Record Stablecoin Liquidity, Spike in BTC Transactions Could Fuel Bitcoin Price Surge

-

Stablecoin market capitalization has steadily reached $169 billion led by USDT and USDC, with the increase preceding price movements in past cycles.

-

Historical data suggests a positive correlation between increased stablecoin balances on exchanges and rising Bitcoin prices, with a notable 146% increase in USDT on exchanges since January 2023.

-

There has been a significant increase in large or “whale” transactions on the Bitcoin network, alongside a spike in on-chain volume.

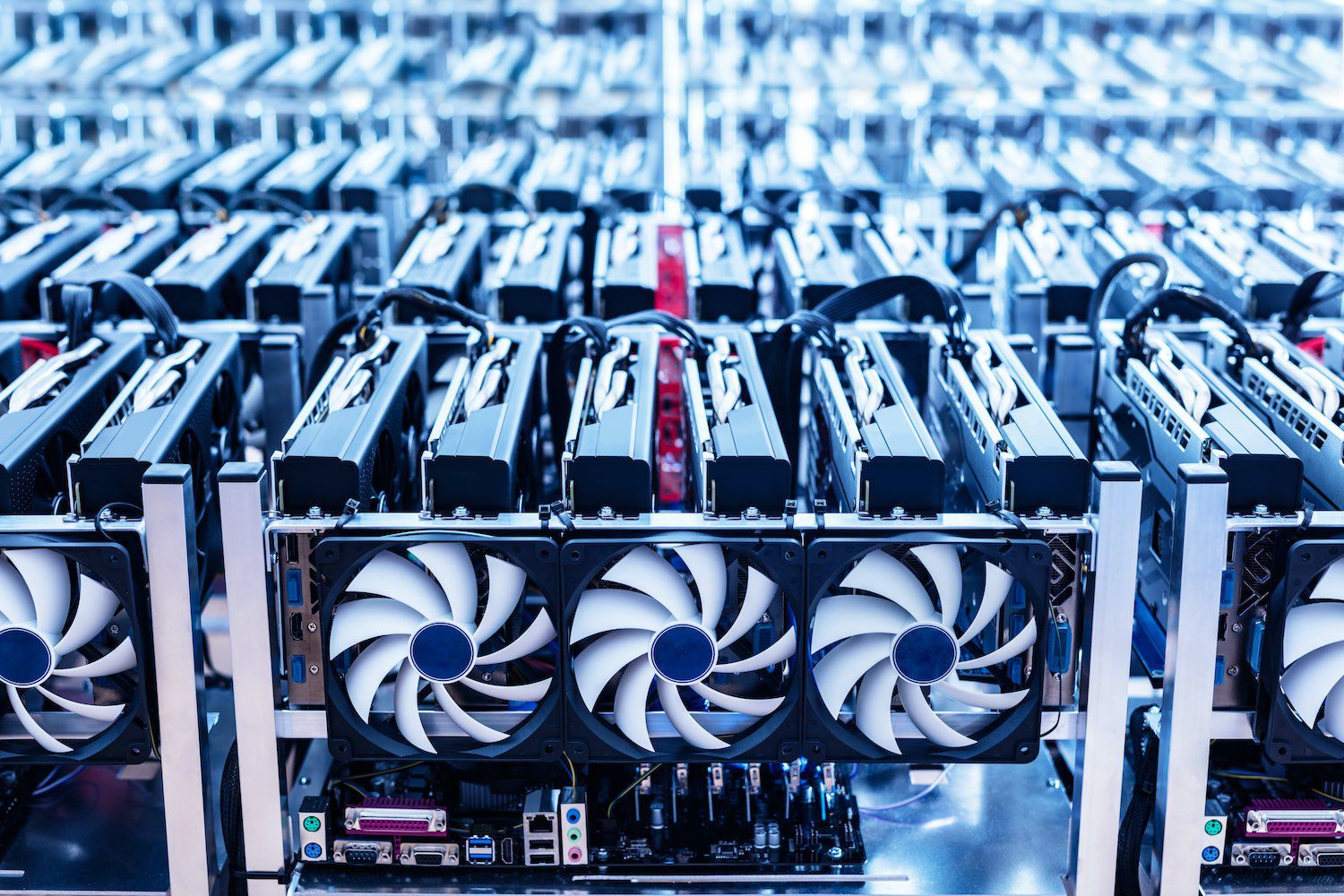

A record amount of dollar-backed stablecoins and a spike in large bitcoin (BTC) transactions could form the bedrock for a broader BTC rally in the coming weeks, keeping the asset’s bullish October seasonality intact.

Stablecoin liquidity has continued to grow to a record $169 billion in late September, data from CryptoQuant shows, indicating a 31% year-to-date (YTD) increase.

The dominant players remain Tether’s USDT, whose market cap increased by $28 billion to nearly $120 billion with 71% of the market share, and Circle’s USDC, which recorded a market cap rise of $11 billion to $36 billion, a 44% increase YTD, with a 21% market share.

Stablecoins are a type of cryptocurrency designed to offer price stability by being pegged to a reference asset, which could be fiat money like the US dollar, commodities like gold, or other cryptocurrencies.

Each stablecoin is supposed to be backed by an equivalent amount of fiat currency held in reserve. Stablecoins are typically issued against fiat deposits, meaning an increase in stablecoin supply is an increase in actual fiat money placed into the crypto ecosystem.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FV2PDQ3MDZD43O2K6GKDQLF3W4.png)

Most crypto spot and futures trading are conducted against stablecoin pairs and an increase in the stablecoin liquidity signals a potential dry powder that can be deployed for crypto purchases.

Historic movements show a clear correlation between the number of stablecoins held on crypto exchanges, which has grown 20% this year, and higher bitcoin prices.

“Larger balances of stablecoins on exchanges are positively correlated with higher bitcoin and crypto prices,” CryptoQuant head of research Julio Moreno said. “Since January 2023, when the current bull cycle officially started, the total amount of USDT (ERC20) on exchanges has grown from $9.2 billion to $22.7 billion (+146%).”

“Notably, these balances have grown by 20%, even as Bitcoin’s price has remained flat,” Moreno said.

Bitcoin is down over 6% since the start of October, data shows, a month that has only twice ended in the red since 2013, chalking gains of as high as 60% and an average of 22% to make it the best for investor returns.

Price jumps of as high as 16% generally appear after October 15, with the available stablecoin liquidity likely supporting a rise. A key catalyst in the months ahead is the U.S. presidential election, which could set the tone for general monetary and crypto policies for the next four years.

Whale Transactions Grow

On-chain analytics firm Santiment reported a bump in whale transactions on the Bitcoin network, which has historically preceded a price surge. Whales are a colloquial term referring to large holders of any asset whose market moves can directly influence prices.

“Our metrics indicate a major spike in dormant activity on Bitcoin’s network to pair with $37.4B in on-chain volume Tuesday, the most in 7 months,” Santiment said in an X post. “Historically, stagnant BTC moving back into regular circulation is a positive for future price movement.”

Edited by Omkar Godbole.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter