, the Head of the UK’s Treasury, confirmed that the country doesn’t plan to stop Facebook’s Libra cryptocurrency, but rather to regulate it. He said that if it’s done properly, Libra could be “transformative in operating systems.”

US Treasury Secretary Shares Trump’s Concerns on Crypto, Stresses Compliance. The Secretary of the United States’ Treasury, Steven Mnuchin, shares President Trump’s concerns on the use of cryptocurrencies to facilitate illicit activity. He also emphasized the need to enforce FinCEN regulations when it comes to organizations which deal with digital currencies.

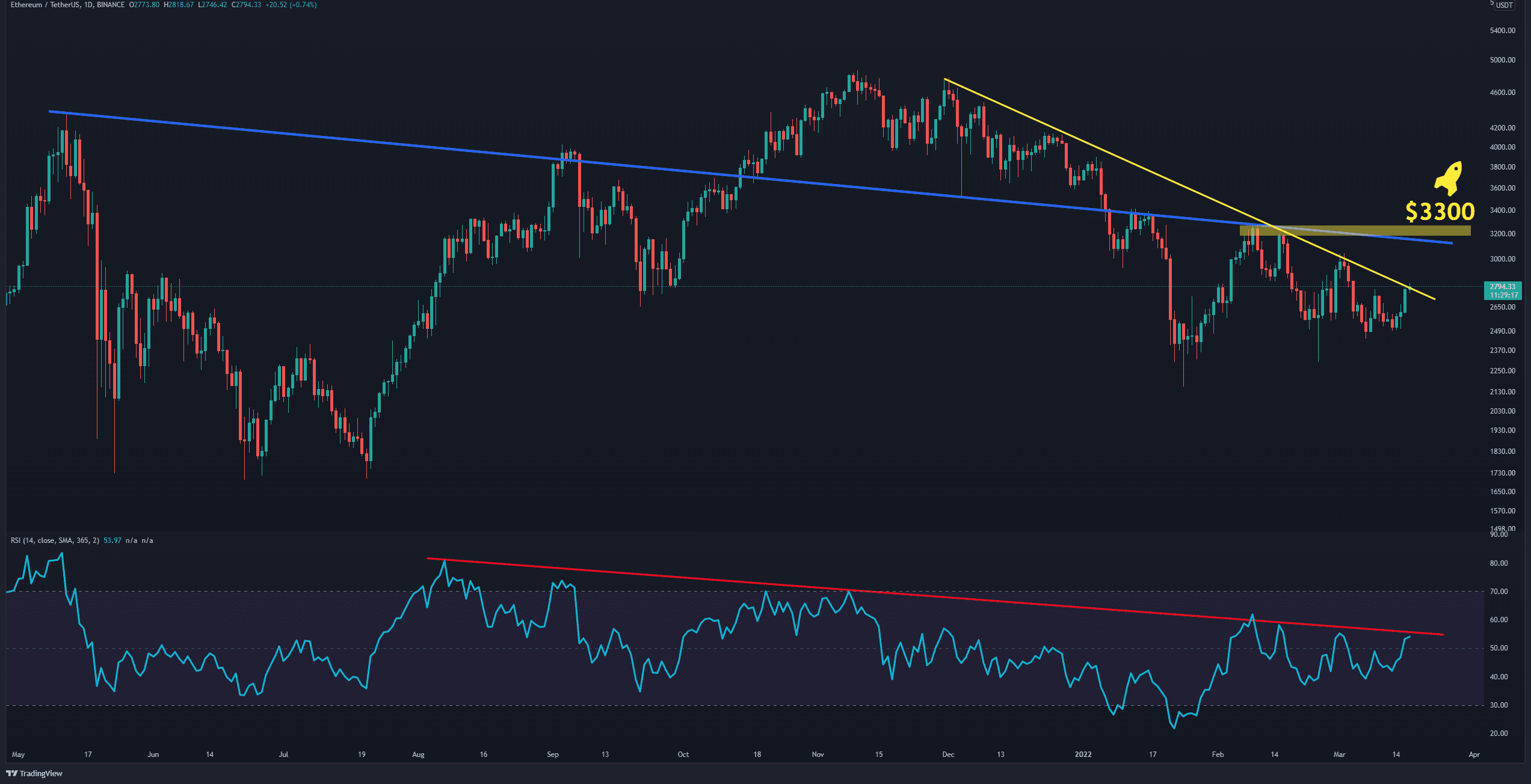

Charts

This week we’ve analyzed Bitcoin, Ethereum, Ripple, Icon, and Decred; click here for the full price analysis.

The post Red Week: Bitcoin Drags the Entire Cryptocurrency Market Down appeared first on CryptoPotato.